Every Indian office has its own version of the infamous “samosa break.” It’s that quick pause where employees gather around, discuss the latest office gossip, vent about work, and, inevitably, talk about one thing—salary day. In Indian workplaces, salary day isn’t just a date on the calendar; it’s an event. The moment you hear that “salary credited” notification, all eyes light up. But what most employees don’t realize is the complexity behind the scenes—specifically, payroll tax types that businesses must navigate to ensure everyone gets their salary on time and in full.

For growing businesses in India, especially SMBs, startups, and service-driven industries like hotels, managing payroll taxes can seem like a maze. However, understanding and optimizing these tax processes is crucial for keeping the wheels of your business running smoothly and, most importantly, compliant.

What are Payroll Tax Types?

Payroll tax types refer to the various taxes and contributions that businesses must deduct from their employees’ salaries and remit to the government. These deductions, though invisible to most employees, are vital in ensuring compliance with statutory regulations. For Indian businesses, understanding these deductions is not just about compliance—it’s about building trust with employees by ensuring financial transparency.

Here are some of the common payroll tax components in India:

- Provident Fund (PF): A compulsory savings plan for employees, PF contributions are deducted monthly, with both employees and employers contributing.

- Employee State Insurance (ESI): Applicable to businesses with more than 10 employees, this is a health insurance scheme for workers earning below a certain threshold.

- Professional Tax: This varies from state to state, with some states requiring employers to deduct a small amount as professional tax.

- Income Tax: Depending on the employee’s income bracket, income tax is deducted as per the Income Tax Act.

In a bustling startup, where the focus is often on growth, innovation, and scaling up, managing these components can seem like an afterthought. But failure to comply with these taxes can lead to hefty penalties, and more critically, a loss of employee trust.

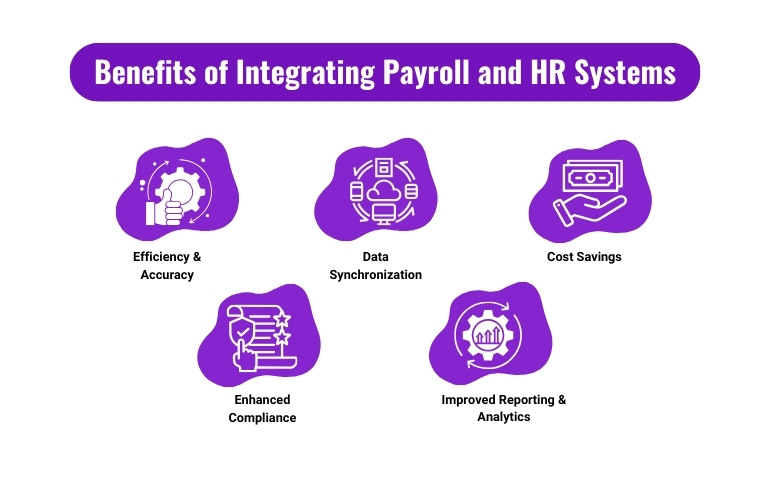

Corporate Payroll Services for Efficient Management

In a world where payroll management can feel like navigating through rush hour traffic, corporate payroll services offer a clear route to efficiency. Outsourcing payroll can significantly reduce the burden on Indian SMBs and startups, allowing them to focus on core business activities.

Why is this particularly useful for SMBs?

According to a 2022 study, 60% of small businesses that manually manage their payroll face tax penalties every year due to errors in tax filing. Corporate payroll services help ensure that taxes, including PF, ESI, and income tax, are accurately calculated and remitted.

Outsourcing this function means you no longer have to worry about constantly changing tax regulations or compliance deadlines. SMBs and startups that adopt corporate payroll services reduce their compliance risks while also freeing up time to focus on growth.

Enterprise Payroll Software: A Digital Leap for Indian Businesses

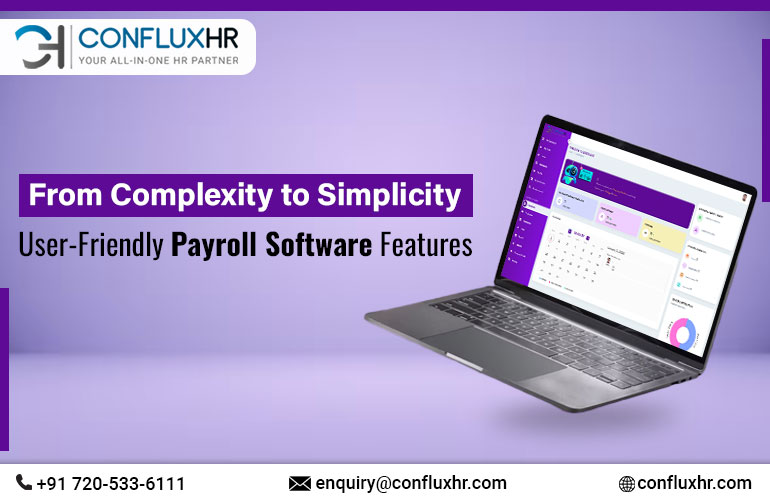

In the era of digital transformation, enterprise payroll software is no longer a luxury but a necessity for Indian businesses. Imagine a world where payroll taxes are calculated automatically, salaries are disbursed on time, and tax reports are generated with a single click. That’s the power of enterprise payroll software.

