Managing payroll calculations can be a daunting task for businesses, especially when faced with complex scenarios and ever-changing regulations. Accuracy and efficiency are crucial to ensure employee satisfaction and compliance.

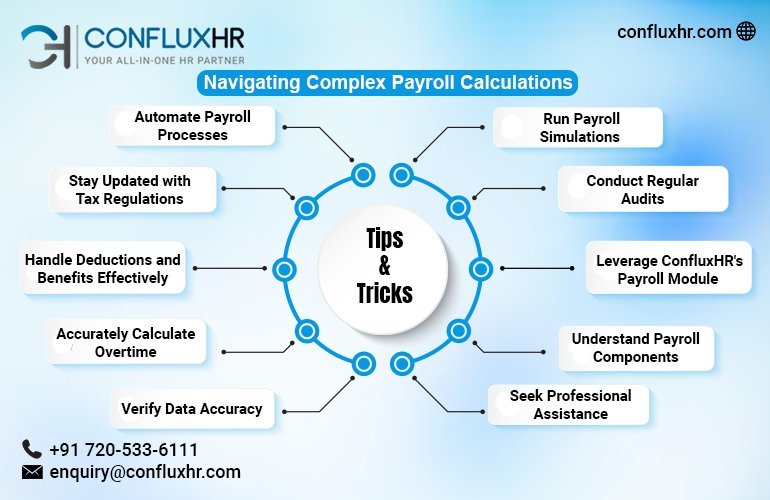

In this blog, we will explore effective tips and tricks to navigate complex payroll, making the process streamlined and error-free.

Understand Payroll Components

Before diving into calculations, it’s essential to have a solid understanding of payroll components. Familiarize yourself with factors such as gross wages, deductions, taxes, benefits, and bonuses.

Break down each component and ensure you have the necessary information to calculate accurately.

Automate Payroll Processes

Employing an automated payroll management system, like ConfluxHR, can significantly simplify and streamline the payroll process. Automation eliminates manual errors, saves time, and ensures consistency in calculations.

ConfluxHR’s payroll module automates complex calculations, allowing you to focus on other critical HR tasks.

Stay Updated with Tax Regulations

Tax regulations can change frequently, and it’s crucial to stay updated to ensure compliance. Keep track of federal, state, and local tax laws that impact payroll calculations.

Utilize payroll software that integrates tax tables and automatically adjusts calculations based on the latest regulations.

Accurately Calculate Overtime

Calculating overtime can be complex, especially when dealing with different pay rates, shift differentials, and varying work schedules. Ensure you understand the overtime rules specific to your location and industry.

Leverage payroll software that can accurately calculate overtime based on these rules, reducing the risk of errors and non-compliance.

Handle Deductions and Benefits Effectively

Managing deductions and benefits is another critical aspect of payroll. Whether it’s healthcare contributions, retirement plans, or other deductions, ensure they are accurately calculated and applied.

With ConfluxHR’s payroll module, you can easily manage and track employee deductions and benefits, ensuring accurate payroll.

Verify Data Accuracy

Data accuracy is paramount in payroll management. Double-check employee data, including hours worked, pay rates, and personal information.

Any discrepancies or inaccuracies can lead to errors in payroll calculations. Regularly review and update employee records to maintain data accuracy.

Run Payroll Simulations

Before finalizing payroll, consider running simulations to ensure accuracy. Use payroll software that allows you to simulate payroll runs without affecting actual employee payments.

This step helps identify potential errors or discrepancies and provides an opportunity to rectify them before processing payroll.

Conduct Regular Audits

Regularly audit your payroll processes and calculations to identify any anomalies or discrepancies. This proactive approach can help catch errors early and mitigate potential issues.

Utilize payroll software that provides detailed reports and audit trails, making it easier to review and reconcile payroll data.

Seek Professional Assistance

Complex payroll calculations may require professional expertise. Consider consulting with an accountant or payroll specialist who can provide guidance and ensure compliance with regulations.

Their expertise can help address specific challenges unique to your business and industry.

Leverage ConfluxHR’s Payroll Module

ConfluxHR’s comprehensive Payroll module offers a range of features and functionalities that simplify complex payroll calculations.

With automation, accurate tax calculations, and robust reporting capabilities, ConfluxHR ensures efficient payroll management, reducing errors and saving valuable time.

Conclusion

Mastering complex payroll is crucial for businesses to maintain accuracy, compliance, and employee satisfaction.

By understanding payroll components, automating processes, staying updated with regulations, and leveraging ConfluxHR’s payroll module, you can streamline payroll management and avoid costly errors.

Implement these tips and tricks to navigate the complexities of payroll calculations effectively and ensure the smooth operation of your HR processes.

Ready to simplify your payroll calculations? Schedule a demo of ConfluxHR’s Payroll module today and experience the benefits of accurate, efficient, and compliant payroll management.