Did you know that Indian small and medium-sized businesses (SMBs) spend up to 30% of their HR time on manual processes like payroll, leave tracking, and compliance? Managing human resources efficiently in today’s competitive market can make or break a business’s success. This is where HR software for SMBs comes into play, offering streamlined solutions to enhance productivity, reduce costs, and ensure compliance.

Modern HRMS (Human Resource Management Systems) combine cloud-based HR solutions, automated payroll management, and employee self-service tools to revolutionize HR processes for SMBs in India. By automating routine tasks and simplifying workforce management, SMBs can focus on growth and employee satisfaction. Let’s explore why HRMS is a game-changer for SMBs in 2025.

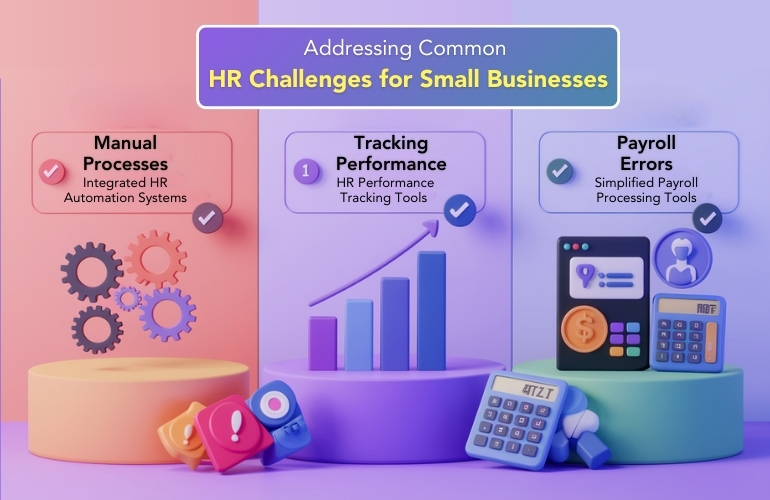

The Growing Challenges of HR Management in SMBs

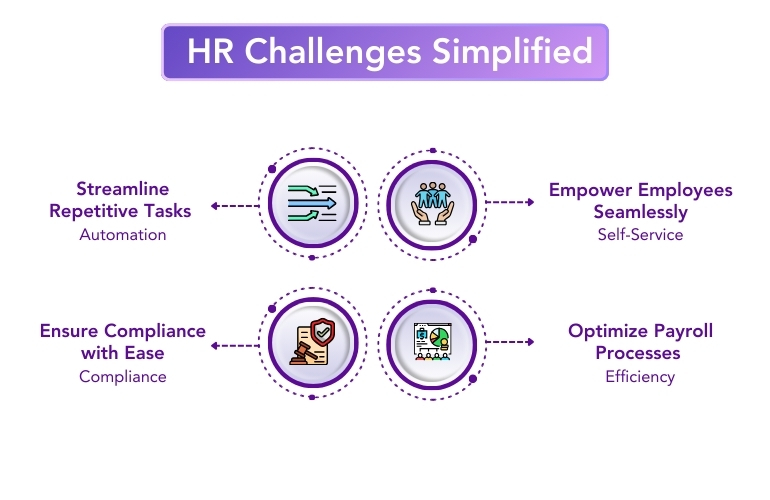

Indian SMBs often operate with limited resources, which makes manual HR management inefficient and error-prone. Here are some of the top challenges they face:

1. Manual Processes Waste Time and Resources:

Tracking attendance, managing payroll, and processing leave requests manually consumes significant time and effort.

2. Errors in Payroll and Compliance Management:

Mistakes in salary calculations, tax deductions, and regulatory compliance can lead to penalties and employee dissatisfaction.

3. Difficulty in Scaling HR Operations:

As businesses grow, managing a larger workforce without workforce management tools for SMBs becomes a logistical challenge.

4. Employee Engagement Gaps:

Without HRMS with employee self-service, employees struggle to access payslips, update profiles, or track leave balances independently, leading to frustration.

Stat: “60% of SMBs in India struggle to automate HR tasks, resulting in higher operational costs and inefficiencies.”

