In today’s fast-paced digital economy, small businesses are under increasing pressure to do more with less. As these businesses juggle growth and operational efficiency, one critical area is often left playing catch-up: payroll. Managing payroll manually or with outdated systems isn’t just inefficient—it’s a recipe for errors, compliance risks, and frustrated employees.

Here’s the game-changer: enterprise payroll software, designed not only for large corporations but also tailored to empower small businesses. With innovations like automated compliance, seamless integration with HR policies, and real-time employee reimbursement policy tracking, payroll software in 2025 is set to revolutionize how small businesses operate.

But why now? Because the stakes are higher than ever. Studies show that 68% of small businesses experience payroll errors annually, leading to financial losses and employee dissatisfaction. The next wave of payroll innovation promises to eliminate these inefficiencies while enhancing productivity.

Section 1: The Changing Landscape of Payroll Software in 2025

The year 2025 is shaping up to be a landmark for payroll innovation. Why? Because technology is redefining the way payroll operates, making it smarter, faster, and more aligned with the needs of small businesses.

The Role of Technology

Artificial intelligence (AI) and automation are driving the change. These tools are transforming payroll from a repetitive, manual task into an intelligent, automated process.

Key Trends in Payroll Innovation

1. Cloud-Based Systems for Remote Teams

- With the rise of hybrid work, cloud payroll systems are critical for managing teams across multiple locations.

- Statistic: Companies using cloud payroll see a 30% reduction in processing time, according to Forbes.

2. Integration with Key Performance Indicators (KPIs)

- Payroll is no longer just about salaries—it’s now a tool for workforce analytics.

- KPIs like employee productivity and attendance can be directly tied to payroll systems, providing actionable insights.

3. Real-Time Employee Reimbursement Processing

- Gone are the days of waiting weeks for expense reimbursements. Payroll systems now process these in real time, improving cash flow for employees.

Section 2: Why Small Businesses Need Enterprise Payroll Software

Challenges Faced by Small Businesses

Small businesses often struggle with:

- Manual Errors: Traditional payroll methods are prone to mistakes, which can lead to compliance penalties.

- Complex Compliance: Adhering to changing labor laws and HR policies can overwhelm small teams.

Advantages of Enterprise Payroll Tools

1. Automation

- Reduces errors and ensures accurate calculations.

- Frees up time for business owners to focus on strategy.

2. Scalability

- As small businesses grow, enterprise payroll systems scale effortlessly, accommodating larger workforces.

3. Simplified Compliance

- Automated updates for labor laws and tax regulations eliminate compliance guesswork.

Statistic: Businesses using automated payroll systems report 70% fewer compliance issues, according to Deloitte.

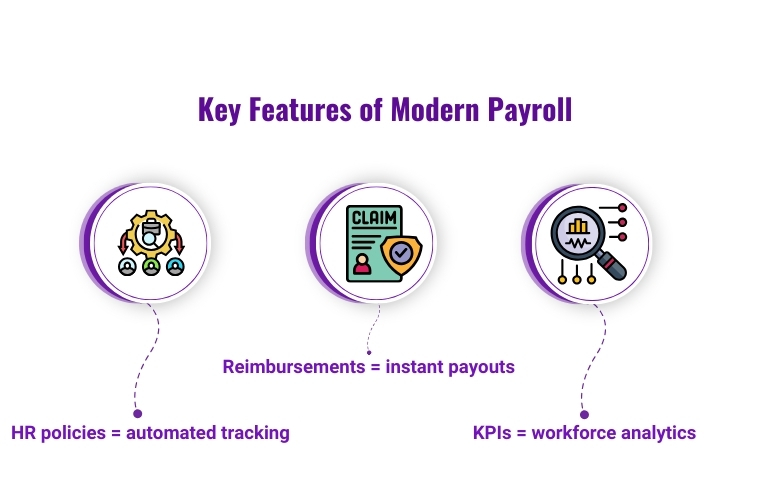

Section 3: Key Features of Modern Payroll Software

HR Policy Integration

Modern payroll software automates essential HR policies, including:

- Leave and Attendance Tracking: Simplifies time-off management and reduces disputes.

