Small and medium-sized businesses (SMBs) in Tier 2 and Tier 3 cities often face hurdles that limit their growth potential. Challenges like limited access to skilled HR professionals, reliance on manual processes, and navigating complex compliance requirements can hinder efficiency. These obstacles make it difficult for SMBs to manage their workforce effectively, leading to operational bottlenecks.

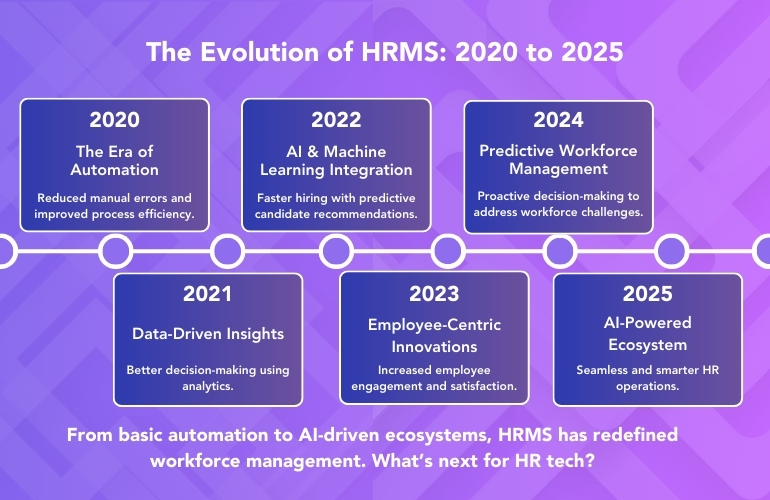

Enter Human Resource Management Systems (HRMS) – a transformative solution designed to streamline HR operations, optimize processes, and help businesses thrive in competitive markets. From automating payroll to centralizing employee data, HRMS is set to redefine how SMBs handle human resources.

