The landscape of human resources management is rapidly evolving, with small and medium-sized businesses (SMBs) facing unprecedented challenges in managing their workforce effectively. As we navigate 2025, HR automation software has emerged as a game-changing solution for organizations seeking to streamline their operations and stay competitive. This comprehensive guide explores how modern HRMS software addresses critical pain points while ensuring seamless performance management and compliance. With the right tools and implementation strategy, businesses can transform their HR operations from an administrative burden into a strategic advantage.

Understanding the Critical HR Challenges Facing SMBs in 2025

Small businesses today grapple with multiple HR-related challenges that impact their growth and efficiency. Manual processes consume valuable time, while compliance requirements become increasingly complex. Recent studies indicate that HR professionals spend up to 40% of their time on administrative tasks that could be automated. The cost of these inefficiencies extends beyond just time — it affects employee satisfaction, compliance risk, and overall business performance.

Key challenges include:

- Time-consuming employee data management and documentation that pulls HR professionals away from strategic initiatives.

- Complex compliance requirements and regulatory updates that require constant attention and expertise.

- Inefficient performance review processes leading to decreased employee engagement and retention.

- Difficulty in tracking time, attendance, and leave management across multiple locations or remote teams.

- Limited visibility into workforce analytics and metrics that could drive better decision-making.

- Rising costs associated with manual HR processes and potential compliance violations.

- Increased security risks from paper-based document storage and outdated systems.

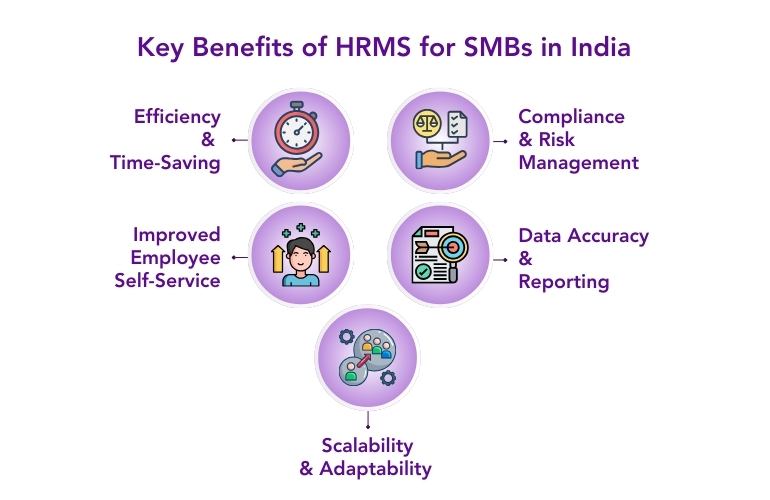

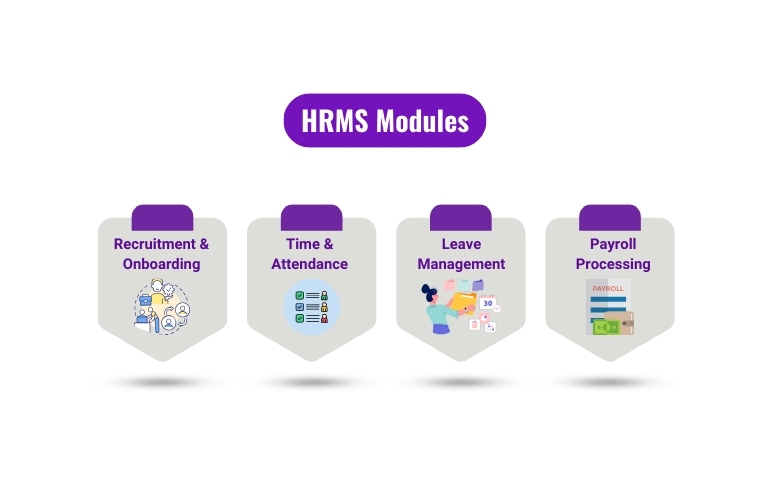

How HR Automation Software Transforms Small Business Operations

Modern HRMS software solutions offer comprehensive features designed specifically for small business needs. These platforms integrate essential HR functions into a single, user-friendly interface, delivering significant improvements in efficiency and accuracy. The transformation extends across all aspects of HR operations, from daily tasks to strategic planning.

Employee Self-Service Capabilities:

- Digital onboarding and documentation with automated workflow management.

- Intuitive leave request management with calendar integration.

- Secure access to personal information, pay stubs, and tax documents.

