Human Resource Management Software (HRMS) has emerged as a game-changer, particularly for Small and Medium Businesses (SMBs) in India, . As companies continue to grow and adapt to new challenges, HRMS offers a streamlined approach to managing employee data, payroll, and compliance. In 2025, the demand for efficient HR Solutions Software is greater than ever, driven by the need for digital transformation, enhanced employee self-service options, and automated HR systems. This blog explores how adopting HRMS for employee self-service and automated HR systems can significantly improve SMBs’ HR operations.

The Current HR Challenges for SMBs in India

Despite being crucial to the success of any business, HR management processes in many SMBs in India remain outdated and inefficient. In 2024, a study by Deloitte found that over 40% of SMBs still rely on manual HR processes, resulting in a range of operational inefficiencies. These challenges include:

- Manual HR Processes: From attendance tracking to payroll calculation, many SMBs still rely on paper-based systems or basic spreadsheets. This method is prone to errors and can be time-consuming.

- Difficulty in Managing Employee Data: As SMBs grow, managing employee records manually becomes increasingly difficult. Inaccuracies can occur, leading to payroll errors or compliance issues.

- Compliance and Payroll Management: Navigating complex labor laws, tax regulations, and statutory compliance requirements is a significant hurdle for SMBs, especially without automated tools.

- Scalability: As the business expands, HR tasks can become increasingly difficult to manage, requiring more resources and time for tasks like hiring, onboarding, and performance reviews.

These issues underscore the importance of HRMS for Employee Self-Service and Automated HR Systems that streamline tasks and reduce human error.

What is HRMS?

