Managing human resources and payroll is one of the most time-consuming challenges for small and medium-sized businesses (SMBs). Imagine spending countless hours manually tracking attendance, processing salaries, calculating tax deductions, and ensuring compliance with labor laws—all while juggling other critical business priorities.

In fact, a recent study revealed that 40% of SMBs spend over 20 hours a month on HR and payroll tasks, with an error rate of 30% due to manual processes. These inefficiencies not only waste valuable time but also hinder business growth. That’s where HRMS software steps in as a game-changer.

Whether it’s automating payroll calculations, streamlining attendance management, or ensuring compliance with complex labor laws, HRMS and HR automation software provide the tools SMBs need to simplify operations and focus on growth.

Understanding HRMS Software: The Backbone of SMB HR Operations

HRMS (Human Resource Management Software) is a comprehensive tool that integrates HR, payroll, and compliance functionalities into one streamlined system. It automates repetitive tasks like attendance tracking, leave management, and payroll processing, allowing businesses to save time and reduce errors.

For SMBs, HRMS offers a cost-effective way to centralize employee data, manage compliance, and provide employees with better self-service options. Unlike manual methods or spreadsheets, an HRMS ensures accuracy, scalability, and efficiency.

Common HR and Payroll Challenges Faced by SMBs

1.Time-Intensive Payroll Processing

Manual payroll management often involves reconciling attendance records, calculating overtime, and handling tax deductions, all of which consume significant time and effort.

Statistic: SMBs spend an average of 15-20 hours per month on payroll processing alone, with many reporting delays and errors.

2.Compliance Issues

Keeping up with changing labor laws and regulations, such as PF, ESI, and TDS, can be overwhelming. Non-compliance can result in hefty fines and damage to a company’s reputation.

3.Inefficient Data Management

Without an HRMS, maintaining employee records, performance evaluations, and attendance data often results in scattered information and mismanagement.

4.High Costs Due to Errors

Payroll errors not only frustrate employees but also cost businesses money. SMBs operating on tight budgets can’t afford such inefficiencies.

How HRMS and HR Automation Software Solve These Problems

1.Automating Payroll Management

One of the core functions of payroll and HR software for small businesses is automating payroll calculations. HRMS software integrates seamlessly with attendance tracking systems to calculate salaries, overtime, deductions, and bonuses in real time.

Example: A mid-sized IT firm in Bengaluru saved over 20 hours a month by automating payroll through HRMS software. Errors in tax calculations were also reduced by 90%.

2.Ensuring Legal Compliance

HRMS tools automatically update compliance requirements for statutory deductions such as PF, ESI, TDS, and professional tax, ensuring businesses are always audit-ready. They also generate reports that meet regulatory filing requirements.

Statistic: SMBs using HRMS software report a 70% reduction in compliance-related penalties.

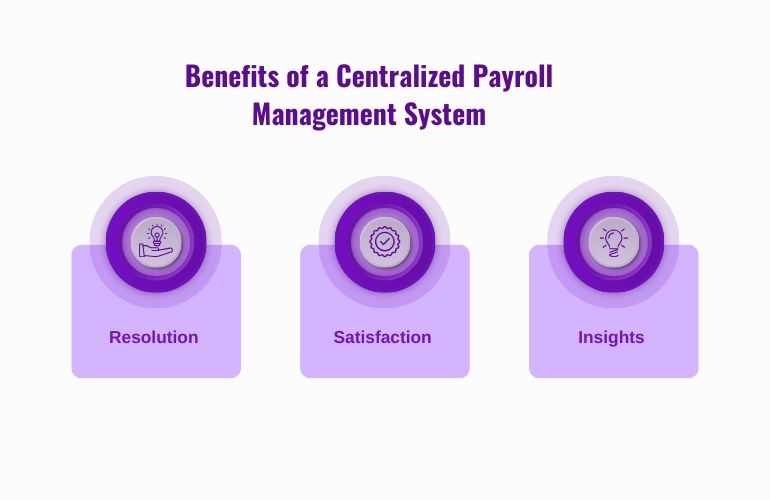

3.Centralized Employee Data

HRMS software stores all employee records, from attendance to performance evaluations, in a centralized database. This makes it easy to access, update, and analyze data, streamlining HR operations.

4.Enhancing Employee Self-Service

Modern HRMS solutions offer employee self-service portals, where employees can view payslips, apply for leave, update personal details, and submit reimbursement claims without HR intervention.

Advantages of HRMS Software for SMBs

1.Increased Efficiency

By automating time-consuming HR and payroll tasks, SMBs can focus their energy on strategic initiatives like employee engagement and business growth.

2.Better Decision-Making with Analytics

HRMS tools come with advanced analytics dashboards that provide insights into employee attendance trends, turnover rates, and productivity levels. This data helps HR teams make informed decisions.

