Managing payroll and HR processes manually can be a nightmare for small businesses. Picture this: an Indian SMB spending countless hours on payroll calculations, employee attendance, and compliance reporting—only to discover errors that cost both time and money. Payroll management software and HR system software have revolutionized the way Indian SMBs operate, enabling seamless, streamlined payroll processing and boosting workforce management solutions. According to a recent survey, 67% of SMBs report saving time and reducing errors by adopting automated payroll systems. This blog serves as the ultimate guide for Indian SMBs looking to enhance efficiency with the right payroll and HR software.

Why Payroll and HR Software is Crucial for SMBs

Indian SMBs often face challenges balancing efficiency and compliance. Choosing the right payroll processing software can eliminate manual errors and enhance productivity.

1. Simplified Payroll Processing

Manual payroll systems are prone to errors, especially when handling diverse salary structures, incentives, and bonuses. For example, a Pune-based retail startup reduced payroll errors by 60% after switching to cloud-based payroll software. Automating payroll calculations ensures accurate and timely salary disbursement, even when dealing with complex tax deductions, bonuses, and variable pay structures.

Stat: Businesses that automate payroll processing save 20-25% of administrative time and costs annually (NASSCOM).

2. Better Workforce Management

Automating employee attendance tracking and leave approvals eliminates tedious paperwork. With tools like timesheet management software, businesses can track employee productivity in real time. Stat: Companies using automated attendance systems see a 30% improvement in workforce efficiency.

Example: A Chennai-based manufacturing unit implemented biometric attendance integrated with payroll software. This helped reduce time theft, absenteeism, and manual errors in attendance tracking, significantly boosting productivity.

3. Tax and Compliance Automation

Staying compliant with Indian tax laws, PF, ESI, and TDS can be complex. A well-implemented payroll and compliance tool ensures timely tax filings, reducing penalties. SMBs often face challenges during peak tax seasons, but payroll software simplifies compliance management by automating calculations and filing returns on time.

Stat: Over 40% of small businesses in India incur fines due to payroll compliance errors. Adopting HR automation tools minimizes such risks.

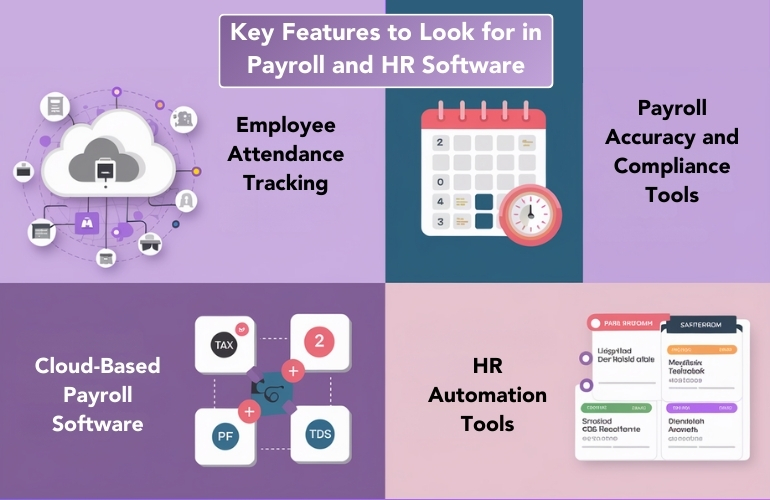

Key Features to Look for in Payroll and HR Software

1. Cloud-Based Payroll Software

For businesses with remote or hybrid teams, cloud-based payroll software provides flexibility and accessibility. Employees can access payslips and tax documents anytime through employee self-service portals.

Example: A Bengaluru-based IT firm implemented a cloud-based solution, enabling their HR team to manage payroll for remote employees scattered across India seamlessly. The software ensured quick salary disbursement and access to payslips on mobile devices.

2. Employee Attendance Tracking

Modern software includes features like biometric integration, geotagging for field employees, and leave management systems to streamline attendance tracking. SMBs can eliminate buddy punching and reduce payroll inaccuracies caused by manual entries.

Stat: Businesses with automated attendance systems save an average of 14 hours per month previously spent on manual attendance tracking.

3. Payroll Accuracy and Compliance Tools

Indian SMBs can benefit from tools that automate PF, ESI, TDS, and gratuity calculations. For example, an IT firm in Bangalore saved 20 hours per month by using automated tax and compliance automation features. This ensures payroll accuracy while avoiding penalties for late filings.

4. HR Automation Tools

From onboarding new hires to managing leave approvals, HR automation tools simplify HR workflows. This reduces administrative workload and improves accuracy. Features like automated offer letters, employee onboarding forms, and performance tracking allow SMBs to focus on strategic business growth rather than repetitive tasks.

Types of Payroll and HR Systems for SMBs

1. Integrated HR and Payroll Systems

An integrated HR and payroll system combines payroll, employee attendance, and performance management into one platform. This is ideal for SMBs aiming to streamline operations. For example, integrating payroll with attendance reduces discrepancies and ensures accurate payouts.

2. Standalone Payroll Software

For businesses solely focused on payroll accuracy, standalone tools handle automated payroll calculations and compliance efficiently. These tools are cost-effective for small businesses that don’t require extensive HR features.

3. Comprehensive HRMS Solutions

Best HRMS software for SMBs offers a one-stop solution with HR analytics and reporting, attendance management, and payroll processing—making it perfect for growing businesses. These tools provide actionable insights into workforce performance and trends, enabling better decision-making.