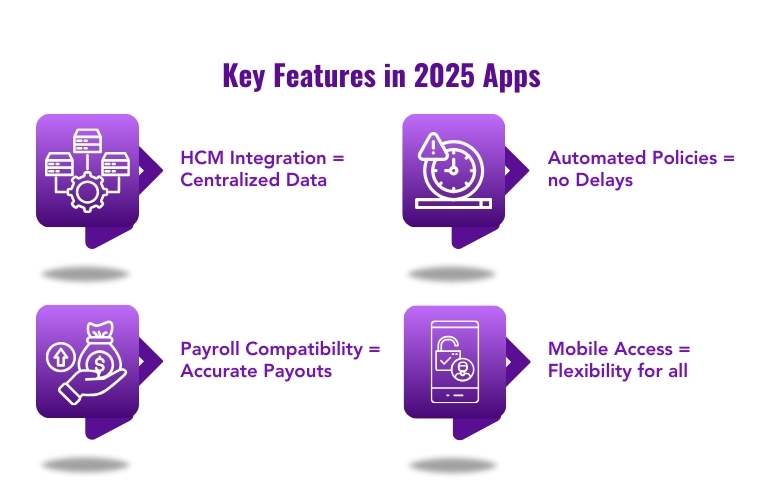

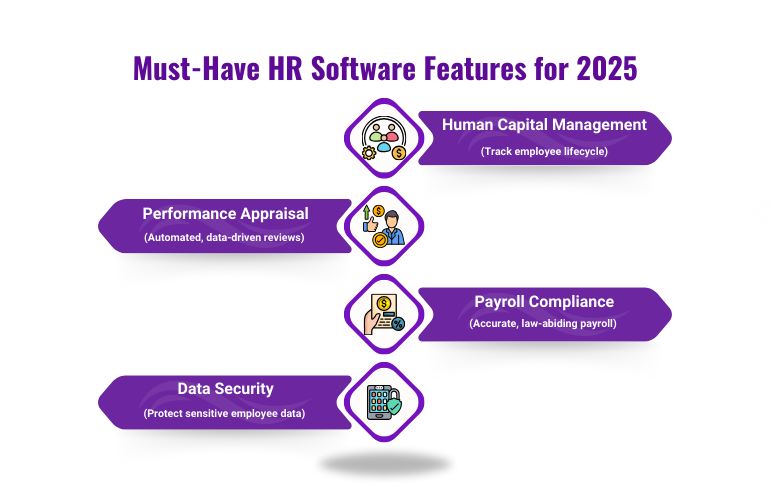

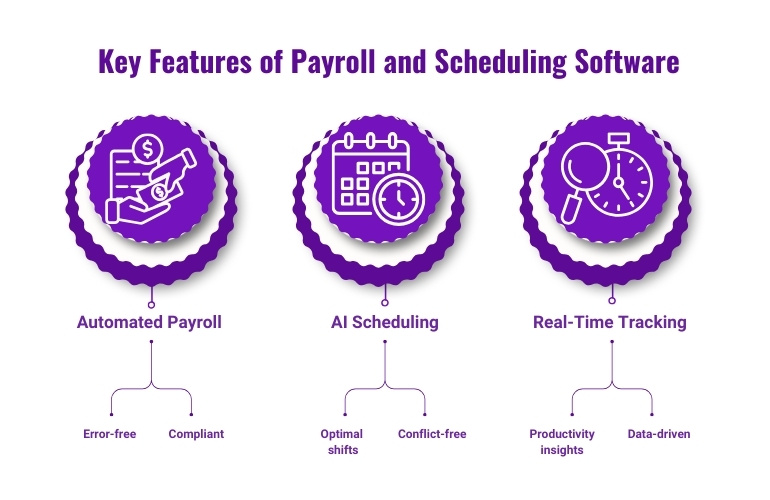

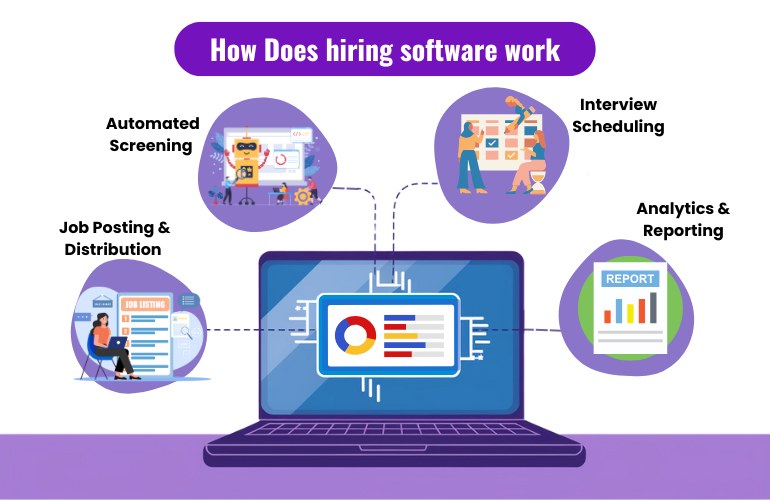

HRMS (Human Resource Management Software) is a digital platform designed to streamline and automate HR tasks, helping businesses manage their employee lifecycle more effectively. The software integrates various HR functions, such as payroll, attendance, recruitment, and performance management, into one centralized system.

HRMS for Employee Self-Service is a standout feature. Allowing employees to access and update their personal information, track attendance, apply for leaves, and view payroll details, all from a single platform.

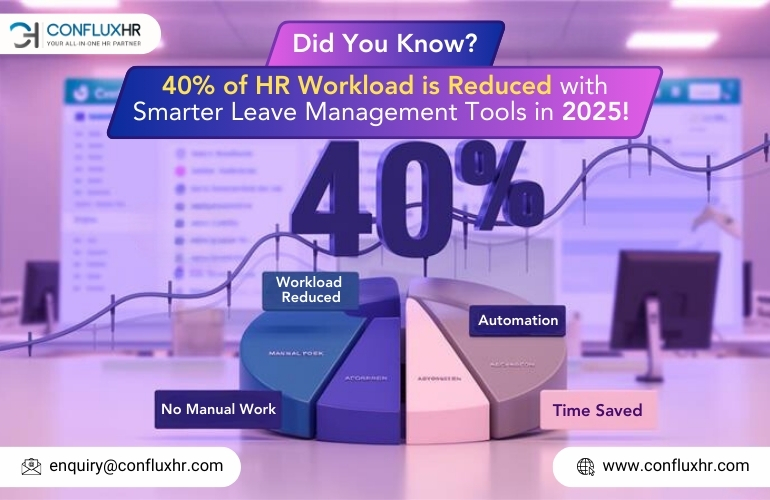

Moreover, HRMS solutions often come with automated HR systems that take over routine administrative tasks, such as payroll processing and statutory compliance updates, ensuring accuracy and reducing the workload of HR teams.

