Payroll processing is an intricate combination of a series of other operations. Learn all about it here.

Have you ever thought of the repercussions of inaccurate payroll processing? Just imagine a group of people with a salary as their only or primary source of income. Above all, payroll mistakes can happen in a quicker time frame than you can ever think of.

Payroll irregularities and mistakes can bring the morale of the employees incredibly down. Finally, it takes a toll on the business productivity of the organization. Well, that’s not all, as you must also adhere to the legalities, including statuary compliance, PF, PT, labor law etc. Not adhering to these laws might face legal havoc.

Therefore, timely, accurate, and law-compliant payroll processing is about understanding the process in detail and the best way to get it done. By the end of this manual, we will cover the following crucial topics:

What is Payroll?

When you employ human resources, you pay them. Payroll is eventually the list of employees and their monthly remuneration after calculating all the effective deductions. Apart from a few compliance differences and deduction processes, most organizations follow a similar process.

So, a simple salary calculation includes these many aspects and, sometimes, even more, depending on the organization. The calculation of “net pay” depends on many factors, including salary breakups, deduction policies, and leave encashment policies.

However, Net Pay= Gross salary-Gross deduction.

Where Gross Salary includes regular pay, allowances, and one-time benefits

The gross deduction includes the regular and one-time deductions

But that simple calculation is not so simple. When done manually, it often causes mistakes and creates havoc.

Why does a business need to do payroll?

Payroll processing helps maintain a record of the salaries paid to the employees. Besides that, the accuracy of payroll processing substantially impacts an organization’s net income. Businesses ought to adhere to the laws and regulations of employment. Several legal aspects of payroll processing make it one of the crucial business processes apart from the core functions.

Inaccuracy payrolls or untimely payroll processing often cause hazardous repercussions like the poor trust of employees in the company.

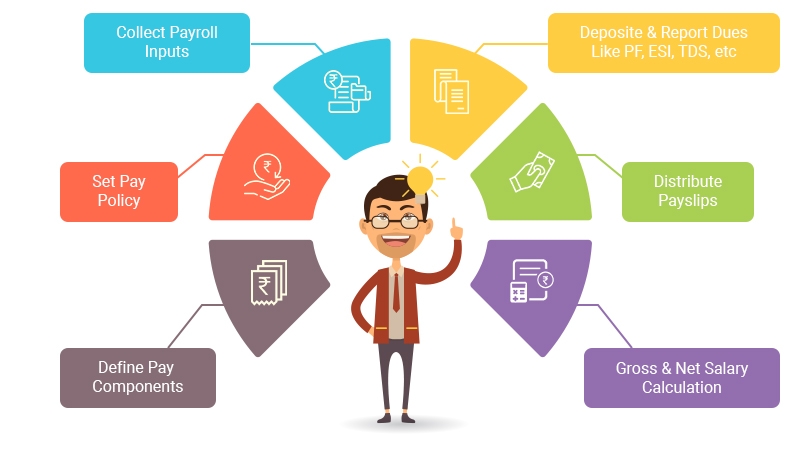

What are the stages of payroll processing?

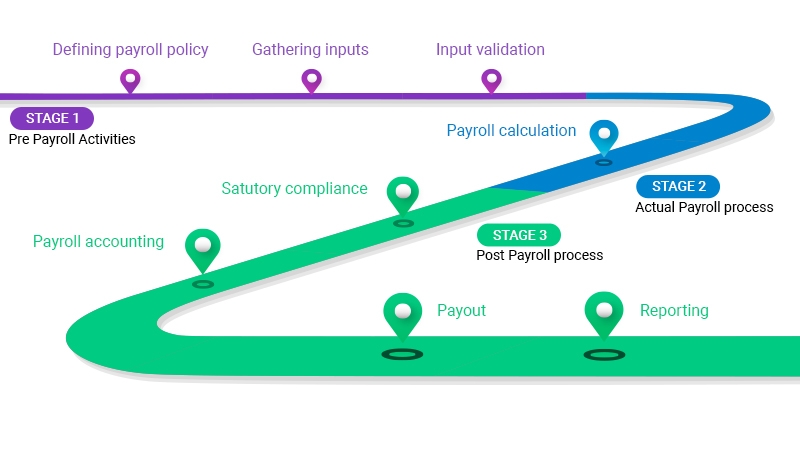

One who processes payroll must pay attention to the ongoing process and keep track of the changes. With careful mind, a payroll processor should try to keep everything on track because errors on the payroll front can take a toll on the morale and motivation of employees. Payroll processing can generally be divided into three stages- pre-payroll activities, actual payroll, and post-payroll activities.