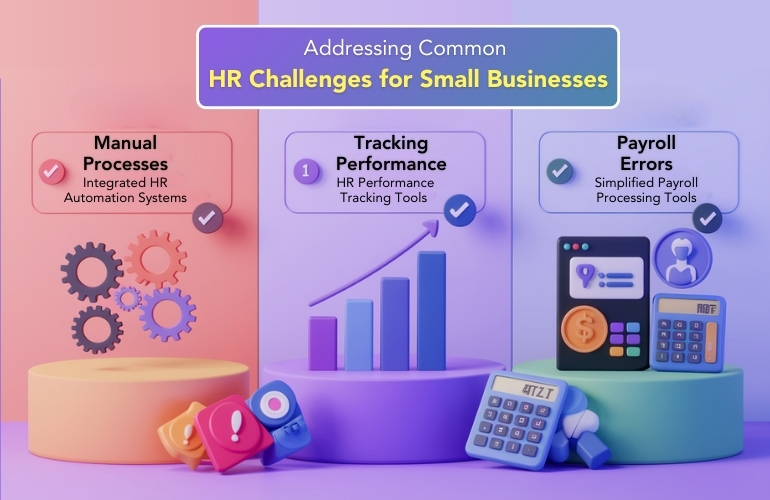

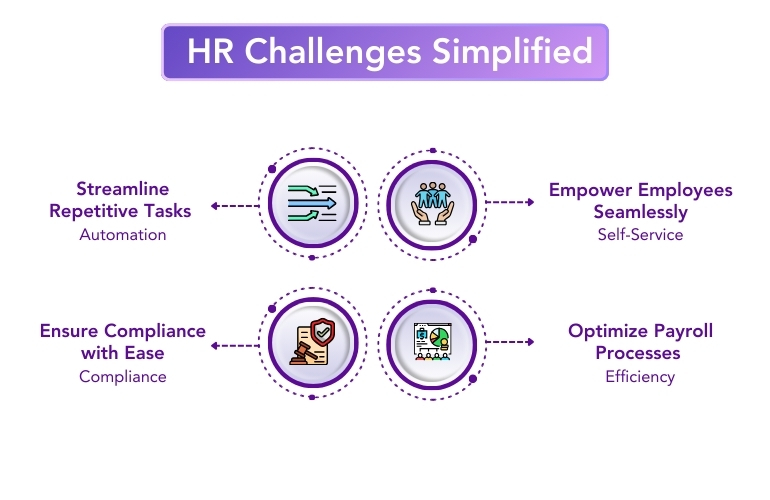

1. Addressing Common HR Challenges for SMBs

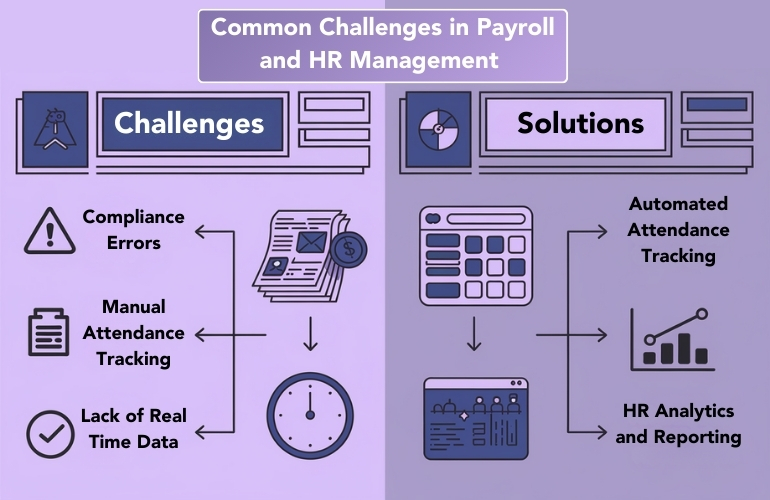

Many SMBs in smaller cities encounter specific challenges that impact their HR operations. Let’s examine some of these hurdles:

Limited HR Expertise

With budget constraints and a smaller talent pool, SMBs often struggle to hire experienced HR professionals. Existing staff members are overburdened, juggling HR tasks alongside other responsibilities. This often results in inefficiencies and errors that could have been avoided with specialized expertise.

Manual Processes

A significant number of SMBs still rely on spreadsheets and manual paperwork for critical tasks like payroll, attendance tracking, and compliance. Manual processes are time-consuming and prone to errors, leading to inefficiencies that distract from strategic priorities.

Compliance Issues

Navigating complex labor laws and regulations can be daunting for SMBs without a dedicated HR team. Failing to meet compliance requirements can result in hefty fines, legal complications, and reputational damage. This is particularly true in Tier 2 and Tier 3 cities, where businesses may not have access to the latest updates in labor laws.

2. The Transformative Role of HRMS Software

HRMS software is specifically designed to address these challenges, empowering SMBs with tools and capabilities to automate and optimize their HR functions. Let’s delve into some of the ways HRMS revolutionizes HR operations.

Streamlining Payroll Management

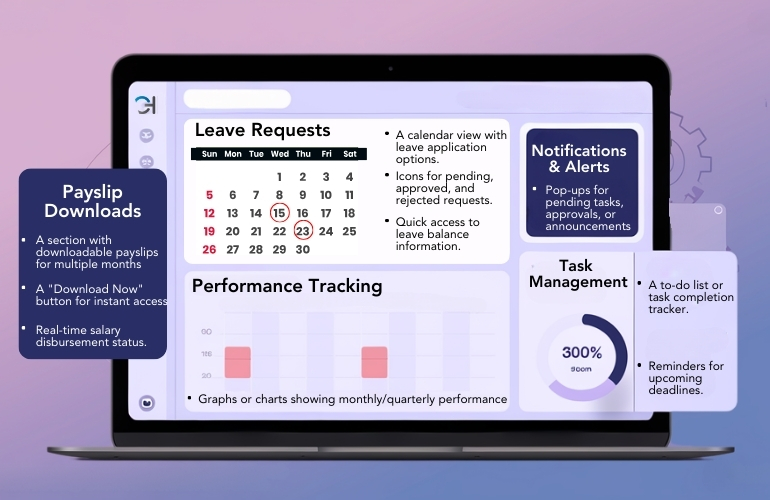

One of the most time-consuming HR functions, payroll management, is made effortless with HRMS. Automating payroll processes ensures accuracy and compliance, reducing the chances of errors that could lead to financial losses. Key features include:

- Automatic tax calculations and deductions

- Seamless integration with attendance and leave data

- Generation of real-time payroll reports

- Automated salary disbursements and notifications

By implementing HRMS, businesses can save significant time and reduce the risk of costly mistakes.