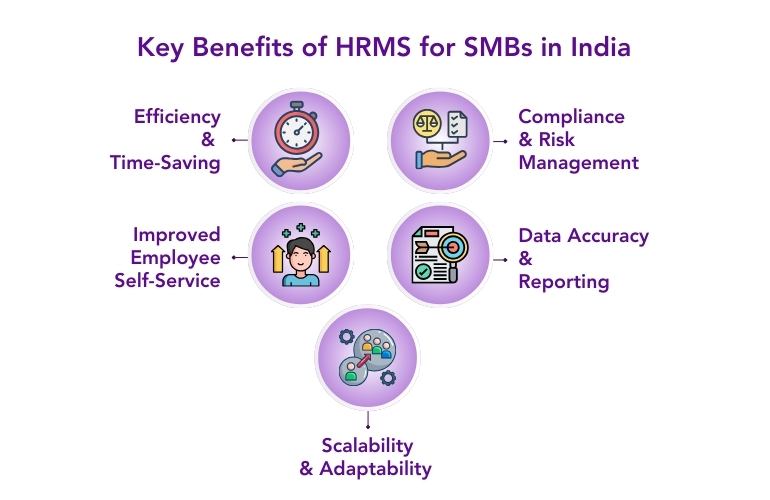

The Key Benefits of HRMS for SMBs in India

1. Efficiency and Time-Saving

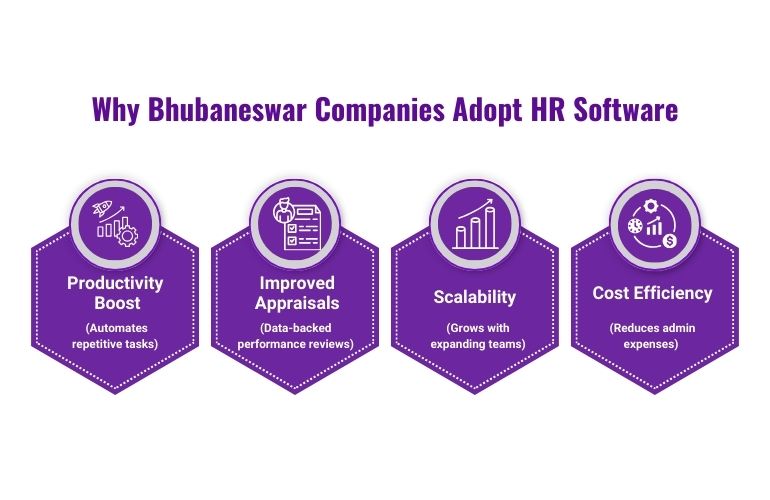

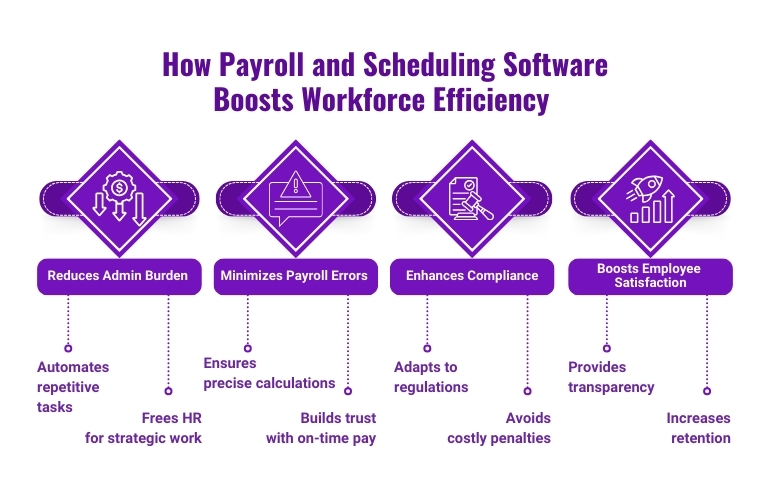

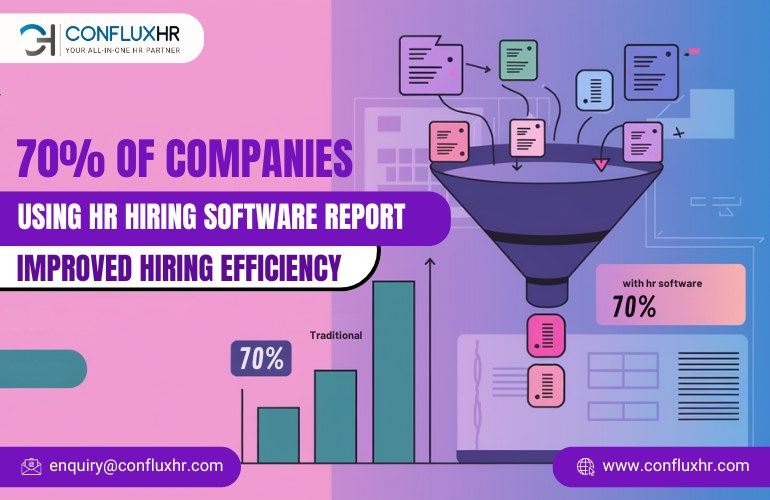

One of the most significant advantages of adopting HRMS is the automation of routine tasks. With automated HR systems, HR managers can focus on strategic decision-making rather than time-consuming administrative work.

According to a 2023 report by SHRM (Society for Human Resource Management), businesses that implemented HRMS experienced a 25% reduction in HR operational costs, as tasks like payroll, leave management, and attendance tracking were automated.

2. Improved Employee Self-Service

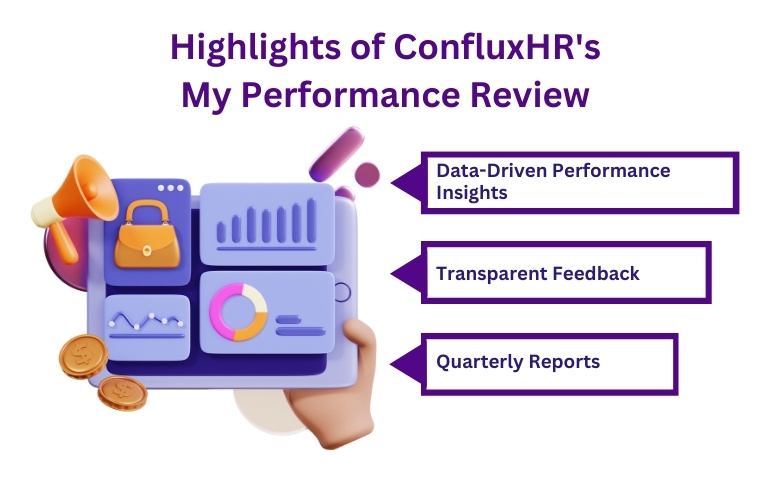

