HR professionals today face an overwhelming workload, juggling recruitment, compliance, payroll, and employee management—all while ensuring a positive workplace culture. However, the sheer volume of administrative HR tasks leaves little room for strategic decision-making.

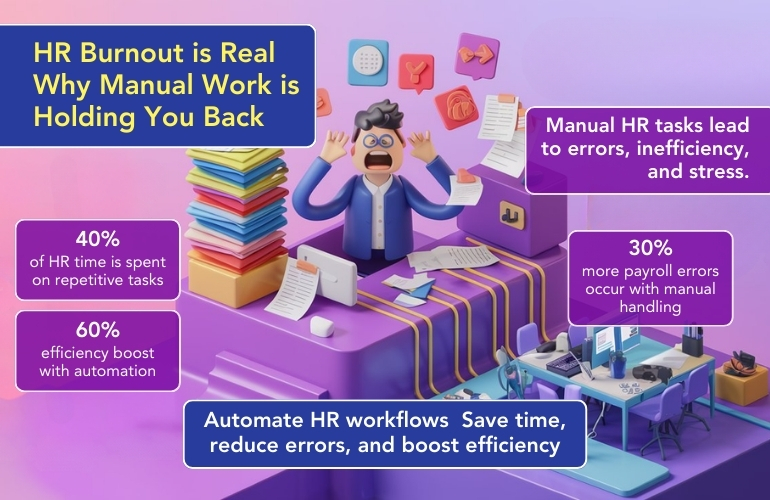

The growing complexity of HR responsibilities, coupled with outdated manual HR processes, is leading to high levels of burnout. According to industry research, HR teams spend nearly 40% of their time on repetitive administrative work. This is not just inefficient; it is unsustainable.

HR automation software offers a way to ease this burden. By leveraging HR workflow automation, businesses can streamline processes, reduce manual errors, and help HR professionals focus on employee engagement and strategic initiatives. This blog explores the root causes of HR burnout and how automation can provide long-term relief.

Why HR Professionals Are Burning Out

The Reality of Manual HR Work

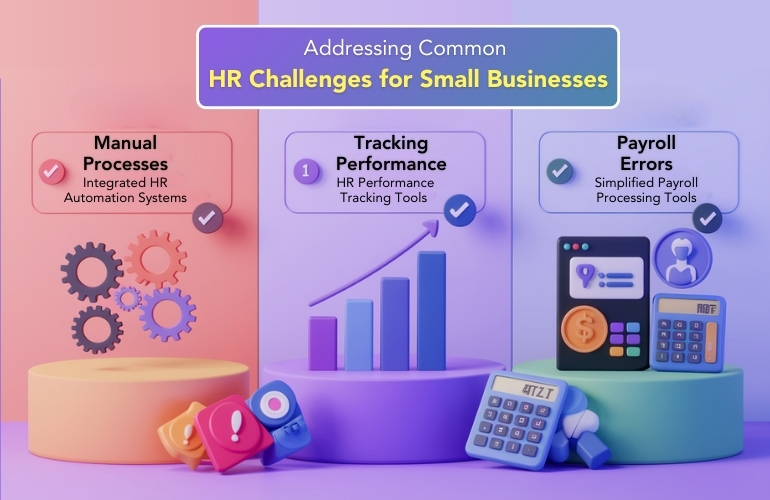

HR teams are expected to manage employee records, recruitment, payroll, compliance, and performance evaluations. Without HR process automation, these tasks become time-consuming and error-prone. This administrative overload contributes to workplace stress, impacting both HR professionals and employees.

Top Causes of HR Burnout

- Repetitive administrative tasks – Payroll processing, compliance documentation, and resume screening take up a large portion of the workday.

- Compliance risks and legal pressures – Missing a single regulatory update or payroll deadline can lead to serious financial penalties.

- Bottlenecks in employee management – HR teams struggle to keep up with leave requests, benefits administration, and performance tracking manually.