Enhancing Performance Management

Employee performance is a critical factor in organizational success. However, traditional methods of performance reviews are often inconsistent and biased. HRMS software offers structured performance management tools, including:

- 360-degree feedback mechanisms

- Automated goal tracking and performance reviews

- Data-driven insights for employee development

With these tools, SMBs can identify high-performing employees, address skill gaps, and foster a culture of transparency and growth.

Centralizing Employee Data Management

HRMS acts as a centralized repository for all employee data, eliminating the need for fragmented systems. Employee records, including personal details, leave history, performance metrics, and payroll information, are securely stored and easily accessible. Centralized data not only improves administrative efficiency but also ensures compliance with data protection regulations.

Supporting Recruitment and Onboarding

Finding and retaining talent is a major challenge for SMBs. HRMS systems simplify recruitment by:

- Automating job postings across platforms

- Filtering resumes based on predefined criteria

- Managing interview schedules and communication

For onboarding, HRMS ensures a seamless experience by automating document submission, training schedules, and orientation programs, helping new hires integrate quickly and efficiently.

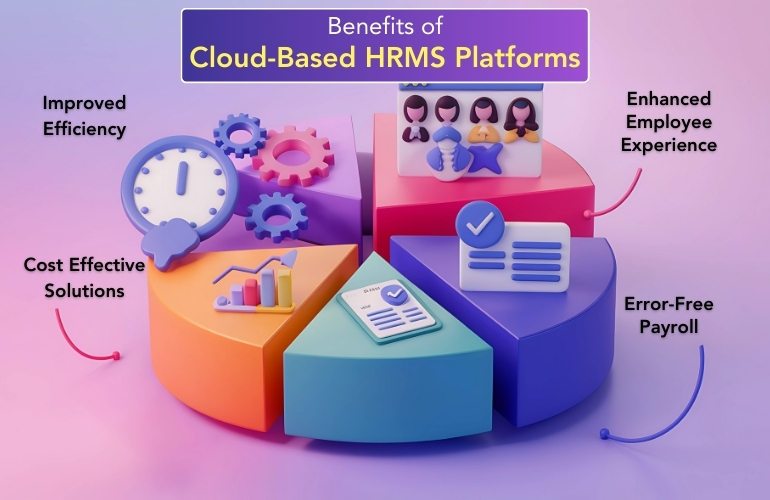

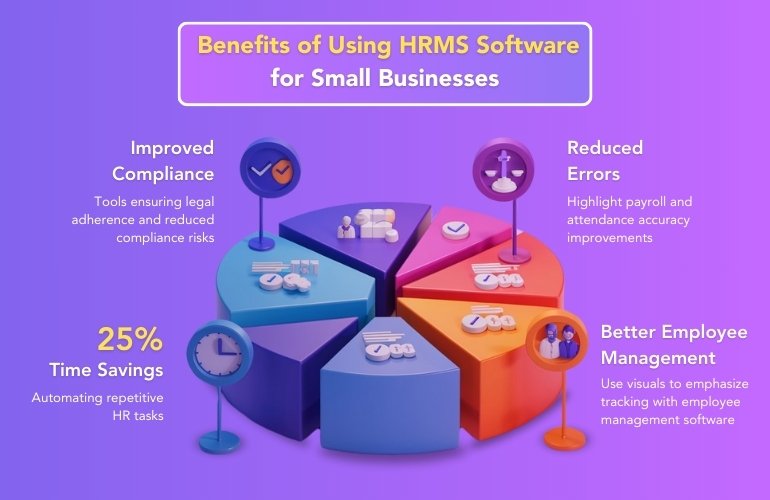

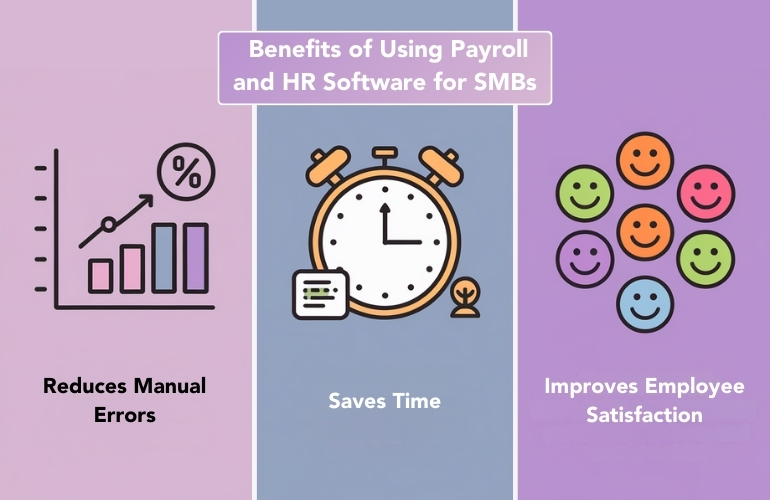

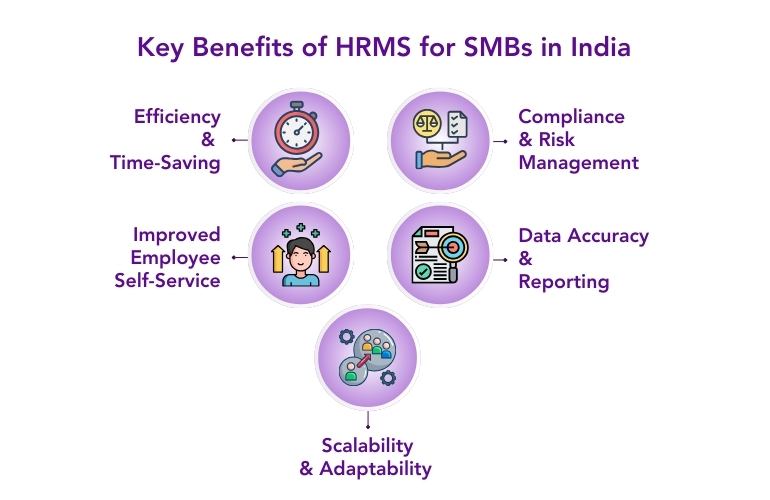

3. The Benefits of HRMS for SMBs in Tier 2 and Tier 3 Cities

Implementing HRMS software offers a range of advantages tailored to the unique needs of SMBs in smaller cities:

Cost Savings

Automating HR functions reduces the reliance on extensive manpower, allowing SMBs to focus their resources on growth-driven initiatives. Additionally, the reduction of errors in payroll and compliance minimizes the risk of financial losses.

Improved Employee Experience

HRMS enhances employee satisfaction by providing self-service portals where employees can:

- Apply for leave

- Access payslips

- Track performance goals

Transparency in HR processes fosters trust and engagement, which are critical for employee retention.