- Comprehensive training and development tracking with certification management.

- Mobile accessibility for remote and on-the-go workforce management.

Automated Compliance Management:

- Real-time regulatory updates across federal, state, and local jurisdictions.

- Automated compliance reporting with customizable templates.

- Digital storage of required documentation with encryption and backup.

- Audit trail maintenance for all HR-related activities and changes.

- Built-in compliance checks and alerts for potential issues.

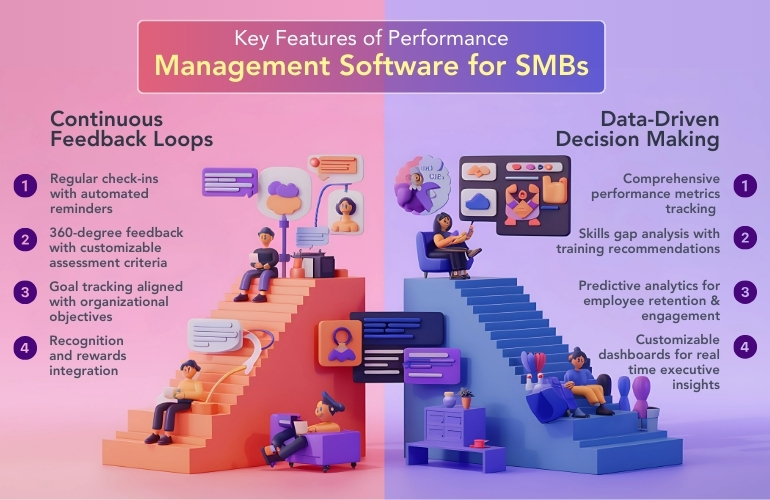

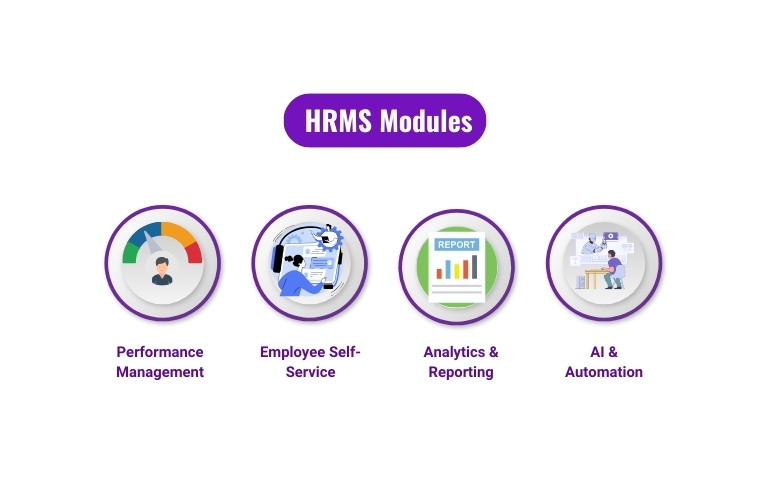

Key Features of Performance Management Software for SMBs

Effective performance management is crucial for business growth and employee development. Modern HR automation solutions include robust performance management tools that facilitate continuous improvement and engagement:

Continuous Feedback Loops

- Regular check-ins and performance updates with automated reminders.

- 360-degree feedback implementation with customizable assessment criteria.

- Goal tracking and alignment with organizational objectives.

- Recognition and rewards integration.

- Performance improvement plan automation.

Data-Driven Decision Making

- Comprehensive performance metrics tracking across departments.

- Skills gap analysis with recommended training paths.

- Succession planning support with talent pipeline visualization.

- Predictive analytics for employee retention and engagement.

- Customizable reporting dashboards for executive insights.

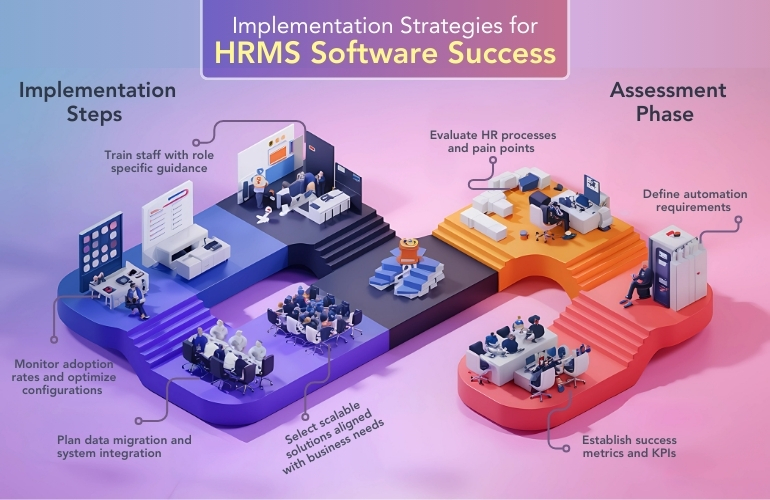

Implementation Strategies for HRMS Software Success

Adopting new HR technology requires careful planning and execution. Here’s a strategic approach to ensure successful implementation and maximize return on investment:

Assessment Phase:

- Evaluate current HR processes and pain points through stakeholder interviews.

- Define specific automation requirements based on business size and industry.

- Establish success metrics and KPIs aligned with business objectives.

- Conduct cost-benefit analysis for various solution options.

- Assess technical infrastructure requirements and limitations.

Implementation Steps:

- Select a scalable solution that aligns with business needs and growth plans.

- Plan data migration and system integration with existing tools.

- Conduct thorough staff training with role-specific guidance.

- Monitor adoption rates and gather user feedback.

- Optimize configurations based on user experience.

- Establish ongoing support and maintenance protocols.

Measuring ROI of HR Automation Software

Understanding the return on investment (ROI) helps justify the adoption of HR automation solutions and guides future improvements. Key metrics to track include:

- Time saved on administrative tasks (measured in hours per week).

- Reduction in compliance-related issues and associated costs.

- Improved employee satisfaction scores through regular surveys.

- Decreased turnover rates and associated recruitment costs.

- Enhanced recruitment efficiency and time-to-hire metrics.

- Reduced paperwork and storage costs.

- Improved data accuracy and reporting capabilities.

According to recent industry reports, businesses implementing HR automation software report an average 30% reduction in administrative time and a 25% improvement in compliance accuracy. Additionally, organizations see up to 40% reduction in onboarding time and a 20% increase in employee satisfaction scores.

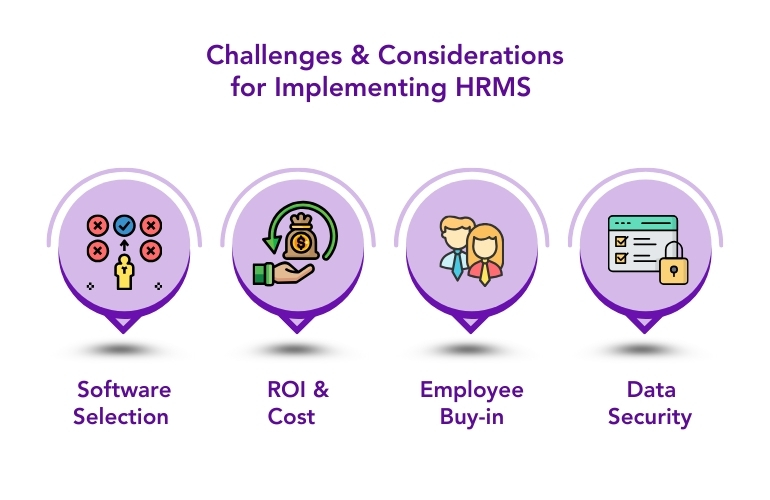

Cost Considerations for Small Businesses

When evaluating HRMS software options, consider these critical factors:

- Subscription costs and pricing models based on company size and features.

- Implementation and training expenses, including potential consulting fees.

- Customization requirements for industry-specific needs.

- Integration costs with existing systems like payroll and accounting.

- Ongoing support and maintenance fees.

- Security and compliance certification requirements.

- Data migration and storage costs.

Future-Proofing Your HR Operations

As technology continues to evolve, choosing an HR automation solution that can grow with your business becomes crucial. Consider these future-ready features:

- AI-powered analytics and predictive modeling.

- Integration capabilities with emerging technologies.

- Scalable architecture for business growth.

- Mobile-first design for workforce flexibility.

- Advanced security features and compliance updates.

- Customizable workflows and automation rules.

Embracing HR Automation for Future Success

As we progress through 2025, HR automation software has become indispensable for SMBs looking to stay competitive and efficient. By implementing the right HRMS solution, small businesses can overcome traditional HR challenges while positioning themselves for sustainable growth. The key lies in selecting a solution that aligns with your specific needs while offering scalability for future expansion. With proper implementation and utilization, HR automation software can transform your HR department from a cost center into a strategic partner in your business’s success.