On the last working day of every month, the office stays a little quieter than usual.

Not because work is done but because payroll is being finalized.

An Excel sheet is open on one screen. Attendance data is pulled from another system. Leave approvals are cross-checked through emails and chat messages. Someone double-checks formulas that were written months ago and never touched again. A last-minute update comes in an unplanned leave, overtime hours, a new joiner.

Payroll goes out. Mostly on time.

But it never feels settled.

There are follow-up questions. Small corrections. A lingering worry about whether everything especially compliance was calculated correctly.

This scene plays out every month across thousands of small and growing businesses.

Why This Feels Familiar to So Many SMEs

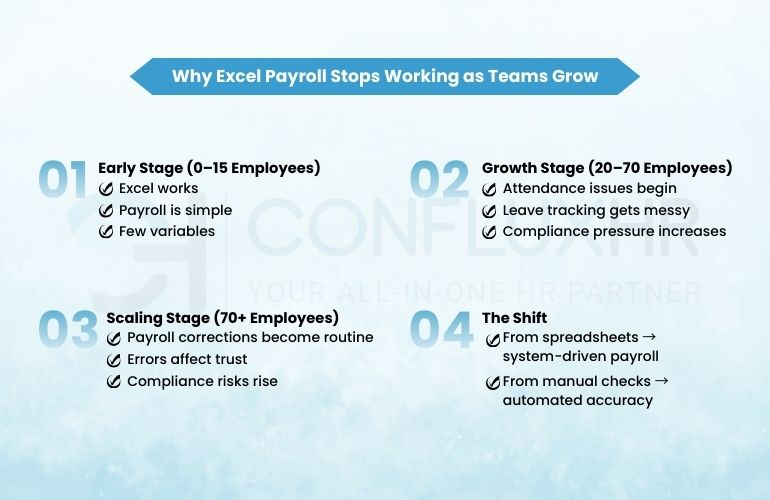

For early-stage teams, Excel payroll feels practical. It’s familiar. It doesn’t require setup. And when headcount is low, it works well enough.

The problem is that payroll doesn’t stay simple.

As teams grow, payroll becomes deeply connected to attendance, leave policies, overtime, statutory deductions, and constant people changes. What once felt manageable slowly turns fragile.

That’s when businesses realize Excel isn’t just inconvenient it’s risky. This is why many SMEs eventually move toward structured payroll management software instead of spreadsheet-based workarounds.

The Costs That Don’t Show Up on Your Balance Sheet

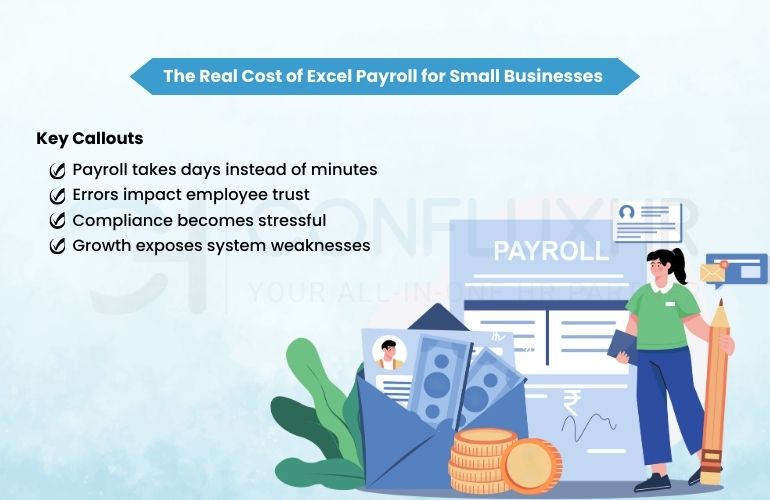

Time That Quietly Disappears Every Month

Excel payroll is rarely “just payroll.”

It’s HR reconciling attendance mismatches. Finance validating deductions manually. Managers confirming leave adjustments. Late evenings spent rechecking numbers.

Over time, these hours add up. What should take minutes stretches into days every single month.

This is why modern businesses turn to automated payroll software to eliminate repetitive, manual effort.

Errors That Slowly Erode Employee Trust

Payroll is one of the most visible HR functions. Employees notice immediately when something feels off.

