The fast-paced business world demands efficient and accurate payroll management. However, for many HR professionals, payroll can feel like a constant battle against the clock. Manual calculations, ensuring compliance with ever-changing regulations, and time-consuming data entry can quickly become overwhelming. But fear not! Advanced Human Resource Management (HRM) software offers a beacon of hope, equipped with user-friendly solutions that simplify the entire payroll process.

Evolving Payroll Software: From Manual Grind to Modern Marvel

Remember the days of endless spreadsheets and manual calculations? Those days are thankfully behind us. Modern HRM software streamlines payroll tasks with automation, transforming the landscape for businesses of all sizes. Here’s a glimpse into some of the user-friendly features revolutionizing payroll management:

-

-

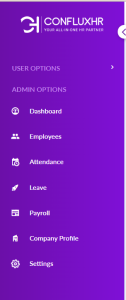

Intuitive Dashboards at Your Fingertips: Imagine accessing critical information with a single glance! User-friendly dashboards provide a comprehensive overview of payroll tasks, from pending approvals to upcoming schedules. No more sifting through mountains of data – everything you need is readily available.

-

Automated Calculations: Banish the Error Bugaboo! Ditch the error-prone manual calculations that can lead to costly mistakes and frustrated employees. User-friendly software automates these calculations, ensuring accuracy and saving valuable time for HR professionals. Focus your energy on strategic initiatives, not tedious number-crunching.

-

Employee Self-Service Portals: Empowering Your Workforce Put control in the hands of your employees! User-friendly software offers self-service portals where employees can access paystubs, update personal information, and even download tax documents. This reduces HR workload and fosters a sense of ownership among employees. They’ll appreciate the ease and convenience of managing their payroll information directly.

-

Customizable Configurations: Tailored Solutions for Your Unique Needs One size definitely doesn’t fit all! User-friendly software allows HR professionals to tailor payroll settings to match your organization’s unique structure, policies, and requirements. No more struggling to fit your payroll processes into a rigid system.

-

Seamless Leave Management Integration: Eliminate Discrepancies Say goodbye to discrepancies between leave and payroll data! Integrated leave management automatically syncs leave data with payroll calculations, ensuring accurate payments even during employee absences. This eliminates the need for manual adjustments and ensures your employees receive the correct compensation, every time.

-

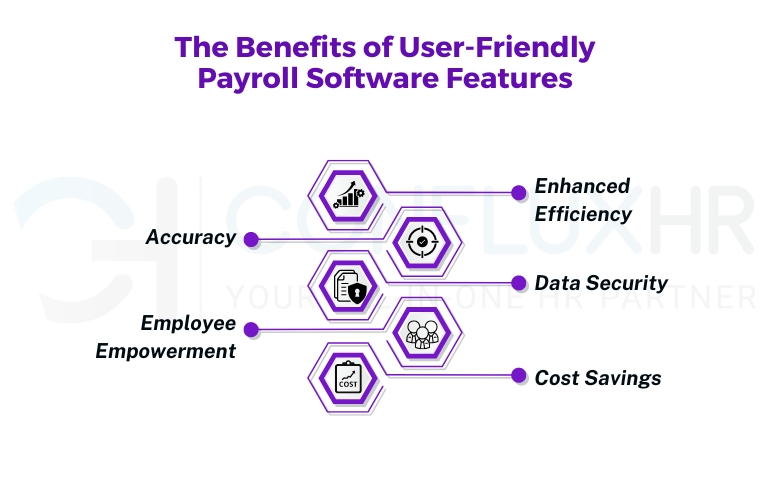

The Benefits of User-Friendly Payroll Software Features

Now that we’ve explored some of the essential features let’s delve into the benefits of incorporating user-friendly payroll management into your HRM toolkit.

-

-

Enhanced Efficiency: User-friendly payroll software simplifies complex tasks, reducing the time and effort required for payroll management. Automation and intuitive interfaces enable HR professionals to complete tasks more efficiently.

-

Accuracy: Automated calculations and integration with leave management minimize errors in payroll processing. This ensures that employees are paid accurately, enhancing trust and satisfaction among your workforces.

-

Data Security: Employee payroll data is sensitive and must be handled with care. User-friendly payroll software prioritizes data security, implementing encryption and access controls to safeguard confidential information.

-

Employee Empowerment: Providing employees with self-service portals empowers them to manage their payroll-related queries independently. This not only reduces HR’s workload but also fosters a sense of ownership among employees.

-

Cost Savings: While there is an initial investment in payroll software, the long-term benefits far outweigh the costs. Reduced errors, efficient processes, and compliance adherence contribute to significant cost savings.

-

Conclusion: Embrace Efficiency and Empower Your Workforce

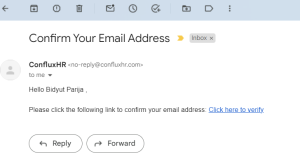

Ready to transform your payroll process and unlock the potential of user-friendly software?

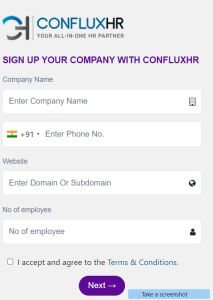

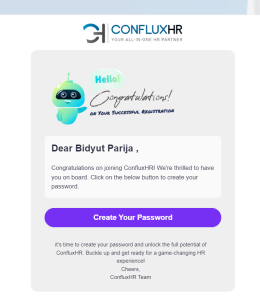

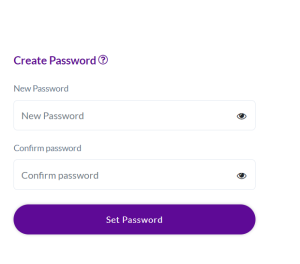

Here at ConfluxHR, we understand the challenges businesses face in managing payroll. Our comprehensive HRMS platform is designed with user-friendliness in mind, offering a suite of features that simplify tasks, enhance accuracy, and empower your workforce.

Contact ConfluxHR today for a free trial and discover how our innovative solutions can streamline your payroll and empower your business for success!