Every month-end, HR teams across India repeat the same cycle—attendance mismatches, last-minute corrections, and constant compliance verification. But with major payroll and statutory updates expected by December 2025, this manual struggle may no longer be sustainable.

For businesses relying on Excel sheets or outdated processes, the next compliance cycle could bring avoidable penalties, delays, and significant administrative burden.

This is the moment for HR teams to understand the real differences between manual payroll vs automated payroll—and why 2025 will be a defining year.

Why Payroll Is Challenging in India: A Ground Reality Check

Payroll isn’t just “salary processing.” In India, it includes:

- Managing real-time attendance

- Overtime calculations

- Shift scheduling

- Leave encashment

- PF, ESI, PT & TDS deductions

- Changing state-wise labour laws

- Statutory compliance filings

- Payslip generation

- Audit-friendly reports

When all of this is done manually, errors aren’t just likely—they’re inevitable.

Why this matters in 2025

Regulatory bodies are pushing for greater accuracy, digitalisation, and timely filing. Even a small mismatch in PF or TDS calculations may result in:

- Compliance penalties

- Delayed payments

- Audit challenges

- Employee dissatisfaction

This is where an accurate HR attendance and payroll solution becomes essential.

Manual Payroll: Why Indian Businesses Struggle With It

Manual payroll is still widely used—especially in SMEs and growing companies. But its limitations become sharper as compliance rules tighten.

Key Problems With Manual Payroll

Attendance mismatch delays

HR professionals spend hours reconciling:

- Missed punches

- Incorrect shift entries

- Offline registers

- Work-from-home logs

Even a single mismatch can throw off the entire payroll cycle.

Human-dependent calculations

Manual PF, ESI, PT and TDS calculations often lead to:

- Incorrect deductions

- Wrong tax slabs

- Mismatched challans

With 2025 compliance tightening, these errors could become costly.

No real-time shift data

For companies with rotating shifts or field teams, reconciling timesheets manually creates unnecessary delays.

High risk of data loss

Excel sheets can be:

- Overwritten

- Misplaced

- Corrupted

- Version-conflicted

This creates audit and governance risks.

Time-consuming approvals

Managers approving attendance, overtime, and leave manually results in delayed payroll every month.

Automated Payroll: How It Solves India’s Payroll Challenges

An employee attendance and payroll system integrates attendance, shifts, leave, and payroll calculations into one automated workflow.

Here’s why automated payroll is quickly becoming essential for 2025.

Real-time attendance sync

Automated systems connect:

- Biometric devices

- Mobile punch with geo-fencing

- Web login

- Shift scheduling

This ensures payroll is always based on accurate, real-time data.

Compliance-ready payroll

Automated payroll software assists with:

- PF auto-calculation

- ESI eligibility mapping

- State-wise PT rules

- TDS slab updates

- Auto-generated statutory reports

When 2025 updates roll out, the system adjusts—reducing manual load for HR.

One-click payroll processing

HR no longer needs hours of manual reconciliation.

Automated payroll supports:

- Bulk salary calculations

- Overtime mapping

- Loss of pay auto calculation

- Leave deductions

- Arrears

- Bonus and variable pay

This transforms payroll into a few clicks instead of days of work.

Zero spreadsheet dependency

All data is securely stored and accessible anytime. This reduces the risks of:

- Data corruption

- Accidental edits

- Version confusion

- Miscommunication

Audit-ready reports

Automated systems maintain:

- Salary registers

- PF/ESI statements

- Attendance logs

- Tax reports

- Form 16 data

- Reconciliation history

This ensures HR is always prepared for audit cycles.