Time Efficiency

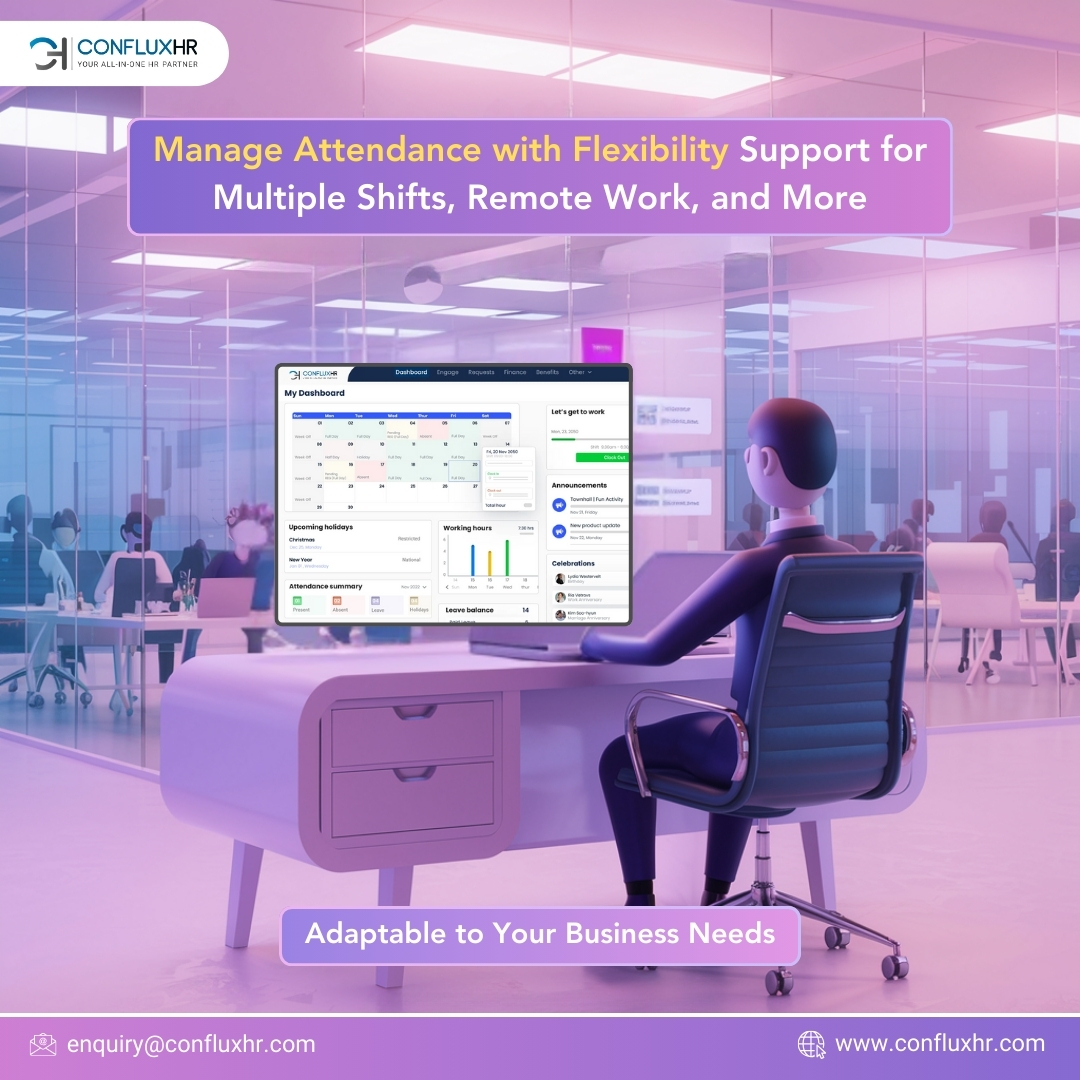

Automated workflows allow HR teams and business owners to focus on strategic decision-making rather than mundane administrative tasks. Processes like payroll, recruitment, and performance reviews become streamlined and efficient, saving time and effort.

Scalability

As SMBs grow, their HR needs evolve. Scalable HRMS solutions can adapt to increased employee counts, additional locations, and more complex requirements without disruption.