Pre-payroll activities:

These are a series of activities conducted before the actual payroll processing. It is one of the most foundational steps to an effective payroll process with no errors. Payroll management is an integral part of business process management.

Let us run through a few pre-payroll activities!

Defining the payroll policies

The net amount of remuneration for each employee depends on multiple factors. The company’s policies can affect payment, leaves, and other benefits policies. As the first step, you must define those policies and involve management in approving the standard payroll process.

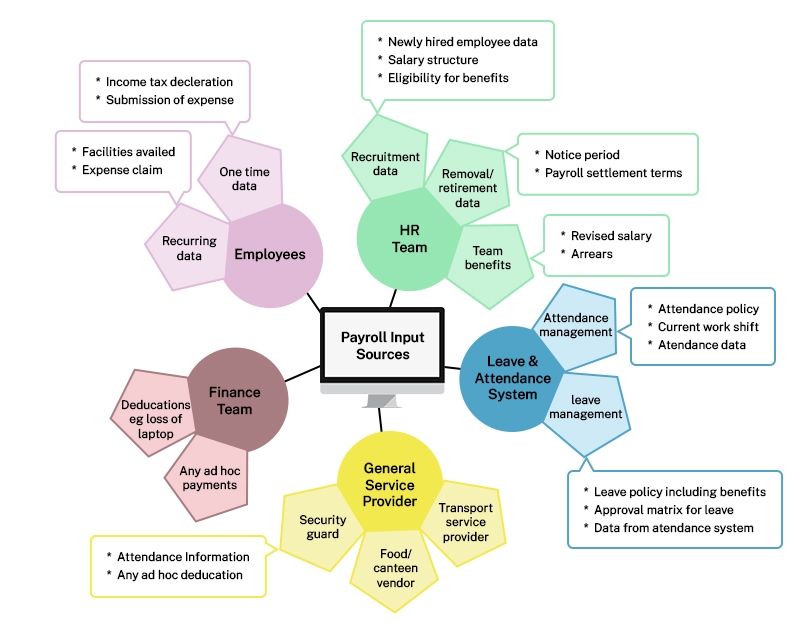

Gathering inputs

Payroll processing requires interaction with multiple departments and personnel. You will have to collect intricate data like mid-salary revision data, attendance data etc. In SMEs and relatively smaller organizations, gathering data can be overwhelming. If you have a small payroll system with integrated features like leave, attendance, and employee service, you will have to face less fuss related to the data collection process.

Validation of inputs

Once you get the inputs, you must validate the data and take it forward. Adhere to the company policy and ensure that the format is right. Besides that, as an HR you also have to make sure that no active employee is missed, and no inactive member is there in the payroll records.

Actual Process of Payroll:

By the time, you have got all your input for the payroll system. At the end, the net pay is all about calculating taxes, LPWs and other deductions. Once you are done calculating payroll, it is advisable to reconcile the inputs and verify the details to ensure accuracy.

Post-payroll Process:

After the actual payroll processing, there are a series of other activities for HRs. Let us run through them in the following pointers:

Statutory Compliance:

Statutory compliances like EPF, ESI, and TDS are crucial deductions during payroll processing. The company produces the amount to the concerned governing agency. Return and report filing, like PF and ECR, is crucial to payroll processing.

Payroll Accounting:

Every organization must keep a record of its financial transactions. Employee Salary is one of the most operational costs which must be there in the book of account. Having a record of reimbursement and salary bank account can help organizations for future reference.

Payout:

Salary release is an action point post-payroll processing. Salary can be paid by cash, bank transfer or by cash. Once you complete the payroll processing, you must ensure that the company’s funds have enough funds to release the payment. Post the process; you need to send a detailed statement along with the particulars like employee ID, payable amount, bank account number etc.