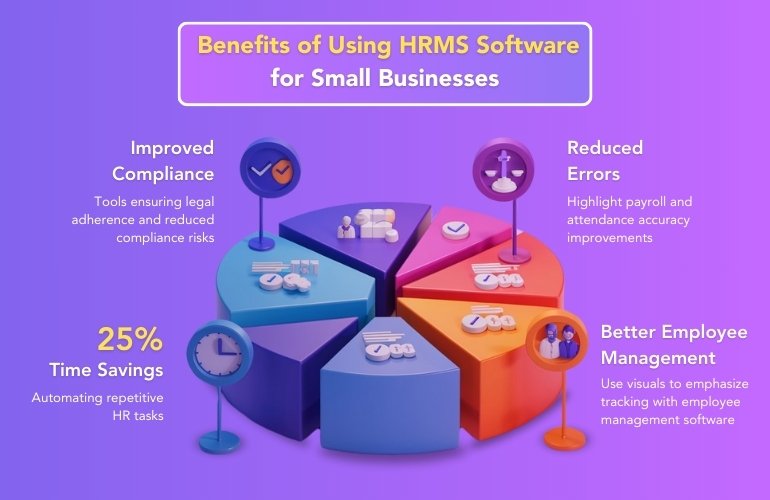

What is HRMS and How Does It Benefit SMBs?

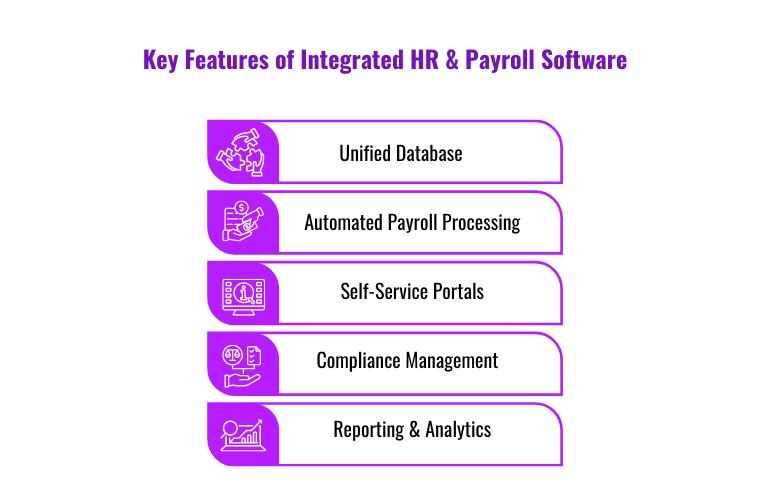

A Human Resource Management System (HRMS) is a software solution that automates and streamlines key HR functions such as payroll, attendance, compliance, and performance management. For SMBs, adopting HR software for SMBs means simplifying day-to-day HR tasks while improving accuracy and efficiency.

