Payroll management is a critical function for small and medium-sized enterprises (SMEs). It ensures that employees are paid accurately and on time while complying with legal requirements.

However, payroll can be complex and prone to mistakes that can impact your business operations and employee satisfaction.

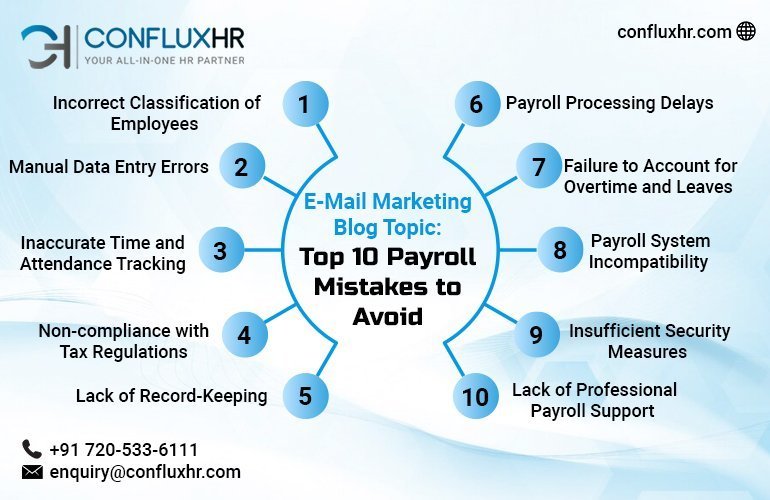

In this blog, we’ll explore the top 10 payroll mistakes commonly made by SMEs and provide practical tips to avoid them. By streamlining your payroll processes, you can save time, minimize errors, and keep your business on track.

Incorrect Classification of Employees

Misclassifying employees as independent contractors or vice versa can lead to serious legal and financial consequences. Ensure that you accurately determine the employment status of each worker based on applicable laws and regulations.

Manual Data Entry Errors

Relying on manual data entry increases the risk of errors in payroll calculations. Implementing an automated payroll system like ConfluxHR+ eliminates manual entry and reduces the likelihood of mistakes.

Inaccurate Time and Attendance Tracking

Poor time and attendance management can result in overpayment or underpayment of wages. Utilize a reliable time and attendance tracking system to accurately record and calculate employee work hours.

Non-compliance with Tax Regulations

Failing to comply with tax regulations can lead to penalties and audits. Stay updated with tax laws, deductions, and reporting requirements to ensure accurate tax calculations and timely remittance.

Lack of Record-Keeping

Insufficient record-keeping can make it challenging to track payroll data and resolve discrepancies. Maintain detailed records of employee information, pay rates, tax forms, and payroll reports for easy reference and compliance.

Payroll Processing Delays

Late payroll processing can create dissatisfaction among employees and strain employer-employee relationships. Establish a consistent payroll schedule to ensure timely and predictable payments.

Failure to Account for Overtime and Leaves

Ignoring overtime hours and leave accruals can result in incorrect payments and labor law violations. Implement a payroll system that accurately calculates overtime pay and tracks employee leaves.

Schedule a personalized demo today and discover how ConfluxHR+ can transform your payroll management for the better.

Payroll System Incompatibility

Using incompatible payroll systems or outdated software can hinder efficiency and accuracy. Invest in a modern payroll solution like ConfluxHR+ that integrates seamlessly with other HR modules, ensuring data consistency and streamlining processes.

Insufficient Security Measures

Inadequate data security can expose sensitive employee information to risks of identity theft and privacy breaches. Protect payroll data by implementing robust security measures, including data encryption, access controls, and regular backups.

Lack of Professional Payroll Support

Managing payroll complexities without professional guidance can lead to costly mistakes. Partnering with an experienced HR and payroll service provider like ConfluxHR+ can offer expert support, ensuring compliance, accuracy, and peace of mind.

Conclusion

Avoiding payroll mistakes is crucial for the smooth functioning of your SME. By recognizing these common pitfalls and implementing proactive measures, you can streamline your payroll processes and ensure accurate and timely payments for your employees.

ConfluxHR+ offers a comprehensive payroll management solution tailored for SMEs, enabling you to automate calculations, maintain compliance, and streamline your payroll operations.