One incorrect payslip leads to questions. Repeated issues lead to doubt.

Manual processes increase the likelihood of these errors, especially when leave, attendance, and payroll data live in different places. Growing organizations therefore rely on HR payroll software that calculates salaries using connected, real-time data.

Compliance Stress That Builds in the Background

Compliance mistakes are rarely intentional but they are expensive.

PF, ESI, TDS, professional tax each comes with specific rules, calculations, and deadlines. In Excel-driven payroll, accuracy depends entirely on human precision.

The real stress doesn’t appear during payroll runs. It appears during audits.

This is where payroll software for small business becomes a safety net automating statutory logic and maintaining clean, audit-ready records by default.

Why Payroll Breaks When Systems Don’t Talk to Each Other

One of the biggest weaknesses of Excel payroll is fragmentation.

Attendance lives in one system. Leave approvals happen somewhere else. Payroll attempts to reconcile everything at month-end.

This disconnect guarantees inconsistencies.

Modern HRMS payroll management systems work differently. Attendance, leave, and payroll operate as one workflow. Approved leaves automatically adjust salary calculations. Attendance data flows directly into payroll.

Accuracy becomes the default not something you chase.

A Realistic Scenario: When Excel Payroll Stops Scaling

Consider a growing services company let’s call them NovaTech Solutions.

NovaTech began with 18 employees. Payroll on Excel worked fine. By the time they reached 65 employees across sales, operations, and support, payroll had quietly become one of their biggest internal stress points.

Each month looked like this:

– Attendance tracked separately

– Leave approvals handled via emails and chats

– Payroll calculations managed on Excel

– Compliance checks done manually

Payroll was technically “done.” Operationally, it was fragile.

What Started Going Wrong

Over time, patterns emerged:

– 3–4 payroll corrections every month due to leave and attendance mismatches

– Payroll processing took nearly 2.5 days per cycle

– HR spent 25–30% of their time reconciling payroll data

– Employee confidence in payslip accuracy dropped

– Compliance filings became last-minute and stressful

Payroll had turned into a monthly fire drill.

The Shift: Moving Away from Excel

NovaTech didn’t hire more HR staff or tighten controls. Instead, they moved to centralized payroll management software that integrated attendance, leave, and payroll into a single system.

They implemented automation with three clear goals:

– Reduce payroll errors

– Cut processing time

– Improve compliance confidence

Attendance and leave data were directly linked to payroll. Salary structures and statutory rules were configured once. Payroll became system-driven not person-dependent.

The Impact After 3 Months

The results were immediate and measurable:

– Payroll processing time dropped from 2.5 days to under 30 minutes

– Payroll errors reduced by over 90%

– Employee payroll-related queries declined sharply

– Compliance filings became predictable and stress-free

– HR reclaimed 20+ productive hours every month

Payroll stopped being a risk area. It became routine.

This is exactly what reliable payroll software for small business is meant to deliver.

Why More SMEs Are Leaving Excel Behind

This shift isn’t about adopting new technology for its own sake. It’s about operational clarity.

SMEs are moving away from Excel because:

– Payroll delays affect morale

– Errors damage internal credibility

– Compliance risks create uncertainty

– Manual systems don’t scale with growth

A dependable online payroll management system provides control, consistency, and peace of mind.

How ConfluxHR Simplifies Payroll for Growing Teams

ConfluxHR is built for SMEs and startups that want payroll to run quietly and accurately in the background.

With ConfluxHR:

– Attendance and leave data flow automatically into payroll

– Salary calculations are rule-based and consistent

– Compliance logic is built in

– Payroll runs take minutes, not days

For growing teams, ConfluxHR works as scalable, dependable payroll management software without the complexity of enterprise systems.

The Bottom Line: Excel Payroll Isn’t Cheap It’s Costly

Excel doesn’t charge a subscription fee. But it charges in time, risk, and trust.

If payroll still feels like a monthly scramble instead of a predictable process, that’s the signal.

Switching to purpose-built payroll management software like ConfluxHR isn’t an upgrade it’s a correction.

Ready to Move Beyond Excel Payroll?

Discover how ConfluxHR helps small and growing businesses run accurate, compliant payroll without the chaos.