As the landscape of workforce management transforms at a rapid pace, technology has become a linchpin in optimizing HR processes and enhancing efficiency. With organizations facing growing complexities in managing diverse and dispersed teams, the demand for solutions that streamline payroll, scheduling, and time tracking has surged. Technology’s role in refining these systems is undeniable. It introduces speed, accuracy, and adaptability—crucial factors in the HR domain’s evolution. The potential for modern software to reshape how companies handle these essential tasks sets the stage for a new era of workforce efficiency.

- The Impact of Payroll and Scheduling Software on Workforce Efficiency

The fusion of payroll and scheduling software has revolutionized how organizations manage their teams. Combining these capabilities not only saves time but also enhances precision and accountability. For companies that strive to stay competitive, adopting these integrated solutions provides a clear edge. As HR tech continues to evolve, payroll and scheduling software offer a unified platform that mitigates errors, reduces manual workload, and allows HR professionals to focus on higher-level strategic initiatives. This transformative software will be key in optimizing workforce efficiency and ultimately driving a more agile and responsive organizational culture.

- Why 2025 Will Be a Landmark Year for HR Technology

By 2025, the HR technology field is projected to undergo groundbreaking advancements, particularly in payroll, scheduling, and time tracking. Driven by the rise of artificial intelligence (AI), machine learning, and predictive analytics, 2025 will witness unprecedented automation in HR processes, setting new standards for accuracy, speed, and employee satisfaction. This leap forward will be characterized by the ability of software to handle complex calculations and scheduling intricacies with minimal human intervention. As companies adopt these technologies, they will reap the benefits of streamlined processes, improved compliance, and an empowered workforce prepared to meet modern business challenges.

1.The Evolution of Payroll and Scheduling Software

- From Manual Methods to Digital Solutions

In the past, payroll and time tracking were manually managed, requiring significant time and effort. HR departments would sift through mountains of paper, double-check figures, and navigate the risk of errors. With the rise of digital solutions, these tedious processes transitioned into more efficient, computerized formats. Payroll and scheduling software emerged, allowing HR teams to handle large-scale operations with greater ease and accuracy. This shift was more than a mere upgrade; it marked a turning point where technology began to redefine what was possible in workforce management.

- Current Trends Shaping HR Management Today

Today’s payroll and scheduling solutions are packed with innovative features designed to make workforce management seamless and responsive. These platforms often incorporate mobile apps, cloud-based accessibility, and user-friendly interfaces that provide real-time insights into employee hours, payroll status, and scheduling conflicts. AI-powered tools help HR managers predict scheduling needs, and integrated time-tracking apps enable accurate records of hours worked. The software available today has already set new standards for transparency, accountability, and flexibility in HR management, making these solutions invaluable for companies of all sizes.

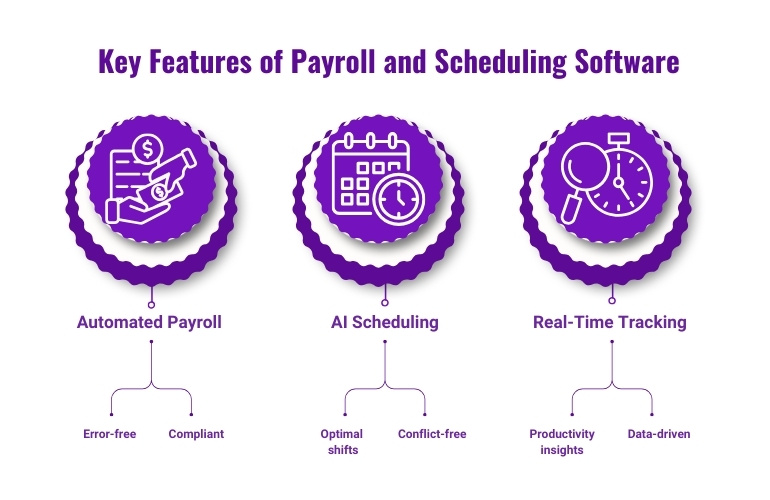

2.Key Features of Modern Payroll and Scheduling Software

- Automated Payroll Processing

Automated payroll processing is a standout feature in today’s HR software, dramatically reducing the time and effort involved in calculating wages. This automation mitigates the risk of human error, ensuring that employees are paid accurately and on time. From tax calculations to benefit deductions, automated payroll processing offers peace of mind to HR managers and employees alike, as it streamlines payment processes while maintaining accuracy and compliance with regulations.

- Seamless Scheduling Tools

AI-driven scheduling tools bring a level of efficiency and fairness that manual scheduling methods cannot match. These tools analyze employee availability, skill sets, and even company needs to generate optimal schedules that reduce conflicts and maximize productivity. By automating the scheduling process, HR teams can better allocate shifts, avoid overstaffing or understaffing, and respond swiftly to last-minute changes. Seamless scheduling benefits not only HR teams but also employees, who gain greater control over their work hours.

- Integrated Time Tracking

Integrated time tracking has become essential for companies that need precise data on working hours, overtime, and productivity. Time tracking apps provide real-time insights into how hours are allocated, helping managers identify trends and optimize workflows. This data-driven approach supports better decision-making, enabling businesses to maximize efficiency and ensure that employees’ time is used effectively.