- Limited time for strategic work – Instead of focusing on workforce planning and employee retention, HR professionals are tied up with paperwork.

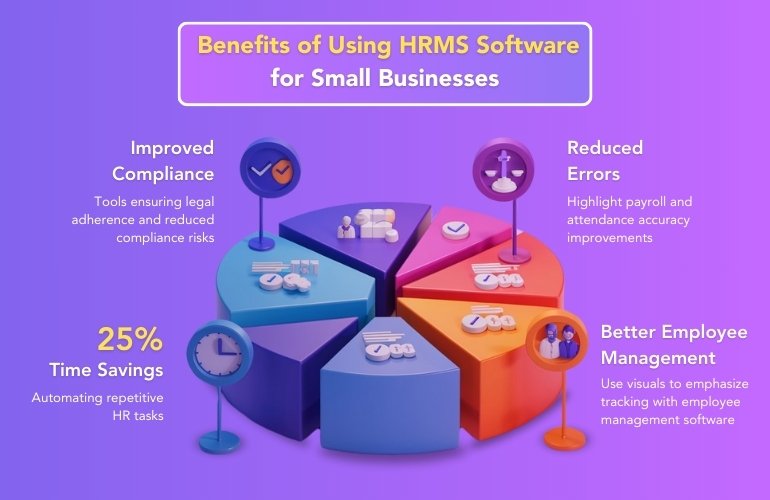

These challenges result in reduced efficiency, lower job satisfaction, and high turnover among HR professionals. The solution lies in reducing administrative burden through HR digital transformation.

Time Wasted on Routine Tasks

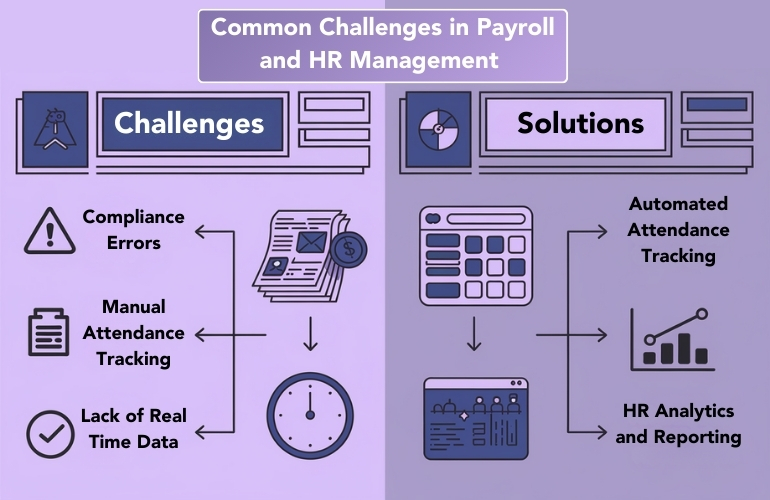

HR professionals spend hours each week managing routine tasks like payroll calculations, compliance documentation, and employee record updates. A manual HR system slows down workflows and increases the risk of errors, which can have significant financial and legal consequences.

When HR teams are bogged down by administrative work, they cannot focus on more critical responsibilities, such as talent acquisition, workforce engagement, and leadership development. This inefficiency also affects business operations, leading to delays and miscommunication across departments.

Compliance Risks and Legal Liabilities

Regulatory compliance is a critical aspect of HR, but manually tracking labor laws, tax regulations, and benefits requirements is prone to errors. A small mistake in payroll tax calculations or missed compliance deadlines can lead to fines, legal action, and reputational damage.

With HR automation software, compliance tracking becomes seamless. Automated HR processes ensure that HR teams remain updated with labor law changes, reducing legal risks and enhancing efficiency.