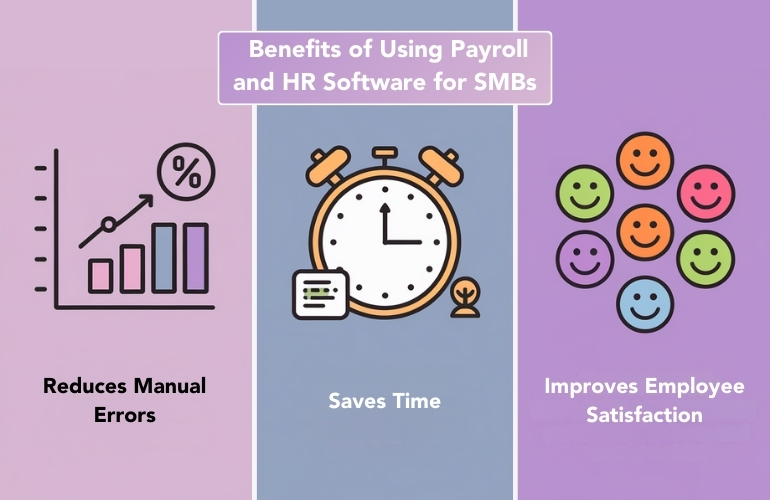

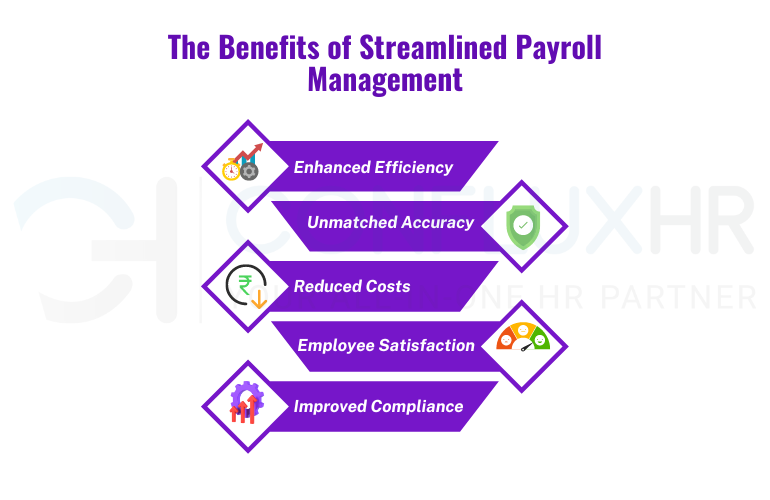

Key Benefits of HRMS for SMBs:

- Automates repetitive tasks like payroll and attendance tracking.

- Reduces errors and ensures compliance with labor laws.

- Enhances employee satisfaction with self-service tools.

- Provides actionable insights into workforce productivity.

With HRMS, Indian SMBs can scale their operations effortlessly while saving time and money.

