HR compliance has become one of the most significant focus areas for businesses in the modern era. With an increasingly complex regulatory framework and rapid changes to labor laws in India, staying compliant has become more challenging than ever. For businesses operating in highly regulated industries or those with multi-location operations, compliance isn’t just a legal mandate—it’s a critical aspect of building credibility and protecting their workforce.

India’s transition to a unified labor code, which consolidates over 44 labor laws into four major codes, reflects the urgency of compliance readiness. Businesses must ensure that their HR processes align with these changes while minimizing manual errors, avoiding penalties, and mitigating risks. Moreover, B2B organizations are under immense pressure to optimize costs and demonstrate operational efficiency.

The right tools, such as HR compliance software, risk and compliance tools, and HR payroll systems, can help businesses navigate these challenges seamlessly. In this blog, we’ll explore actionable insights and key technologies that are set to revolutionize HR compliance for Indian businesses in 2025.

Why HR Compliance Matters More Than Ever

In a world of dynamic regulatory environments, compliance is not optional. It’s integral to building trust with employees, investors, and stakeholders. Non-compliance can result in severe financial penalties, reputational damage, and operational disruptions, which can be fatal for businesses in competitive markets. Below are the primary reasons why HR compliance is gaining prominence in 2025:

- Evolving Regulatory Frameworks: The introduction of India’s new labor codes has brought greater transparency but also more complexity. Companies must comply with rules related to wages, social security, and occupational safety, or risk legal consequences.

- Hybrid Work Models: With remote and hybrid workforces becoming the norm, businesses face new challenges in tracking compliance with attendance, leaves, and work-hour regulations.

- Globalization of Workforces: Organizations now manage teams across multiple geographies, requiring them to meet compliance requirements in multiple jurisdictions. Tools like compliance management systems provide a centralized framework to address global compliance.

- Mitigating Risks: Regular compliance helps prevent legal disputes related to employee rights, such as underpayment, wrongful termination, or workplace safety violations. It safeguards companies from costly lawsuits and reputational harm.

By integrating tools like HR legal compliance platforms into their operations, organizations can proactively address these issues and maintain robust compliance processes.

Key Challenges in HR Compliance

Despite its critical importance, compliance management is fraught with challenges that most organizations struggle to overcome. Below are some of the most pressing obstacles:

- Manual Processes and Human Error: Manual compliance tracking is not only time-consuming but also prone to errors. Filing statutory documents, processing employee benefits, and keeping up with policy updates require precision, which is hard to achieve without automation.

- Frequent Regulatory Updates: Indian labor laws are constantly evolving, with new amendments and notifications issued frequently. HR teams often lack the bandwidth to keep track of these updates in real time, leading to lapses in compliance.

- Fragmented Systems: Many organizations still rely on disparate systems that don’t integrate well, making it difficult to maintain centralized compliance records or generate comprehensive audit reports.

- Cost of Non-Compliance: Non-compliance can cost businesses significantly in terms of penalties, loss of licenses, and lawsuits. Moreover, it damages employee trust and brand reputation, making it difficult to attract and retain top talent.

Adopting integrated compliance solutions, such as HR payroll and compliance tools, can help organizations address these challenges and ensure seamless operations.

Essential Tools for HR Compliance in 2025

- Compliance Management Systems

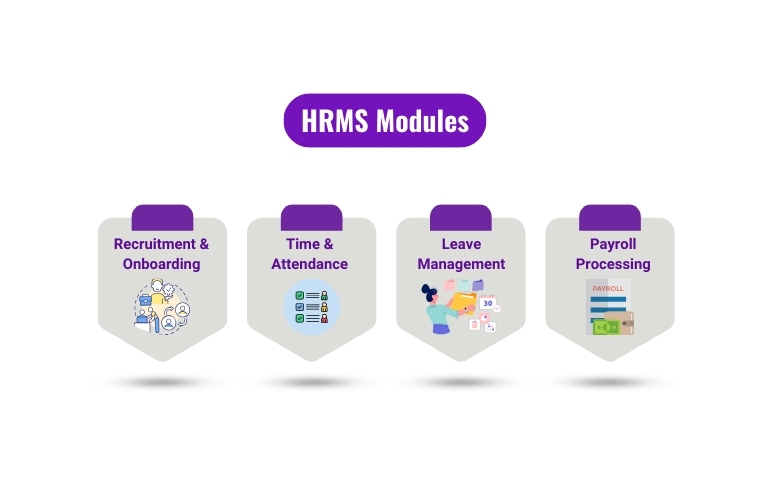

Compliance management systems are indispensable for streamlining and automating compliance workflows. These systems allow HR teams to centralize data, automate repetitive tasks, and ensure that all compliance requirements are met on time. Some of the key features of compliance management systems include:

- Automated Updates: Get real-time alerts whenever a new regulation or policy change is introduced, ensuring your organization remains compliant without manual tracking.