Negative Impact on Employee Experience

Inefficient HR processes do not just affect HR teams—they also impact employees. Delays in payroll processing, slow responses to leave requests, and mismanaged performance evaluations create frustration among staff. When employees face administrative hurdles, overall job satisfaction declines, affecting workplace morale and retention rates.

Automating HR processes allows for quicker approvals, accurate payroll management, and better employee engagement, leading to a more positive work environment.

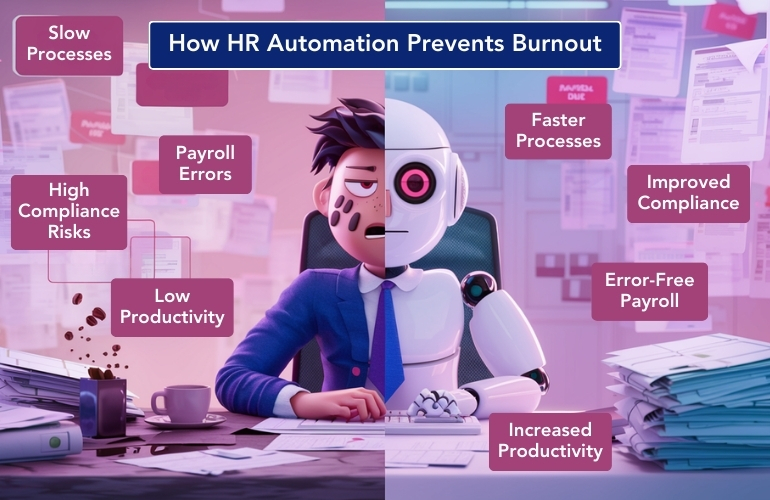

How HR Automation Solves These Challenges

What is HR Automation?

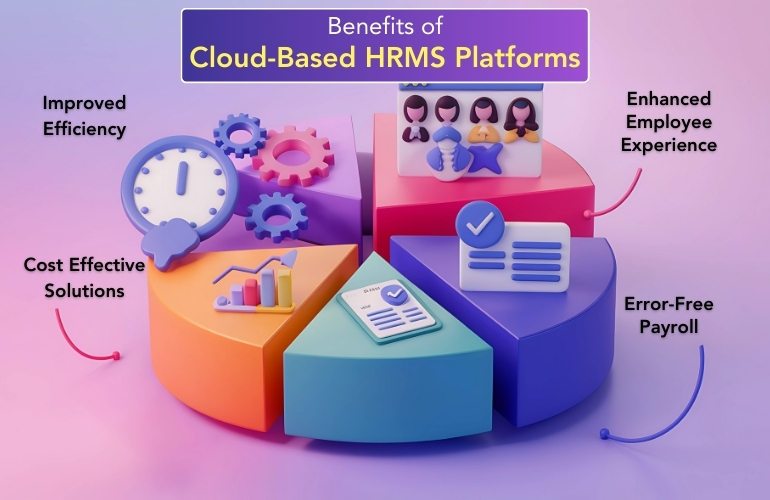

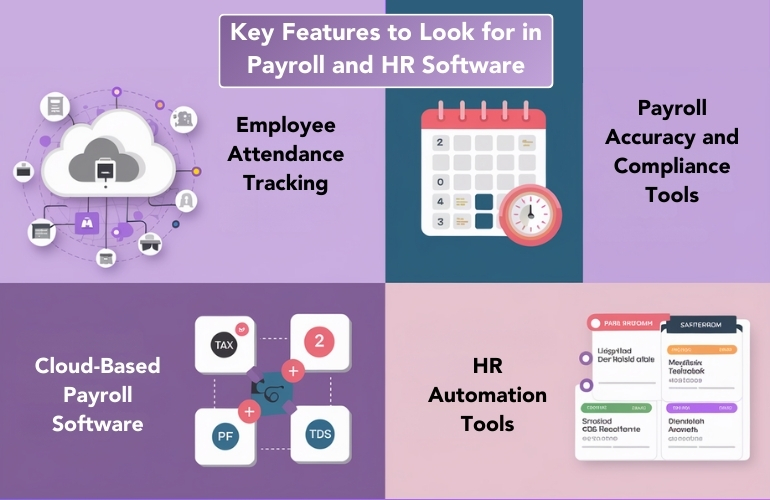

HR automation software refers to the use of technology to streamline and manage repetitive HR tasks such as payroll processing, compliance tracking, recruitment, and performance evaluations. By eliminating manual processes, businesses can reduce errors, save time, and allow HR professionals to focus on more strategic initiatives.