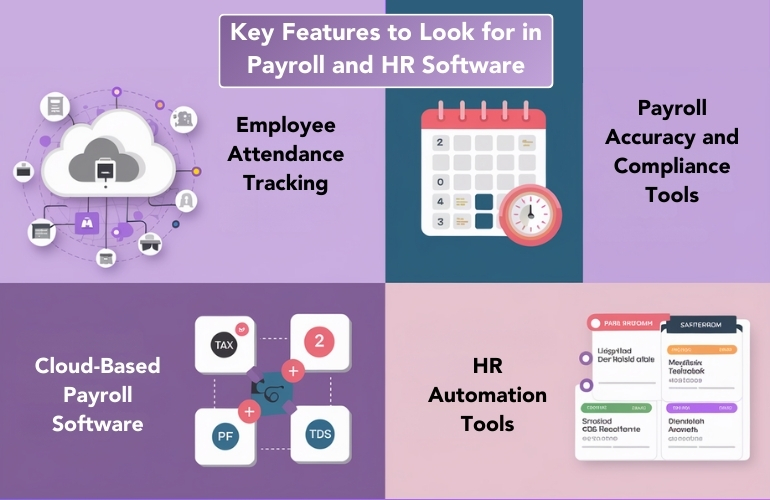

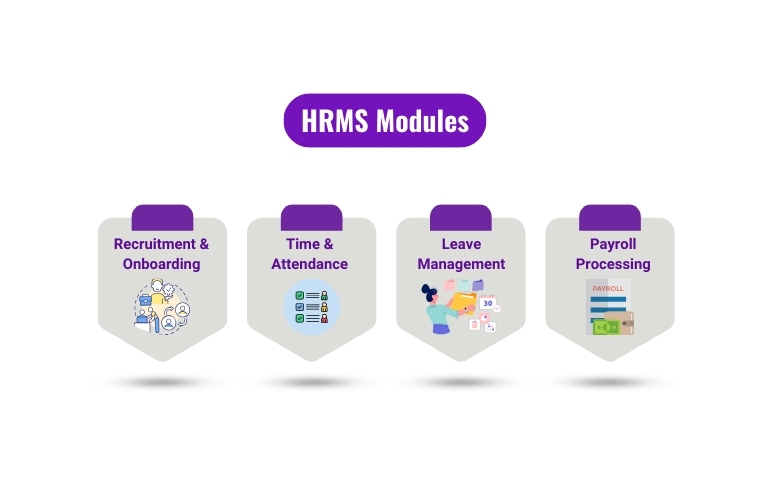

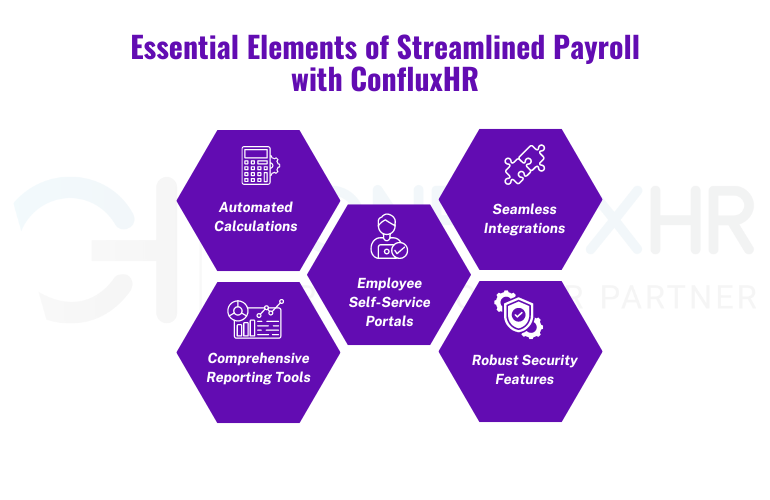

Key Features of HRMS for SMBs

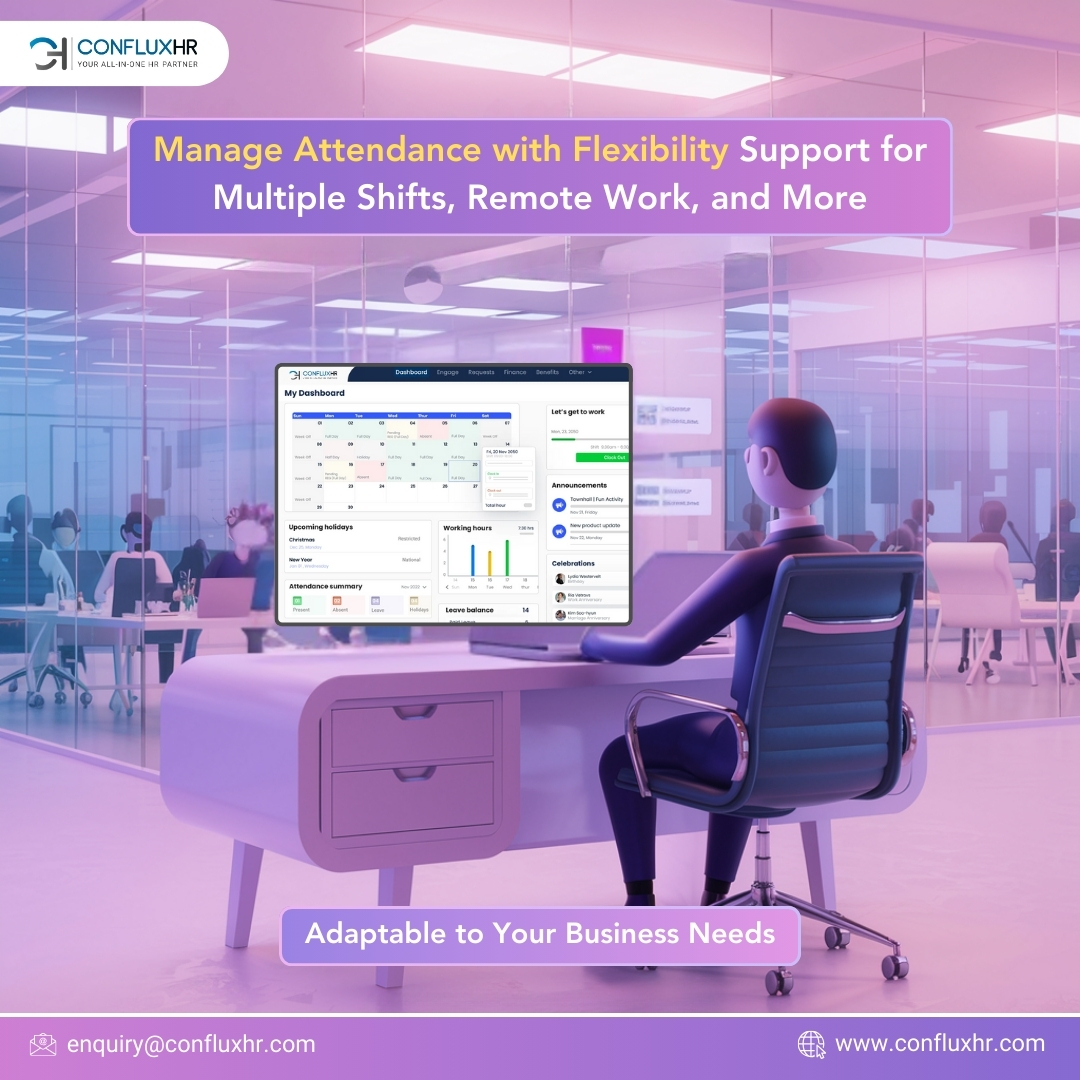

1. Attendance and Leave Tracking System

Manual attendance tracking can lead to errors and disputes. An attendance and leave tracking system automates this process with real-time attendance logs and leave approvals.

- Integration with Payroll: Automatically syncs attendance data with payroll for accurate salary calculations.

- Example: A retail SMB reduced absenteeism issues by 40% using attendance tracking software.

2. Payroll and HR Solutions

Handling payroll manually increases the risk of calculation errors and compliance violations. Payroll and HR solutions automate salary processing, tax deductions, and statutory compliance.

- Automated payroll management ensures error-free payouts every month.

- Example: A Bengaluru-based logistics company reduced payroll errors by 50% after implementing HRMS.

