In today’s fast-paced business world, efficiency and accuracy in payroll management are vital. It’s no secret that the payroll process can be intricate and time-consuming, often fraught with challenges related to compliance, calculations, and employee satisfaction. However, with the advent of advanced HRM (Human Resource Management) software, managing payroll has become considerably more manageable.

Payroll Software Features have evolved significantly, providing user-friendly solutions that simplify the entire payroll management process. These features are designed to streamline operations, minimize errors, and enhance employee satisfaction. In this blog, we’ll delve into the world of user-friendly software for payroll, exploring their benefits and how they contribute to more straightforward payroll management.

The Evolution of Payroll Software

Gone are the days of manual payroll calculations and painstaking data entry. Modern HRM software has transformed the payroll landscape by automating and simplifying various tasks. Payroll Software Features have evolved to meet the changing needs of businesses, making payroll management user-friendly for organizations of all sizes.

Here are some of the key user-friendly features that are simplifying payroll management:

- Intuitive Dashboard: Many HRM software solutions now feature an intuitive dashboard that provides a comprehensive overview of payroll tasks. This user-friendly interface allows HR professionals to access critical information at a glance, from pending approvals to payroll schedules.

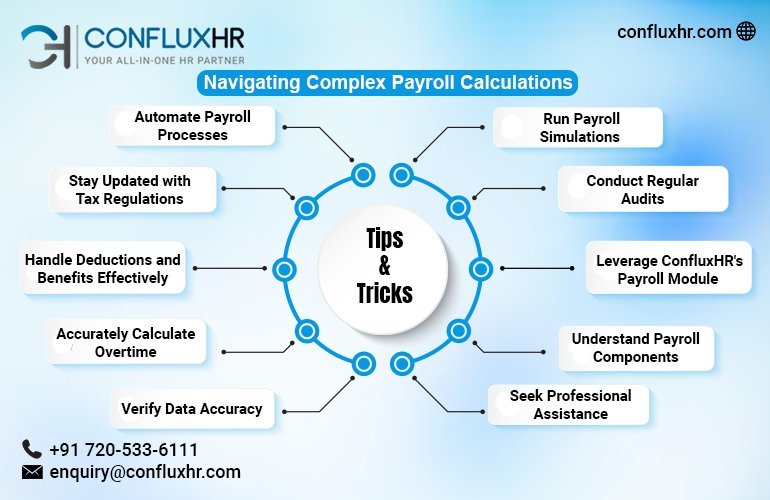

- Automated Calculations: Manual payroll calculations are prone to errors, which can lead to compliance issues and employee dissatisfaction. User-friendly payroll software automates these calculations, ensuring accuracy and saving valuable time.

- Employee Self-Service: Empowering employees to access their payroll information is a significant benefit. User-friendly payroll software often includes self-service portals where employees can view pay stubs, update personal information, and access tax documents. This reduces HR’s workload and enhances employee satisfaction.

- Customizable Configurations: Every business has unique payroll needs, and user-friendly payroll software recognizes this. It allows HR professionals to customize payroll configurations based on the organization’s structure, policies, and requirements.

- Leave Management Integration: Integrated leave management automatically syncs leave data with payroll calculations, eliminating discrepancies and ensuring accurate employee payments, even during time off.

The Benefits of User-Friendly Payroll Software Features

Now that we’ve explored some of the essential features let’s delve into the benefits of incorporating user-friendly payroll management into your HRM toolkit.

- Enhanced Efficiency: User-friendly payroll software simplifies complex tasks, reducing the time and effort required for payroll management. Automation and intuitive interfaces enable HR professionals to complete tasks more efficiently.

- Accuracy: Automated calculations and integration with leave management minimize errors in payroll processing. This ensures that employees are paid accurately, enhancing trust and satisfaction among your workforces.

- Data Security: Employee payroll data is sensitive and must be handled with care. User-friendly payroll software prioritizes data security, implementing encryption and access controls to safeguard confidential information.

- Employee Empowerment: Providing employees with self-service portals empowers them to manage their payroll-related queries independently. This not only reduces HR’s workload but also fosters a sense of ownership among employees.

- Cost Savings: While there is an initial investment in payroll software, the long-term benefits far outweigh the costs. Reduced errors, efficient processes, and compliance adherence contribute to significant cost savings.

Conclusion: Simplify Payroll Management with User-Friendly Software

In conclusion, user-friendly payroll software features are transforming the way businesses manage payroll. These features enhance efficiency, accuracy, and compliance while providing a seamless experience for HR professionals and employees alike.

Incorporating user-friendly payroll software into your HRM toolkit streamlines payroll processes, reduces errors, and ensures accurate and timely payments to your employees. In an increasingly competitive business environment, this advantage can be a game-changer for your organization.

Are you ready to simplify your payroll management? Discover the benefits of user-friendly payroll software with a free trial of ConfluxHR today!