Key Benefits of HR Workflow Automation

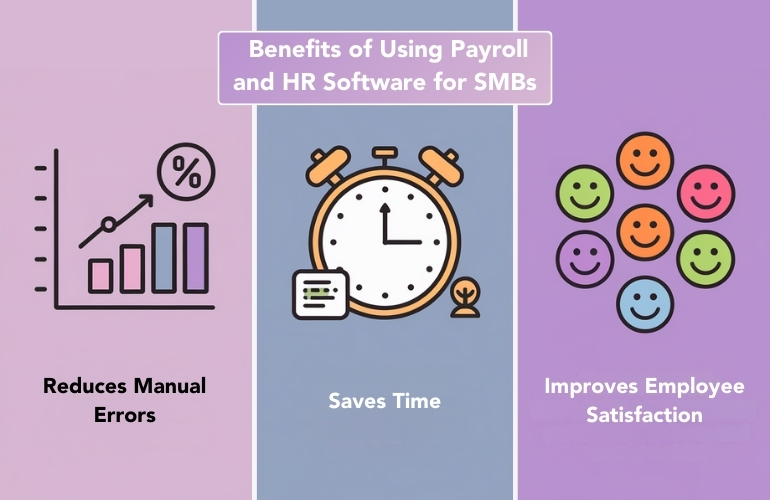

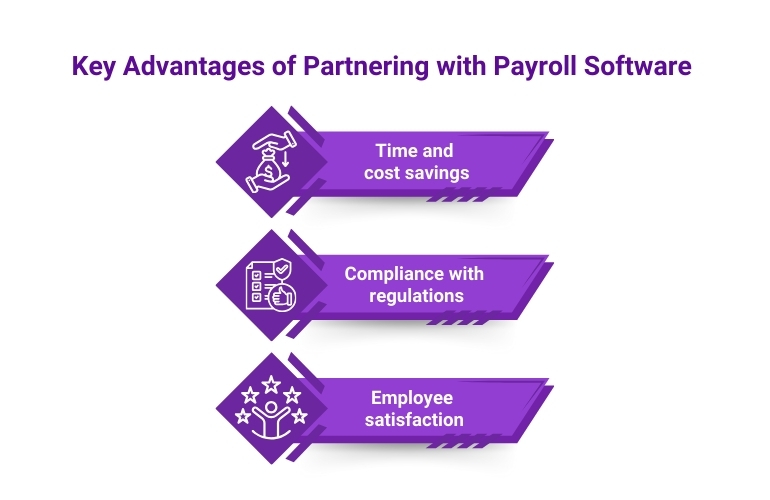

- Increased efficiency – Automating payroll, compliance tracking, and benefits administration saves significant time.

- Error reduction – HR workflow automation minimizes mistakes in payroll processing and regulatory compliance.

- Faster recruitment and onboarding – AI-powered hiring tools streamline resume screening, interview scheduling, and onboarding processes.

- Better employee engagement – Self-service HR portals allow employees to access payroll information, leave balances, and compliance documents without HR intervention.

Automation reduces the administrative burden on HR professionals, allowing them to focus on higher-value activities like talent development, workforce planning, and employee engagement.

