Efficiency is key in this racing business world. Yet, many Indian businesses, especially small and mid-sized enterprises (SMEs), still rely on manual HR processes that drain productivity and frustrate employees. From piles of paperwork to time-consuming payroll tasks, these outdated practices lead to inefficiencies that impact overall business growth. HR automation software is no longer a luxury but a necessity for organizations looking to streamline operations and boost employee engagement.

With a growing demand for digital transformation in India’s HR sector, let’s explore how manual HR processes kill productivity and disengage employees, and why companies must adopt HR productivity solutions for a competitive edge.

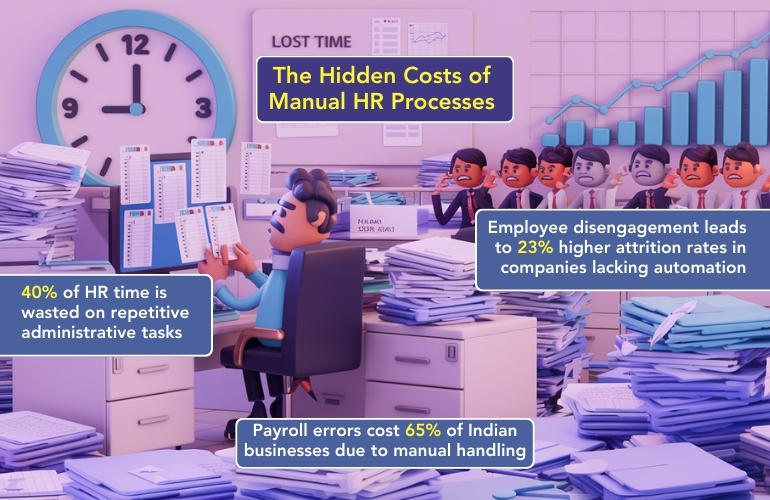

The Hidden Costs of Manual HR Processes

- Time-Consuming Administrative Work

Manual HR tasks such as payroll processing, attendance tracking, and performance reviews are labor-intensive and error-prone. A study by HR Katha (2024) highlights that Indian HR professionals spend nearly 40% of their time on administrative tasks, leaving little room for strategic planning.

- High Risk of Errors and Compliance Issues

Human errors in salary calculations, tax deductions, or compliance documentation can cost businesses significantly. According to PwC India’s HR Compliance Report (2024), nearly 65% of Indian businesses face payroll discrepancies due to manual data handling. Missing statutory compliance deadlines also leads to hefty penalties.

- Poor Employee Experience & Low Engagement

Employees today expect seamless HR processes. When organizations rely on manual leave approvals, outdated communication systems, and inefficient grievance handling, it results in frustration and disengagement. HR digital transformation enhances the employee experience by making HR interactions smoother and more responsive.

- Increased Employee Turnover

Disengaged employees are more likely to leave. According to LinkedIn’s 2025 India Workforce Insights, businesses that fail to invest in workforce management software experience a 23% higher attrition rate compared to those using automation.

How Manual HR Processes Impact Employee Engagement

- Inefficient Performance Management

Without HR workflow automation, performance reviews are often delayed, subjective, or inconsistent. Employees thrive on real-time feedback, and traditional methods fail to provide timely insights into their growth and development.

- Lack of Transparency in Payroll & Benefits

Delayed salary processing and inaccurate payslips due to time-consuming HR tasks create dissatisfaction among employees. Automated payroll and compliance systems ensure transparency and timely payments, reducing workplace grievances.

- Poor Onboarding Experience

First impressions matter. When new hires face lengthy paperwork, unclear onboarding processes, and communication gaps, it sets a negative tone. An employee engagement HR tool helps create a structured, engaging onboarding experience that improves retention.

The Indian Market Shift Toward HR Automation

India’s HR landscape is evolving rapidly, driven by government initiatives like Digital India and a booming startup ecosystem. According to NASSCOM’s HR Tech Adoption Report (2024):

- 80% of Indian enterprises plan to invest in HR tech within the next two years.

- HR automation software adoption has grown by 67% in the last five years.

- Companies using HR efficiency strategies report a 30% increase in employee productivity.

HR Automation: The Ultimate Solution to Productivity Loss

- Automating Payroll & Compliance

With payroll and compliance automation, businesses can eliminate manual errors, ensure timely salary processing, and adhere to statutory regulations like EPF, ESI, and TDS.

- AI-Powered Performance Management

AI-driven performance management systems offer real-time feedback, track employee progress, and align goals with company objectives, improving overall productivity.

- Smart Onboarding & Employee Self-Service

Automated onboarding tools provide self-service portals, digital documentation, and interactive training modules, significantly improving the employee experience improvement journey.

- Data-Driven Decision Making

HR automation tools provide insightful analytics, helping HR leaders make informed decisions regarding talent retention challenges and workforce planning.

Case Study: A Mid-Sized IT Firm in Bangalore Adopts HR Automation

A Bangalore-based IT firm with 500+ employees was struggling with inefficiencies due to manual HR processes. After implementing HR productivity solutions, they experienced:

- 40% reduction in administrative workload

- 20% improvement in employee engagement

- 100% compliance with statutory regulations

This transformation not only improved operational efficiency but also strengthened employer branding, attracting top talent in the competitive IT sector.

Future of HR in India: Embracing Digital Transformation

With India’s workforce expected to reach 900 million by 2030, businesses cannot afford outdated HR systems. Companies must prioritize HR process optimization to remain competitive in the ever-evolving business landscape.

Key Trends Shaping HR in India:

- Increased adoption of AI and ML-driven HR tools

- Rise of cloud-based HR software for remote workforce management

- Emphasis on employee well-being and engagement strategies

Conclusion

Manual HR processes are not just inefficient; they actively harm business productivity and employee engagement. Indian businesses must recognize the urgency of HR digital transformation and embrace HR automation software to stay ahead. Whether it’s automating payroll, enhancing onboarding, or optimizing performance management, the future of HR lies in technology-driven solutions.

Final Thought:

If your business is still stuck in outdated HR workflows, it’s time to explore modern workforce management software and unlock your team’s full potential.

Ready to upgrade your HR processes? Take the first step toward automation today!