- Policy Syncing: Ensures payroll aligns with company rules, avoiding miscalculations.

Employee Reimbursement Policy Management

Payroll systems now streamline reimbursements with features like:

- Real-Time Expense Tracking: Employees can submit expenses digitally for quick approvals.

- Instant Reimbursements: Funds are transferred directly to employee accounts without delays.

Performance Analytics with KPIs

Integration with key performance indicators is a game-changer.

- Employee Productivity Insights: Track efficiency and correlate it with compensation.

- Payroll as a Strategic Tool: Use workforce analytics to make informed decisions about staffing and budgets.

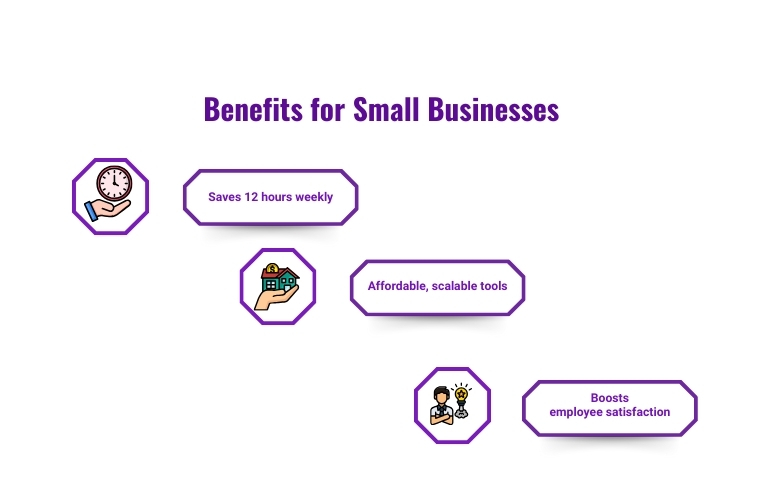

Section 4: Benefits of Payroll Innovation for Small Businesses

Improved Efficiency

Automated payroll reduces the time spent on manual tasks like data entry and tax calculations.

- Statistic: Companies save an average of 12 hours per week by automating payroll processes, according to HR Tech Weekly.

Cost-Effectiveness

Enterprise solutions now offer affordable packages tailored to small businesses, making them accessible for startups and growing companies.

Enhanced Employee Satisfaction

Accurate payroll and timely reimbursements build employee trust and morale.

- Fact: Employees are 2x more likely to stay with companies that pay accurately and on time.

Section 5: Examples of Innovative Payroll Solutions

Top Solutions Leading the Market

1. Gusto: Known for its intuitive interface and small business focus.

2. Rippling: Combines payroll, HR, and IT for a seamless experience.

3. Zoho Payroll: Offers cost-effective solutions with strong reporting features.

Case Study: Real Results with Cloud Payroll

A small retail business switched to cloud-based payroll software and achieved:

- 40% fewer errors in payroll processing.

- 50% reduction in processing time.

Section 6: Actionable Steps to Transition to Enterprise Payroll Software

1. Assess Your Needs

- Identify current challenges like compliance errors or time inefficiencies.

2. Choose the Right Software

- Look for features like HR policy syncing and real-time reimbursements.

3. Onboarding and Training

- Train your team to maximize the software’s capabilities for a smoother transition.

Conclusion: Why ConfluxHR is the Right Choice for 2025

2025 marks a turning point for small businesses looking to transform their payroll processes. By embracing enterprise payroll software, they can achieve greater efficiency, compliance, and employee satisfaction.

ConfluxHR is your trusted partner for this transformation. With features like HR policy integration, automated employee reimbursement policy management, and seamless KPI tracking, ConfluxHR ensures that your payroll is not just a process but a strategic advantage.

Ready to step into the future of payroll? Choose ConfluxHR—because your business deserves smarter solutions and happier employees. Explore our platform today!