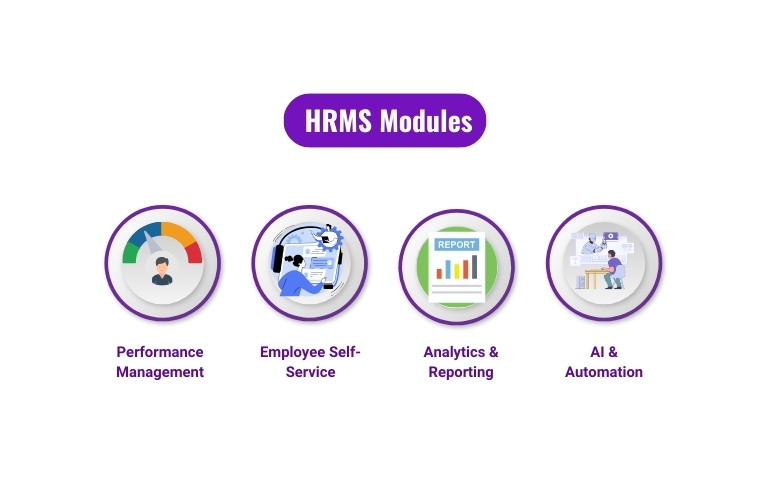

3. Workforce Management Tools for SMBs

Managing workforce productivity and performance evaluations is easier with workforce management tools for SMBs.

- Employee performance tracking systems provide insights into employee output, helping managers identify top performers and training needs.

- Benefits: Streamlined performance reviews and improved decision-making.

4. HRMS with Employee Self-Service

An HRMS with employee self-service empowers employees to handle routine HR tasks like viewing payslips, managing leave, and updating personal information.

- Reduces HR workload significantly.

- Improves employee satisfaction and transparency.

5. HR Compliance Software

Ensuring compliance with Indian labor laws is critical for SMBs. HR compliance software automates statutory filings and documentation, minimizing risks.

- Avoids legal penalties and ensures timely compliance.

- Example: A Delhi-based manufacturing SMB saved countless hours and avoided penalties using automated compliance tools.