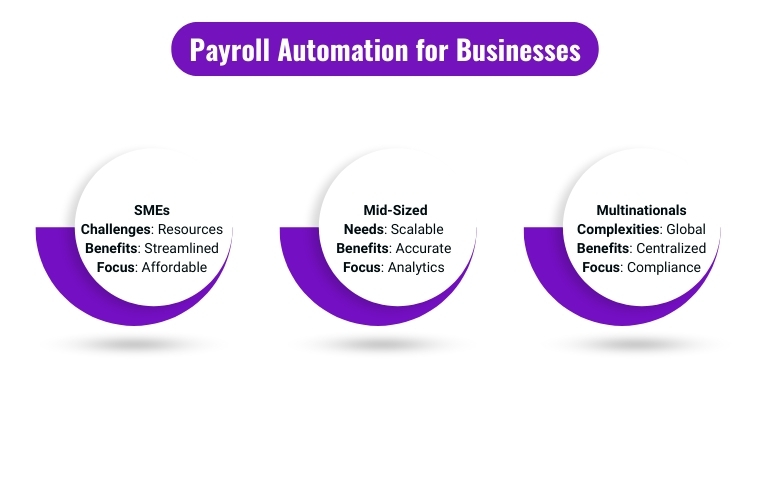

3.Scalability for Growing Businesses

Whether managing a team of 10 or 500 employees, HRMS software scales effortlessly, making it ideal for growing SMBs.

4.Cost Savings

Investing in HR automation software eliminates the need for extensive manual labor, reducing HR operational costs by as much as 40%.

Example: A retail business in Mumbai implemented an HRMS and saved over ₹50,000 annually on payroll operations.

Features to Look for in HRMS Software

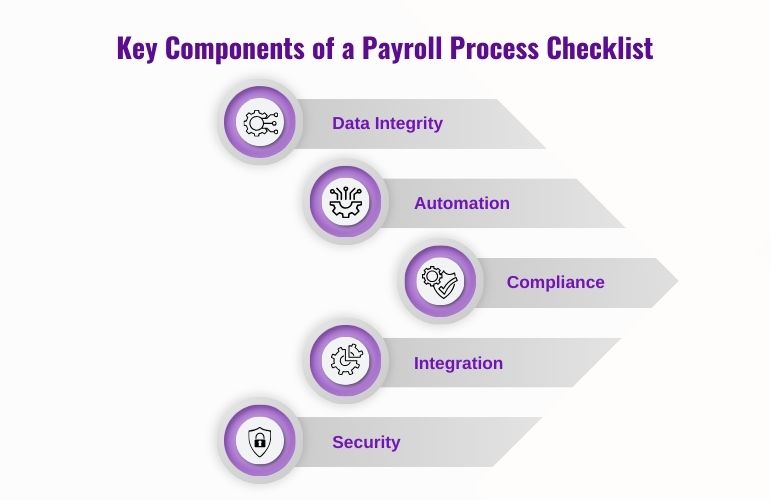

When choosing HRMS software, SMBs should prioritize solutions that address their unique needs. Here’s what to look for:

1.Payroll Integration

The software should automate payroll processes, including salary calculations, tax deductions, and bank transfers. Look for features like bulk processing and error detection.

2.Compliance Management

Ensure the HRMS can handle statutory compliance for PF, ESI, and professional tax. Automated compliance reporting is a must for reducing legal risks.

3.Attendance and Leave Tracking

Choose an HRMS that integrates with biometric devices or mobile apps for real-time attendance tracking. Leave management should also be customizable and automated.

4.Employee Self-Service Portals

A self-service portal allows employees to access their payslips, apply for leave, and update personal details, reducing the administrative burden on HR teams.

5.HRMS Pricing Transparency

Ensure that the software offers scalable HRMS pricing plans, allowing you to upgrade as your business grows.

Case Study Example

ABC Logistics Pvt. Ltd., a logistics startup with 80 employees, struggled with manual HR processes and compliance management. After implementing an affordable HRMS solution, the company achieved:

- 60% faster payroll processing.

- Full compliance with statutory deductions, avoiding penalties.

- Enhanced employee satisfaction through self-service portals.

This transformation demonstrates how the right HRMS software can drive efficiency and growth for SMBs.

Emerging Trends in HRMS for 2025

1.AI-Driven HR Automation

AI-powered HRMS tools are revolutionizing recruitment, performance evaluations, and workforce planning. Predictive analytics can identify potential retention risks and suggest proactive measures.

2.Mobile-First HRMS Solutions

With remote work on the rise, mobile-friendly HRMS platforms are becoming essential. Employees can access their data and HR services anytime, anywhere.

3.Blockchain for Secure Data Management

Blockchain technology ensures tamper-proof employee records, adding a layer of security and transparency to HR operations.

Conclusion: A Smarter Way to Manage HR and Payroll

For SMBs, adopting HRMS and payroll software is no longer a luxury—it’s a necessity. From automating payroll and ensuring compliance to providing actionable insights and enhancing employee satisfaction, HRMS software addresses the core challenges SMBs face in HR management.

If you’re looking to reduce costs, improve efficiency, and simplify HR operations, it’s time to explore HR automation software tailored to your business needs. Don’t let manual processes hold you back—invest in an HRMS solution today and watch your business thrive.