With HRMS for employee self-service, employees can manage their HR-related tasks directly through the platform. This feature empowers employees to update their personal information, apply for time off, and view pay stubs, all in real-time. A survey by Accenture found that 85% of employees prefer self-service platforms for HR tasks, as it gives them more control over their work-life balance and reduces dependency on HR managers.

By giving employees more autonomy, HR teams can focus on more strategic tasks, improving overall productivity.

3. Compliance and Risk Management

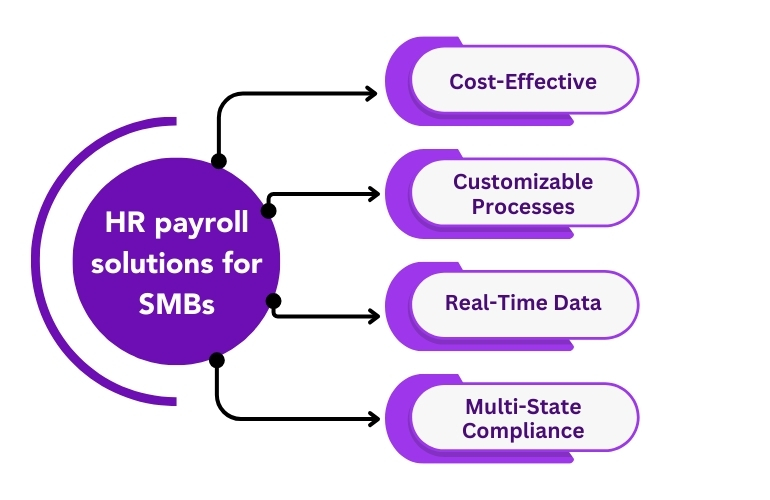

Maintaining compliance with Indian labor laws, tax regulations, and industry-specific standards is a major challenge for SMBs. HRMS helps mitigate this risk by offering built-in compliance tools. That track legal requirements and automatically update the system when regulations change.