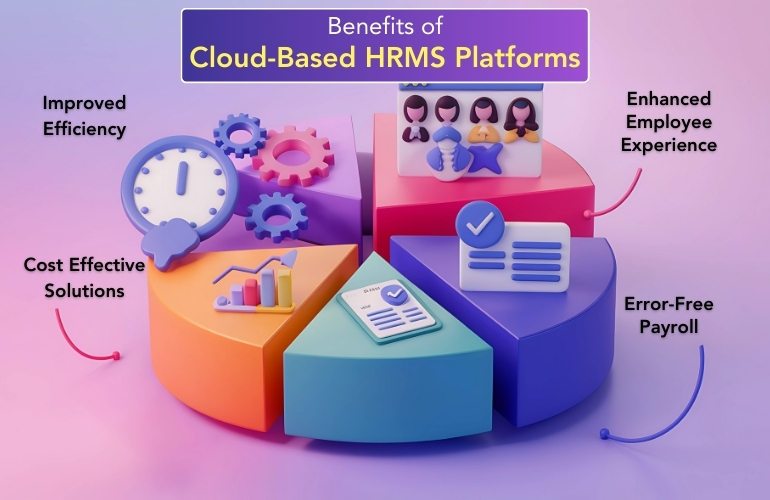

Benefits of Cloud-Based HRMS Platforms

Modern cloud-based HR solutions offer SMBs an affordable and scalable way to streamline HR processes. Here’s how:

1. Improved Efficiency: Automates repetitive HR tasks, saving time and reducing manual errors.

2. Enhanced Employee Experience: Tools like self-service portals empower employees to manage their needs independently.

3. Error-Free Payroll: Accurate salary processing with automated payroll management ensures employee satisfaction and compliance.

4. Cost-Effective Solutions: Cloud-based platforms eliminate the need for expensive hardware or IT teams, offering affordable HR tools for small businesses.

Stat: “SMBs adopting cloud-based HR solutions report a 35% improvement in workforce productivity.”

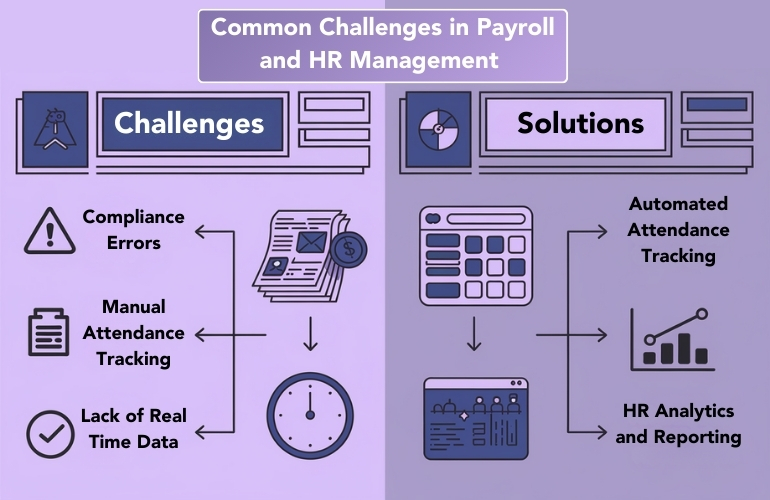

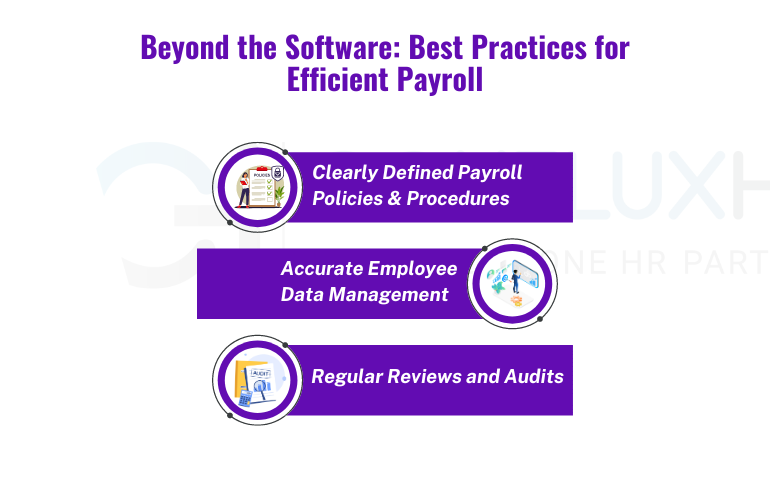

Addressing Common HR Challenges with HRMS

1. Manual Tracking of Attendance and Leave:

Solution: Implement an attendance and leave tracking system to automate approvals and reduce errors.

2. Payroll Errors and Compliance Risks:

Solution: Adopt HR compliance software with integrated payroll management.

3. Employee Dissatisfaction with Slow Processes:

Solution: Enable HRMS with employee self-service for quick access to HR tools.

By addressing these challenges, SMBs can create a more efficient and productive workforce.