- Centralized Record Keeping: Easily store and retrieve compliance documents for audits, significantly reducing preparation time.

- Custom Reporting: Generate reports tailored to your business needs, such as compliance gaps or upcoming deadlines.

For example, solutions like AsterDocs provide a robust platform for Indian businesses, offering compliance tracking, document management, and audit preparation.

- HR Payroll and Compliance Solutions

Payroll compliance is the cornerstone of any HR compliance strategy, as it directly impacts employee satisfaction and legal obligations. Payroll compliance tools ensure adherence to statutory regulations, such as:

- EPF and ESI Deductions: Automatically calculate employee contributions and employer liabilities for Provident Fund and Employee State Insurance.

- Minimum Wages and Overtime: Ensure employees are compensated in line with minimum wage laws and overtime policies mandated by the government.

- Tax Filing: Automate the process of filing tax returns and generating TDS certificates to avoid penalties.

In India, solutions like RazorpayX Payroll and Keka HR offer payroll features that cater to the specific compliance needs of Indian businesses, ensuring accuracy and timeliness.

- Risk and Compliance Tools

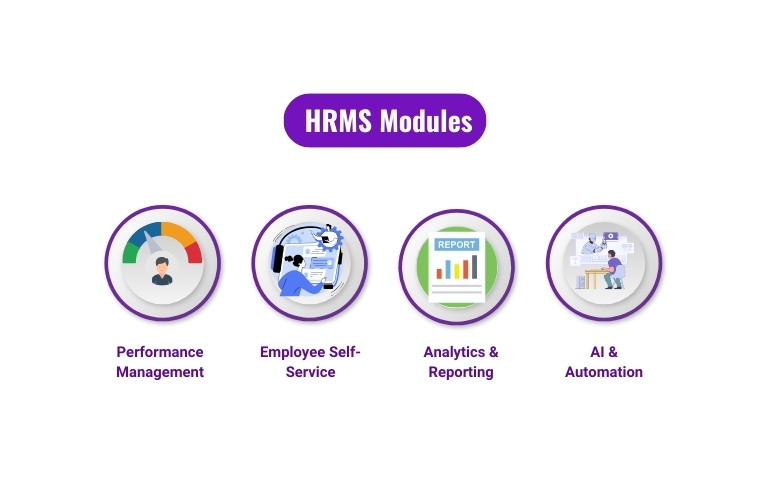

Risk management is an integral part of HR compliance, and modern tools can help organizations proactively identify and mitigate risks. These tools typically provide:

- Real-Time Monitoring: Track compliance performance across different departments and flag potential issues.

- Automated Alerts: Receive notifications about impending deadlines or policy violations to avoid penalties.

- Predictive Analytics: Use data to predict potential compliance risks, enabling HR teams to address them before they escalate.

Platforms like SAP GRC and Wolters Kluwer CCH are excellent examples of tools that combine compliance management with risk assessment for holistic solutions.

- HR Legal Compliance Platforms

Managing legal compliance requires specialized platforms that can handle employment contracts, grievance redressals, and dispute resolutions. Key benefits of HR legal compliance tools include:

- Automated Contract Generation: Generate employee contracts and offer letters that comply with labor laws in various states.

- Legal Risk Alerts: Stay ahead of legal obligations by receiving alerts about pending disputes or contract expirations.

- State-Specific Compliance: Customize workflows to align with specific regional labor laws.

In India, such tools are particularly valuable, as labor laws often differ across states. By automating legal compliance, organizations can focus on strategic priorities without being bogged down by legal complexities.

Conclusion

HR compliance is no longer just about ticking boxes; it’s about building trust, protecting employees, and creating a strong foundation for business growth. By adopting tools like HR compliance software, risk and compliance tools, and HR payroll systems, businesses can transform compliance management from a manual, error-prone process into a seamless, automated one.