Reporting:

Once you have released the payout, you can send the reports to the concerned departments per their requirements. Mostly, the finance team uses such details to dig into the data and generate reports that greatly benefit the organization.

What are the statutory compliance norms in an Indian payroll process?:

What does the term statutory compliance mean? It refers to the process of payment from a business to the state and central legislation per the applicable employment norms. Some most common statutory compliances are subjected to Indian businesses, which include provision for minimum wages, overtime payment to the workers, TDS deduction and other social security schemes for employees such as ESI, PF etc.

The salary computation also includes deductions and contributions. Income tax is one such deduction by the end of each financial year. Based on the tax slabs, employers must include tax liability. TDS applies to the monthly income of the employee. If an employee has successfully filed TDS returns for the fourth quarter of the financial year, they are eligible to issue FORM 16. Form 16 offers substantial relaxation from the total individual IT return.

If you decide not to adhere or pay heed to these legalities, it might lead to huge havoc, hefty penalties, and whatnot! However, a seamless payroll management system can make it easier than ever!

Significant challenges while handling the payroll management process

The end of the month is often the happy time. Because it is salary time. However, for HRs, it is the most pathetic time of the year, as payroll processing is a headache. Every intricate detail, the proper calculation, deduction, and everything can often let you go crazy.

Let us address the “Why” behind that headache. The below pointers bring you a few major challenges of payroll processing!

Compliance Management

As discussed in the above section, compliance management is one of the firms’ most significant challenges while processing payroll. Nonadherence to the legalities might lead to severe repercussions like heavy penalties and even worse.

Dependence on multiple sources for inputs

Getting all the essential data on the table is another part of the task that makes the whole process hectic. Attendance register leaves taken, conveyance facility record, revision information etc., make it a comparatively complicated process.Over the years, businesses have opted for more agile processes than excel sheets.

Popular Ways Of Payroll Processing

While payroll processing has been such a hectic task, HRs across the globe have put their A game up in finding agile ways of doing them. Some of the possible options that an HR can go for are:

Payroll Management:

At the initial stage of business, companies tend to have a handful of employees and usually prefer to go for an excel based payroll management system.

Excel payroll management involves all sorts of calculations on a standard template. Undoubtedly, a series of mathematical formulas are set to help the HR or the payroll officer do the task easily. However, excel payroll management has a high chance of errors.

Payroll Outsourcing

Here is another popular way of managing payroll. Outsourcing payroll involves hiring an external agency to oversee the payroll function. Most organizations with no dedicated resources for payroll processing prefer outsourcing the function.

Considering the statuary compliances, the service provider computes payroll per the provided. However, it is largely advised for businesses to have complete control over the payroll process.

Using a software

Using software for payroll processing is the most agile approach for businesses. Payroll inputs must come seamlessly for successful payroll processing using software. The significant intention of using software is to make the process of gathering inputs smoothly.

How can a dedicated HRMS platform help in payroll processing?

A dedicated HRMS is a holistic way of managing leave, attendance and payroll together. Whether an SME or mid-sized business, HRMS software can cater to all businesses for seamless employee data, leave, attendance and payroll management.

Are you eager to know the relentless benefits of using HRMS software for payroll processing? Find them in the pointers below:

Ease of operation:

Payroll processing becomes comprehensive and straightforward. An HRMS software reduces a payroll officer’s need for training and guidance. The interface is super easy, aiding in a hassle-free process of payroll generation.

Employee self-service:

One of the primary benefits of a dedicated HRMS or payroll software includes offerings like employee self-service. IT deduction becomes a seamless process with the least hassle of communication and data collection.

Scalability

Your ever-growing business requires a scalable solution for each of its processes. Payroll being one of the crucial business processes, requires an agile method that fits all sizes of companies. The advanced features of easy payroll processing are a process worth incorporating.

An integrated approach:

Your accounting and payroll processing becomes a part of the integrated system. Hence, the particular for payroll processing is easier to collect. You are free of the rigorous efforts of pushing data for the payroll process. A one-click payroll processing method through HRMS enables businesses to avoid inaccuracies.

Cloud-based Software

Cloud-based HRMS software is the need of the hour for every business. It is the ultimate transformation of the payroll management space. You can access data at any given time from any location. Above all, you can rely on the software to safely manage employee data and other crucial data of the company.