Running payroll manually is like navigating a maze that never seems to end. It takes hours of double-checking figures, manually writing down details, and making sure you don’t miss any important dates. For Indian business owners, especially in small or medium enterprises, this can be a huge drain on both time and energy. Thankfully, HR payroll solutions are here to change that. If you’re still doing things manually, it might be time to make the switch to something more efficient.

In this blog, we’ll explore why businesses are moving away from manual payroll processes and how you can use smart payroll management software to save time, reduce errors, and focus more on growing your business.

The Struggles of Running Payroll Manually

Running payroll manually means you’re in charge of every calculation, record, and deduction yourself. You need to keep track of:

- Employee attendance and leave records.

- Tax calculations, deductions, and contributions.

- Overtime and bonuses.

- Deadlines for government filings and deposits.

These responsibilities may not seem too daunting at first, but as your business grows, they pile up fast. This is especially true for small businesses with limited human resources and in-house payroll management. Manually processing payroll each month means more room for human error, and let’s not forget the countless hours wasted.

Here are some common problems associated with manual payroll processing:

- Time-consuming tasks: Calculating salaries, taxes, and bonuses every month can be a headache.

- Error-prone: A small mistake in manual entries can cause incorrect payments and tax filing errors.

- Compliance issues: Missing deadlines or making mistakes in statutory deductions (EPF, ESI, etc.) can lead to penalties.

- Lack of employee transparency: When payroll is handled manually, employees often don’t have access to real-time updates about their salary breakdowns, leaves, or bonuses.

Why Upgrade to Smart HR Payroll Solutions?

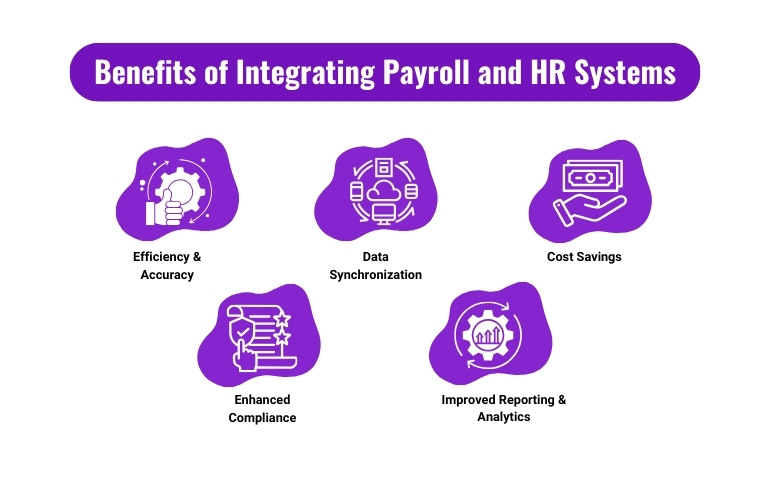

Upgrading to HR payroll solutions not only helps businesses streamline the payroll process but also integrates key HR functionalities in one platform. These systems reduce the complexity of the payroll process while ensuring compliance with regulations.

Benefits of Switching to HR Payroll Solutions:

- Automation of Payroll Processes: With payroll management software, you can automate calculations for employee wages, deductions, tax liabilities, and other components, minimizing the need for manual intervention.

- Time-Saving: The time spent calculating individual pay slips, bonuses, and taxes can be drastically reduced with automated tools. This means your HR team can focus on more strategic activities rather than administrative tasks.

- Compliance Assurance: Payroll solutions ensure your company complies with government rules, deadlines, and tax requirements automatically. They also update regularly to accommodate any changes in statutory obligations, such as PF, TDS, or ESI contributions.

- Employee Self-Service: Many modern HR payroll solutions provide employee self-service portals where employees can view their salary slips, apply for leave, check tax deductions, and much more without bothering the HR department.

- Data Security: Manual payroll processing leaves room for potential data leaks or unauthorized access to sensitive information. Payroll management software keeps this data secure with role-based access and encryption.