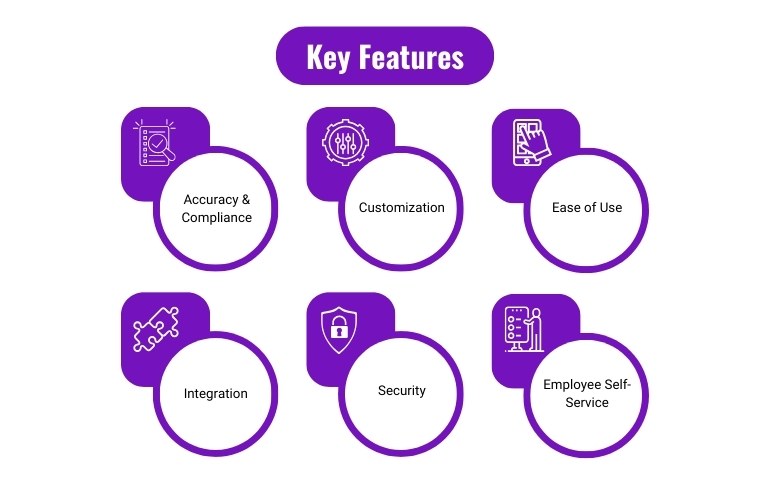

Some of the key features of such software include:

- Automated tax filing: With enterprise payroll software, businesses can automate income tax, PF, ESI, and professional tax calculations.

- Salary disbursement: Software allows for seamless salary processing, ensuring that employees receive their pay without delays.

- Compliance tracking: Given the frequent changes in tax regulations, enterprise payroll software helps businesses stay updated and compliant.

According to a 2023 report, businesses using payroll software see a 50% reduction in payroll errors. For Indian SMBs and startups, this is a digital leap that not only ensures payroll accuracy but also enhances efficiency.

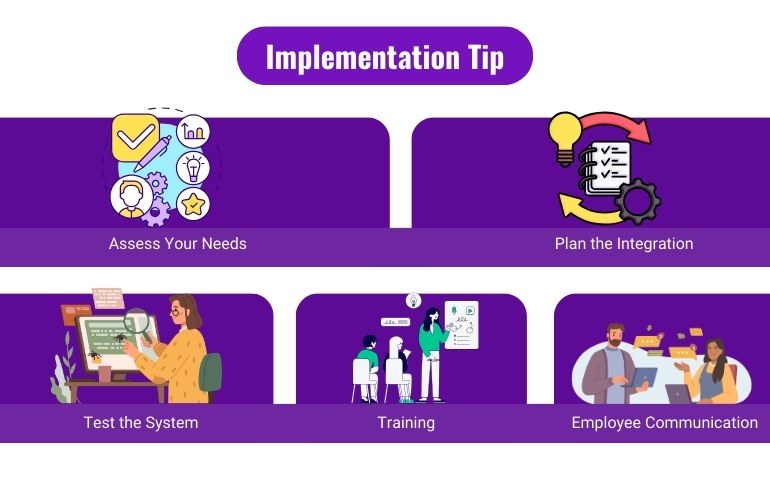

The Onboarding Process and Payroll Tax Compliance

One often overlooked area of payroll tax compliance is during the onboarding process. When new employees are welcomed into an organization, ensuring that their tax documentation is correctly set up is critical. Failing to do so can result in tax discrepancies that are difficult to rectify later.

Integrating payroll tax compliance from day one helps avoid issues down the line. For example, verifying tax declarations during onboarding ensures that income tax is calculated accurately from the start. Moreover, early compliance shows employees that your company values transparency and accuracy—qualities that go a long way in building trust.

Performance Appraisal and Tax Implications

Performance appraisal seasons are exciting for employees—they often come with bonuses, salary hikes, and other incentives. But for employers, they come with tax implications. Bonuses, for instance, are subject to income tax, and depending on the amount, may even push an employee into a higher tax bracket.

Understanding how performance-related pay affects tax deductions allows businesses to plan financial outflows more effectively. It also enables employees to plan their finances better. Ensuring transparency in how bonuses are taxed during performance appraisal cycles builds trust and allows employees to feel secure about their earnings.

Time Tracking and Its Role in Payroll Accuracy

Ever heard the saying, “time is money”? Well, it’s especially true in payroll management. Time tracking apps are essential tools for ensuring payroll accuracy. By tracking overtime hours, leaves, and attendance, businesses can ensure that employees are paid for exactly the time they’ve worked.

In Indian workplaces, particularly in service industries like hotels and restaurants, managing shifts and overtime is crucial. Time tracking tools not only help ensure accurate payments but also play a role in calculating overtime tax deductions. Employees trust businesses that are transparent about working hours and overtime payments.

Challenges Faced by Indian SMBs in Navigating Payroll Tax Types

Indian SMBs and startups often face several challenges in navigating payroll tax types. Some of the most common challenges include:

- Lack of expertise: Many small businesses don’t have a dedicated HR or finance team to manage payroll, leading to errors.

- Manual errors: Manually calculating taxes increases the risk of mistakes, leading to potential penalties.

- Changing tax laws: Indian tax regulations frequently change, making it difficult for businesses to stay compliant.

The solution? SMBs should leverage corporate payroll services or invest in enterprise payroll software to reduce these challenges. By automating payroll management, businesses can avoid errors, stay compliant, and ensure smooth salary processing.

Conclusion

Understanding and managing payroll tax types is essential for every Indian SMB and startup. From simplifying compliance to enhancing employee trust, getting payroll right is crucial for business success.

Embrace the power of payroll software or services, and soon, you’ll find that payroll management—from “samosa breaks” to “salary day”—can be a smooth and stress-free process. In the fast-paced world of Indian business, a reliable payroll system is more than just a necessity—it’s a competitive advantage.