In a 2024 study by PwC, it was found that 47% of SMBs in India experienced challenges with compliance, and many faced penalties due to manual errors. By automating the compliance process, HRMS solutions ensure that businesses stay updated on laws such as the Employees’ Provident Fund (EPF) and Gratuity Act.

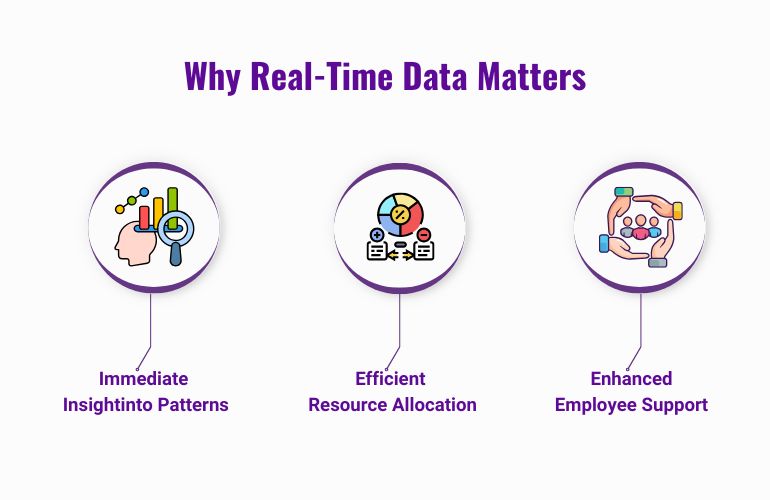

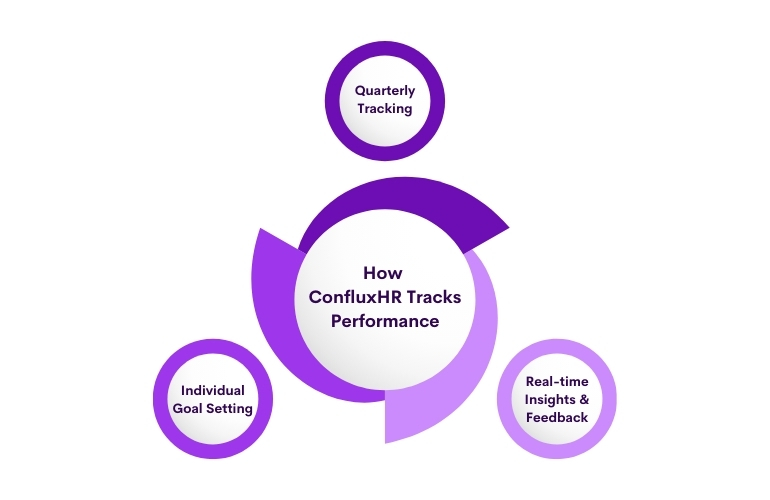

4. Data Accuracy and Reporting

In today’s data-driven world, accurate insights into HR metrics can provide a competitive edge. HRMS solutions offer powerful reporting features that allow businesses to track key performance indicators (KPIs) such as employee productivity, turnover rates, and compensation patterns. Real-time dashboards provide actionable insights, helping managers make informed decisions.

For example, HRMS for employee self-service can track employee performance data and automatically generate reports, enabling more data-driven HR decision-making.

5. Scalability and Adaptability

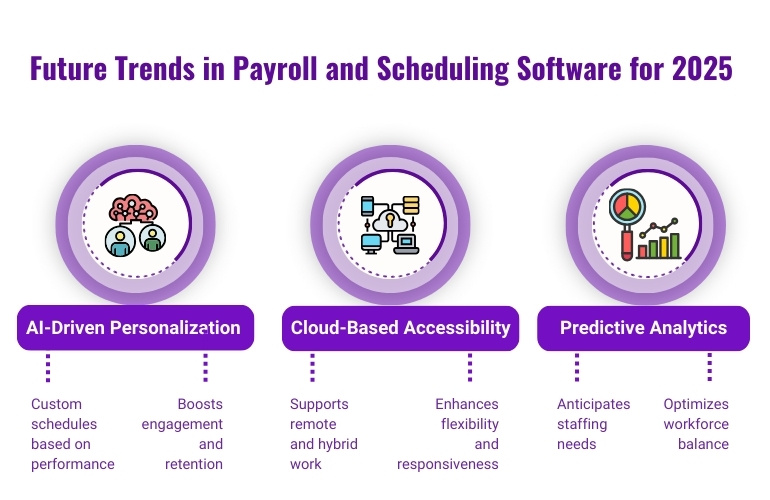

As your business grows, so does the complexity of managing HR tasks. One of the most significant advantages of HRMS is its scalability. Whether you’re onboarding a few new hires or expanding to multiple locations, HRMS can adapt to your needs without increasing the burden on HR teams.