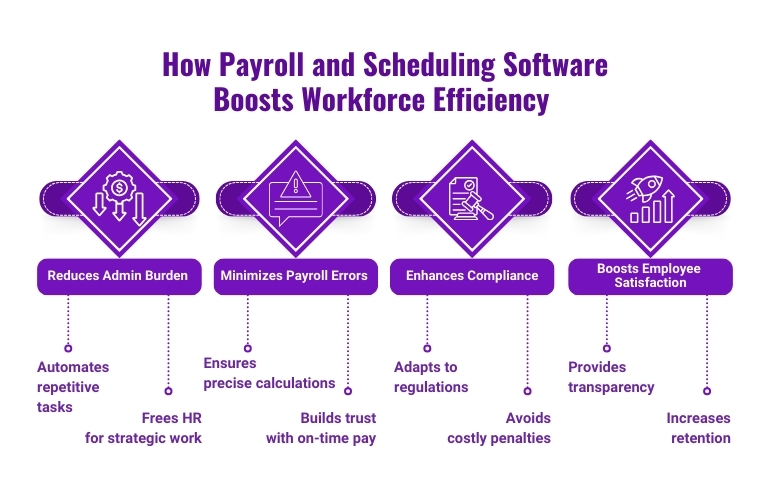

3.How Payroll and Scheduling Software Boosts Workforce Efficiency

- Reducing the Administrative Burden

By automating payroll and scheduling tasks, HR teams are liberated from the repetitive, time-consuming processes that once dominated their workload. This frees up HR professionals to focus on strategic initiatives, such as improving employee engagement and developing talent. In essence, automation allows HR teams to shift their focus from the transactional to the transformational, driving initiatives that add tangible value to the organization.

- Minimizing Payroll Errors and Discrepancies

Errors in payroll can lead to costly consequences, from financial losses to reduced employee morale. Payroll automation minimizes these risks by handling calculations with precision, ensuring that paychecks are accurate and delivered on time. With automated systems in place, companies can significantly reduce the likelihood of errors and discrepancies, fostering a trusting relationship between employees and management.

- Enhancing Compliance and Avoiding Penalties

Staying compliant with labor laws and regulations is critical for any organization. Payroll and scheduling software often include compliance features that automatically adjust for regulatory changes and help companies avoid legal pitfalls. By ensuring adherence to current labor standards, this software protects companies from costly fines and supports a fair and equitable workplace.

- Improving Employee Satisfaction

A transparent payroll and scheduling system plays a significant role in boosting employee satisfaction. When employees have access to accurate pay, predictable schedules, and reliable time tracking, they feel valued and secure in their roles. Improved satisfaction not only enhances productivity but also aids in retaining top talent, a crucial factor in a competitive job market.

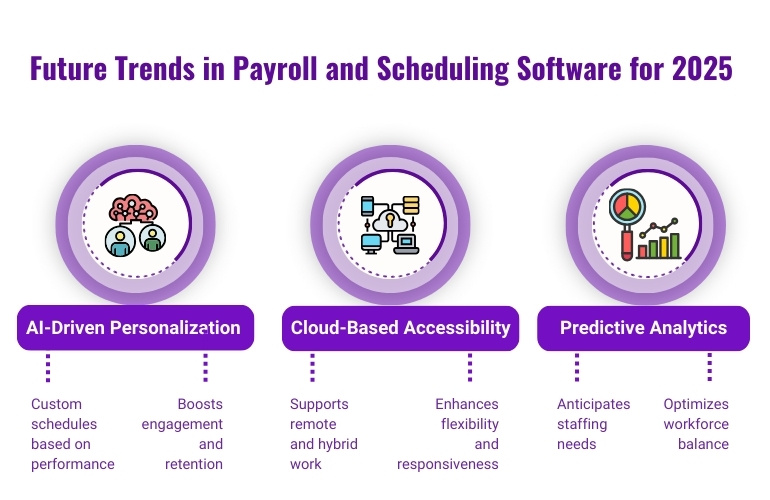

4.Future Trends: What to Expect from Payroll and Scheduling Software in 2025

- AI-Driven Personalization

As AI continues to evolve, payroll and scheduling software will likely incorporate personalized solutions tailored to individual employee needs. AI will analyze performance, preferences, and work habits to create schedules that optimize both productivity and work-life balance. This level of personalization promises to transform employee engagement and retention, as workers feel more supported and understood by their employers.

- Cloud-Based Accessibility and Remote Work

With the rise of remote work, cloud-based accessibility has become a non-negotiable feature for modern HR software. Cloud technology allows employees and managers to access payroll and scheduling data from anywhere, enhancing flexibility and responsiveness. By 2025, cloud-based solutions will further support hybrid work environments, giving teams the tools they need to work efficiently from any location.

- Predictive Analytics for Workforce Optimization

Predictive analytics will be a game-changer in workforce management. These advanced analytics tools will help HR teams anticipate staffing needs, forecast scheduling requirements, and identify trends that impact workforce efficiency. By leveraging predictive analytics, companies can proactively address potential issues, ensuring a well-balanced and highly productive team.

5.Choosing the Right Payroll and Scheduling Software

- Key Considerations

Selecting the right payroll and scheduling software requires a strategic approach. Organizations should consider user-friendliness, integration capabilities, compliance support, and cost-effectiveness. The right software will be easy for employees and HR teams to use, integrate smoothly with other systems, and offer comprehensive compliance features that help the organization meet regulatory requirements.

- Popular Solutions in the Market

The market for payroll and scheduling software is vast, with many solutions available that cater to different business sizes and needs. Some of the top contenders include platforms with robust payroll apps, HR management software, and specialized time-tracking tools. Companies looking to improve their workforce efficiency should evaluate their options carefully to find a solution that aligns with their specific goals and challenges.

Conclusion

Payroll and scheduling software represents a pivotal step toward a more efficient, accurate, and employee-centric workforce management system. By embracing automation, AI-driven personalization, and cloud-based solutions, organizations can simplify complex processes, reduce errors, and promote a culture of transparency and trust. With the right tools in place, companies will be well-prepared to thrive in 2025 and beyond, creating a work environment that meets the demands of a modern, dynamic workforce.