Payroll Management Software: A Game-Changer for Small Businesses

For small businesses, managing payroll manually may seem like the most cost-effective solution, but in the long run, it can end up being costly. Errors, penalties, and inefficient processes can weigh heavily on both financials and employee morale. This is where payroll management software comes in.

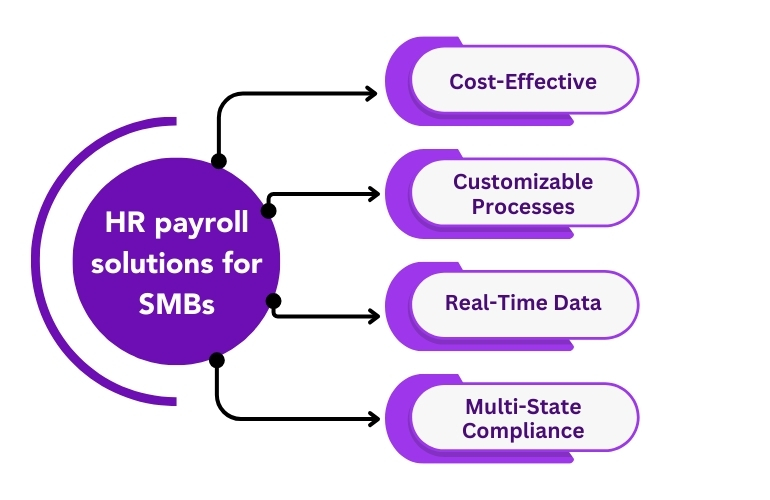

Small business HR payroll solutions offer several advantages:

- Cost-Effective: These tools offer affordable subscription models, meaning you don’t have to invest in expensive, customized software.

- Customizable Payroll Processes: You can customize payroll rules to match your business’s unique salary structure, bonuses, allowances, etc.

- Real-Time Data: Get real-time insights into employee attendance, leave management, and payroll. This transparency improves trust among employees and makes it easier to manage HR processes efficiently.

- Multi-State Compliance: Payroll software ensures compliance not only with central laws but also with local state requirements, helping businesses operating across India.

Features to Look for in Payroll Management Software:

- Automation of Payroll Processing: Look for a solution that can automatically calculate employee salaries, deductions, and tax obligations.

- Tax Compliance: Ensure it supports all statutory compliances like PF, TDS, ESI, etc.

- Employee Self-Service: Employees should have access to their own payroll information at any time.

- Leave and Attendance Management: Integrated leave and attendance tracking to ensure payroll accuracy.

- Cloud-Based Access: The ability to access payroll data securely from anywhere.

Why Indian Businesses Need Smarter HR Payroll Solutions

For businesses in India, especially SMEs, adopting an HR payroll solution could mean the difference between growth and stagnation. Here are a few reasons why:

- Scalability: As your company grows, so do your HR and payroll requirements. Modern payroll solutions grow with you, accommodating more employees, new tax laws, and additional HR processes.

- Compliance: The Indian regulatory framework is always evolving, with frequent changes in labor laws, tax slabs, and statutory deductions. Payroll solutions ensure your company stays compliant effortlessly.

- Employee Satisfaction: When employees have clarity over their salary, bonuses, and performance reviews, their trust in the organization grows. This fosters a better work environment and reduces employee turnover.

Conclusion

Switching to HR payroll solutions is no longer a luxury; it’s a necessity. As businesses grow, managing payroll manually becomes increasingly complex and prone to errors. By adopting payroll management software, businesses can save time, reduce costs, and ensure compliance with Indian labor laws.

If you’re still running payroll manually, it’s time to consider a smarter solution. Platforms like ConfluxHR offer comprehensive payroll management systems designed to meet the unique needs of Indian businesses.

Ready to streamline your payroll management? Learn more about how ConfluxHR can help your business by visiting our website.