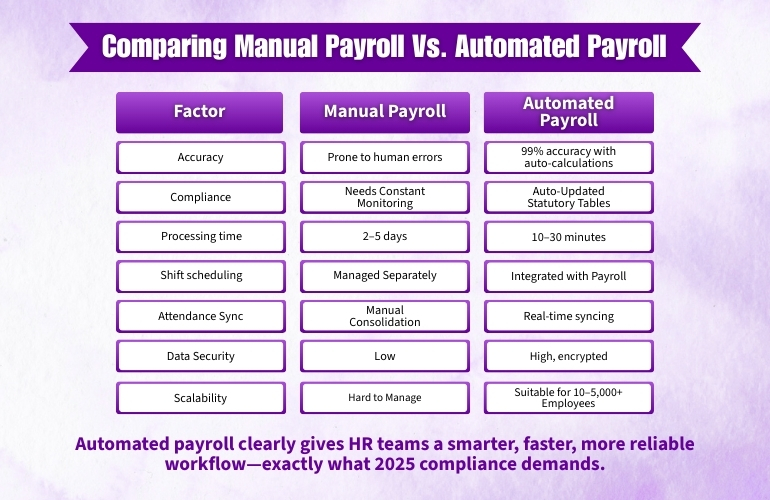

Comparing Manual Payroll vs. Automated Payroll (India 2025)

Automated payroll clearly gives HR teams a smarter, faster, more reliable workflow—exactly what 2025 compliance demands.

How These Changes Impact HR Teams in India

With new rules expected, HR teams should prepare for:

- Accurate payroll every cycle- Compliance errors will have little tolerance by 2025.

- Digital employee records- Paper files and offline attendance may not stand future audit requirements.

- Real-time shift and attendance tracking- Especially for companies with field staff, manufacturing, retail, or distributed teams.

- Faster statutory filings- Deadlines are expected to become stricter.

- Fewer manual dependencies- Automation ensures continuity even when HR bandwidth is limited.

Role of HR Attendance and Payroll Software in 2025

An integrated HR attendance and payroll solution is becoming a necessity—not a luxury—for Indian businesses.

End-to-end attendance capture

Biometric, geo-tracking, QR punch, WFH logs, shift-based attendance—all in one place.

Integrated shift scheduling

Supports companies with:

- Rotational shifts

- Night shifts

- OT policies

- Multi-location teams

Automated payroll deductions

Ensures accuracy for:

- PF

- ESI

- PT

- TDS

- Allowances

- Reimbursements

Transparent approvals

Employees and managers can manage requests through a unified dashboard.

How ConfluxHR Supports Indian Businesses

ConfluxHR is designed to solve practical HR challenges faced by Indian companies—especially those dealing with complex shifts, distributed teams, and month-end payroll pressure.

Here’s how it adds value:

- Real-time attendance & payroll sync- Reduces manual errors and speeds up payroll cycles.

- Automated compliance calculations- Helps HR stay aligned with PF, ESI, PT, and TDS rules.

- Built for SMEs and mid-sized companies- Handles multi-location teams, shift changes, and OT calculations without complexity.

- Audit-ready reports and payslips- Supports smoother audits and monthly filings.

- Safer alternative to spreadsheets- Secure data storage ensures reliability during compliance updates.

ConfluxHR simply helps HR teams work faster, more accurately, and with fewer month-end challenges—making it a reliable tool ahead of 2025.

Preparing for December 2025: What HR Teams Should Do Now

Step 1: Reduce manual payroll dependency, Start shifting towards automation before the compliance rush begins.

Step 2: Centralize attendance and shift scheduling a single source of truth ensures payroll accuracy.

Step 3: Update compliance knowledge keep up with PF, PT, and TDS changes.

Step 4: Build an audit-ready payroll workflow digitised records ensure smoother compliance cycles.

Step 5: Choose a system that grows with your team, Whether 20 employees or 2,000—scalability is essential.

Conclusion

Payroll in India is evolving. With expected December 2025 updates, accuracy, transparency, and digital compliance will become non-negotiable.

Manual payroll simply isn’t designed for this level of complexity or scale.

Automated payroll—especially when integrated with attendance and shift scheduling—gives HR teams more control, fewer errors, and month-end peace of mind.

A modern employee attendance and payroll system like ConfluxHR supports this transformation, without complicating HR workloads.