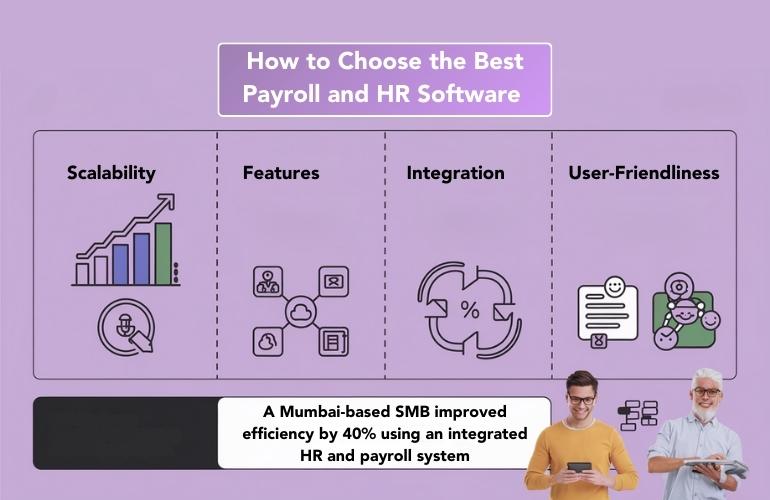

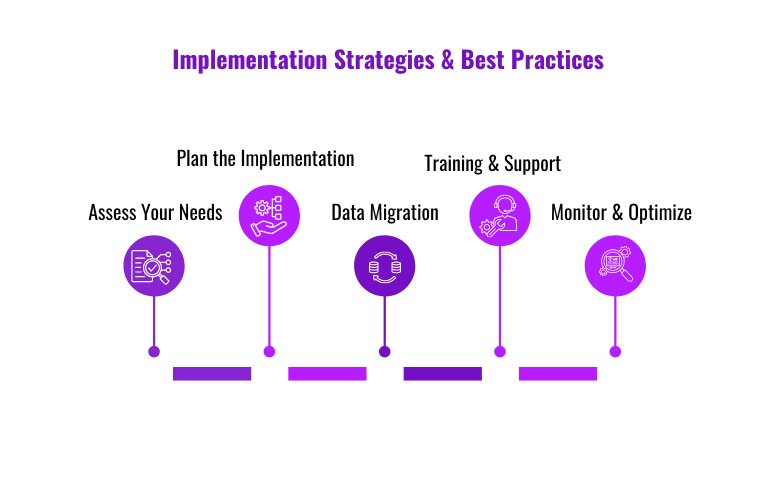

How to Choose the Right HRMS for Your SMB

When selecting an HR software for SMBs, consider these factors:

1. Ease of Use: Ensure the software is user-friendly for non-technical HR teams.

2. Scalability: Choose a solution that can grow with your business needs.

3. Integration: Look for compatibility with payroll systems, compliance tools, and other HR platforms.

4. Cost-Effectiveness: Opt for cloud-based HR solutions that offer affordability without compromising features.

Example: A Chennai-based logistics company reduced HR costs by 25% using integrated HRMS tools for payroll and attendance tracking.

Future Trends in HRMS for SMBs in India

As technology evolves, SMBs in India will witness several HRMS advancements, including:

- AI-Powered HRMS Platforms: Advanced employee performance tracking systems leveraging AI to analyze productivity.

- Enhanced Automation: Automating employee onboarding and payroll processing for faster workflows.

- Cloud-Based HRMS Growth: Increasing adoption of cloud-based HR solutions for remote workforce management.

- Cost-Effective Solutions: Affordable HR tools for small businesses designed to meet SMB budgets.

These trends will drive efficiency, improve decision-making, and support growth in SMBs across India.

Conclusion

Efficient HR management is crucial for SMBs to thrive in India’s competitive market. Adopting HR software for SMBs simplifies critical HR tasks like payroll, attendance tracking, and compliance management, empowering businesses to save time, reduce costs, and boost productivity.

From cloud-based HR solutions to HRMS with employee self-service, modern tools are transforming how SMBs manage their workforce. If you’re an SMB looking to streamline HR operations, investing in advanced HRMS platforms is the key to scaling your business efficiently in 2025.