In fact, cloud-based HRMS solutions are particularly beneficial for SMBs in India as they can scale without requiring heavy investments in hardware or IT infrastructure. According to a report by Grand View Research, the global HR software market is expected to reach $33.85 billion by 2027, with cloud-based solutions driving much of the growth.

Why HRMS is Critical for SMBs in India in 2025

The future of HR management lies in digital transformation, and HRMS solutions are at the heart of this shift. SMBs that adopt HRMS for employee self-service will have a competitive advantage in 2025, as they’ll be better equipped to:

- Adapt to a Tech-Savvy Workforce: Today’s employees expect user-friendly digital solutions for managing HR tasks. A seamless experience increases employee satisfaction and retention.

- Streamline Operations: HRMS automates tedious tasks, enabling HR teams to focus on more strategic roles, such as talent acquisition and employee engagement.

- Compete in a Digital-First Environment: With businesses rapidly shifting towards digital-first operations. Those without HRMS solutions will fall behind in terms of efficiency, employee satisfaction, and compliance.

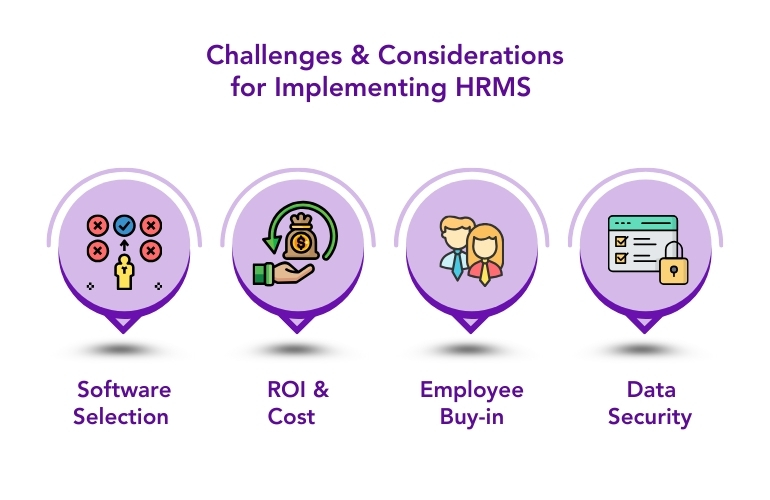

Challenges and Considerations for Implementing HRMS

Despite its benefits, the implementation of HRMS is not without challenges. SMBs need to consider the following:

- Choosing the Right HRMS Software: It’s essential to select HR management software that is easy to integrate, user-friendly, and customizable to your business needs.

- Cost and ROI: While some HRMS solutions can have a high upfront cost, the return on investment is clear, with savings on time, labor, and compliance penalties.

- Employee Resistance: Change management is crucial. Ensuring employees are trained and comfortable using the new platform is key to a smooth transition.

- Data Security: Since HRMS stores sensitive employee data, SMBs must ensure robust security protocols are in place to prevent breaches.

Examples: Success Stories from Indian SMBs

- Company X, a mid-sized manufacturing company in India, implemented HRMS in 2024 and saw a 30% reduction in HR-related operational costs within the first year. The company also reported a 40% increase in employee satisfaction due to the introduction of HRMS for employee self-service.

- Company Y, a retail business in Mumbai, used an automated HR system to manage payroll and compliance. Reducing payroll errors by 50% and ensuring timely compliance with labor laws.

Conclusion

In conclusion, HRMS solutions are no longer optional for SMBs in India—they are essential for staying competitive in 2025. By automating HR tasks, offering employee self-service features, ensuring compliance, and providing powerful data insights, HR management software can significantly streamline HR processes. For SMBs looking to scale, improve operational efficiency, and engage a tech-savvy workforce, HRMS is the key to future-proofing HR operations.

Evaluate your current HR processes and explore HRMS solutions that best suit your business needs. Contact us today. For a demo or consultation and take the first step toward transforming your HR operations for the future.