Best HR Automation Tools to Reduce Burnout

Top HR Technologies for Efficiency

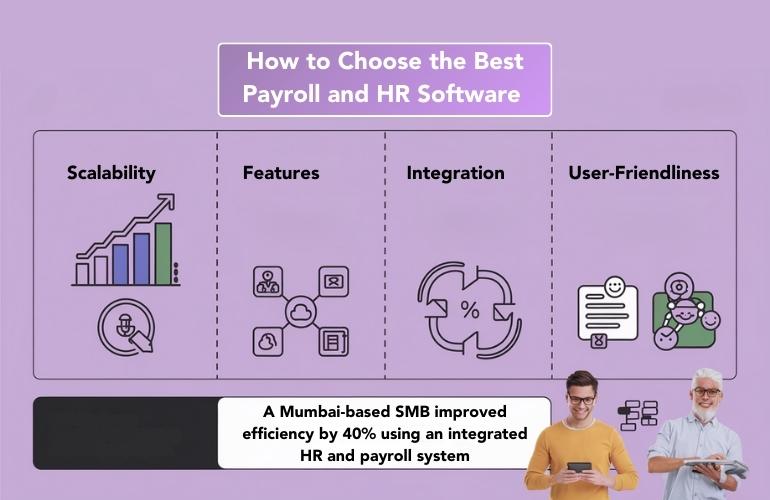

Businesses that invest in HR automation tools can transform HR operations into more efficient and strategic teams. Here are some key automation tools that can help:

- Payroll automation software – Automates salary calculations, tax deductions, and payslip generation.

- AI-driven recruitment tools – Speeds up resume screening, interview scheduling, and candidate assessments.

- Employee self-service portals – Reduces HR workload by allowing employees to manage their own leave requests, benefits information, and payroll details.

- HR compliance software – Ensures that legal updates, audits, and document management are handled efficiently, reducing regulatory risks.

Case Study: How Automation Helped a Company Overcome HR Burnout

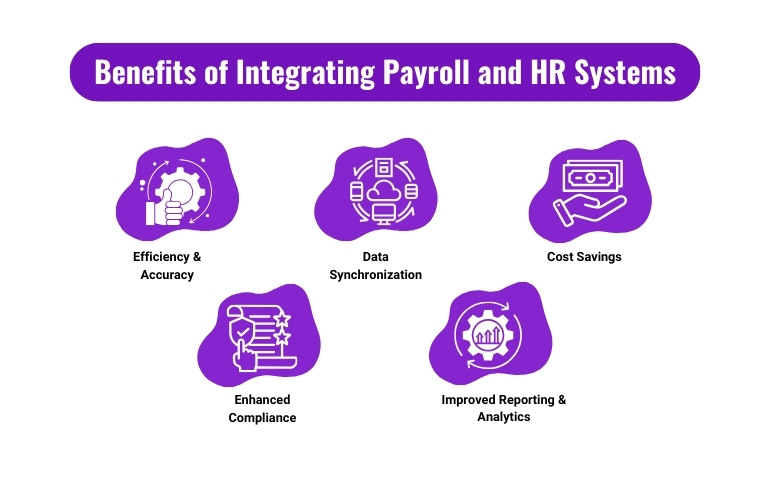

A mid-sized company with over 500 employees struggled with compliance tracking, payroll processing delays, and inefficient recruitment. After implementing HR automation software, they achieved:

- 50% reduction in administrative workload

- Elimination of payroll errors and compliance penalties

- Faster onboarding processes with automated document management

This shift allowed HR professionals to focus on improving employee experience and engagement, leading to a more productive workforce.

Conclusion

HR professionals should not have to choose between efficiency and employee engagement. With HR automation software, they can eliminate repetitive tasks, reduce compliance risks, and improve overall workplace productivity.

Companies that embrace HR automation benefits will not only prevent HR burnout but also build more efficient, strategic, and people-focused HR departments. As businesses continue to evolve, investing in automation will be essential for sustainable growth.

For HR teams still relying on manual processes, now is the time to explore the best HR automation software and streamline workflows for long-term success.