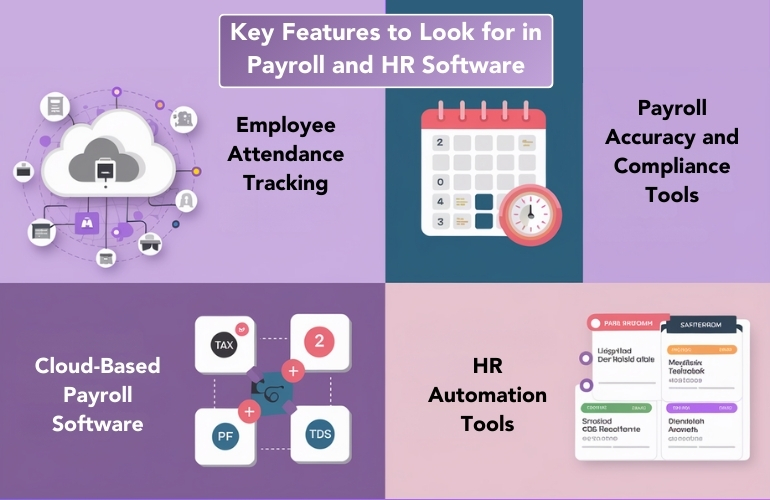

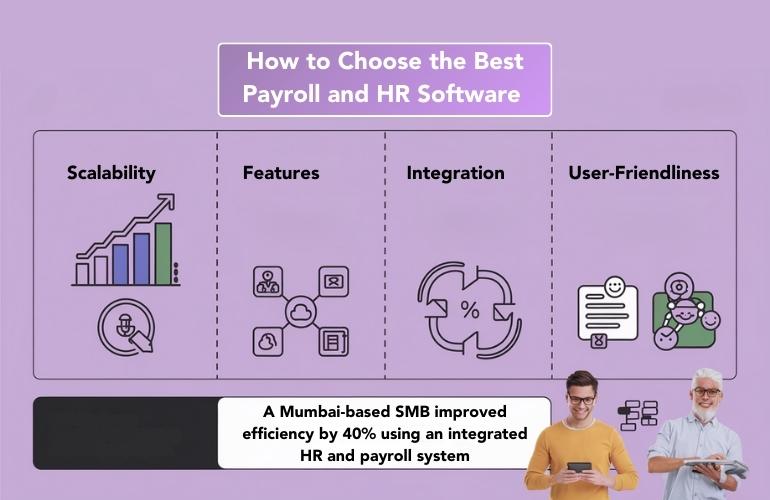

4. Key Features to Consider When Choosing an HRMS

Choosing the right HRMS is crucial for maximizing its benefits. SMBs should look for the following features:

Scalability

The HRMS should grow with the organization, accommodating new employees, departments, and locations without requiring significant upgrades.

Integration Capabilities

Seamless integration with other tools like accounting software, attendance systems, and project management platforms ensures smooth workflows and data synchronization.

Mobile Accessibility

A mobile-friendly HRMS enables employees and managers to access HR functions anytime, anywhere. Features like mobile payslips, leave applications, and attendance tracking enhance convenience and flexibility.

Compliance Management

A robust HRMS includes compliance tracking features, ensuring businesses stay updated with the latest labor laws and regulations. This reduces the risk of legal complications and fines.

5. How HRMS Transformed SMBs

Case Study 1: Payroll Automation for a Manufacturing SMB A manufacturing firm in a Tier 3 city faced consistent payroll errors due to manual calculations. After implementing an HRMS, the company automated salary processing, reducing errors by 90% and saving 15 hours per month on payroll tasks.

Case Study 2: Improving Recruitment Efficiency An SMB in the IT sector struggled with high recruitment costs and inefficiencies. HRMS software streamlined their hiring process, cutting recruitment timelines by 30% and significantly reducing costs.

Why HRMS is a Necessity for SMBs

The dynamic business environment of Tier 2 and Tier 3 cities demands efficiency and innovation. HRMS software provides SMBs with the tools to compete on a level playing field with larger organizations. By automating payroll, streamlining performance management, and centralizing HR operations, SMBs can:

- Overcome traditional HR challenges

- Improve compliance and reduce risks

- Empower employees and boost productivity

Conclusion

In today’s fast-paced business landscape, adopting HRMS software is no longer optional for SMBs in Tier 2 and Tier 3 cities. These systems offer a comprehensive solution to streamline HR processes, enhance employee satisfaction, and drive growth. For SMBs looking to stay competitive and efficient, HRMS is the key to unlocking their potential.

Take the first step towards transforming your HR operations. Explore HRMS solutions tailored to the unique needs of SMBs and set your business on the path to success.