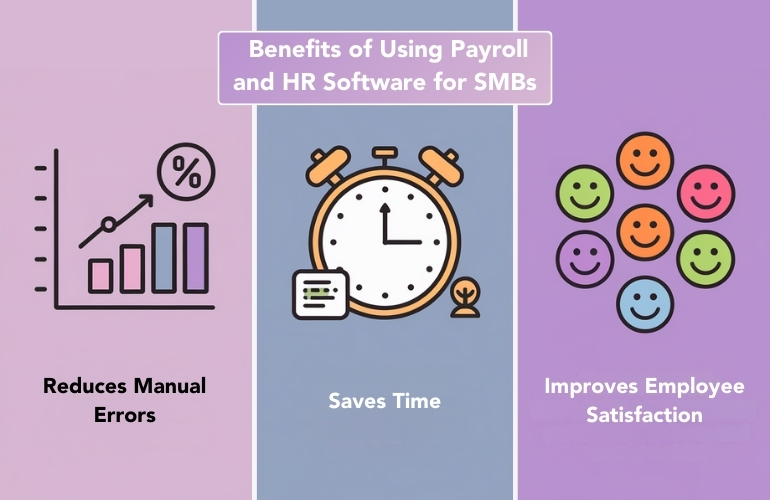

Benefits of Using Payroll and HR Software for SMBs

1. Reduces Manual Errors

Errors in payroll can lead to compliance issues. With payroll accuracy and efficiency, SMBs can ensure error-free payroll disbursement. For example, businesses using payroll automation experience 99% accuracy in salary calculations.

2. Saves Time and Enhances Productivity

Automating HR tasks saves up to 30% of an HR team’s time (Deloitte), allowing them to focus on strategic initiatives. This is especially beneficial for Indian SMBs where HR teams are often small and overburdened.

3. Improves Employee Satisfaction

With employee self-service portals, employees can access payslips, tax documents, and leave balances, improving transparency and satisfaction. For instance, a Delhi-based SMB reported a 20% increase in employee satisfaction after introducing self-service portals.

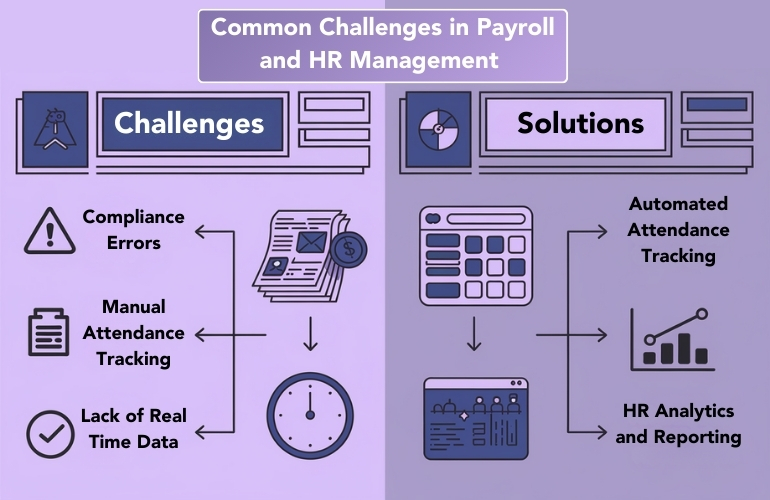

Common Challenges in Payroll and HR Management

1. Managing Compliance

Indian businesses often struggle to stay compliant with labor laws. Payroll and compliance tools automate tax filings and PF/ESI submissions, ensuring SMBs meet legal obligations without delays.

2. Attendance Tracking Issues

Manual tracking leads to inefficiencies. Automated employee attendance tracking ensures real-time monitoring and eliminates errors caused by paper-based systems.

3. Lack of Real-Time Data

Businesses need HR analytics and reporting to make informed decisions, but manual processes rarely provide real-time insights. HRMS solutions offer dashboards that track attendance, leaves, and payroll metrics.

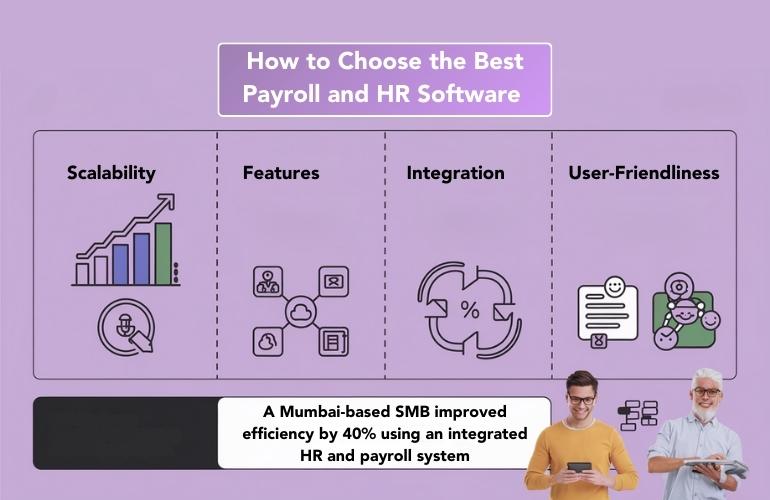

How to Choose the Best Payroll and HR Software

1. Scalability

The software should grow with your business needs, whether you’re a 10-employee startup or a 500-employee company. SMBs planning for expansion must invest in solutions that accommodate future growth.

2. Features

Look for features like cloud-based payroll software, automated compliance tools, and attendance management systems. Prioritize tools that offer customization for Indian tax and labor regulations.

3. Integration Capabilities

Ensure seamless HR software integration for small businesses with existing accounting tools or CRMs. Integration reduces duplication of effort and improves workflow efficiency.

4. Real-Life Example

A Mumbai-based manufacturing SMB increased efficiency by 40% after implementing an integrated HR and payroll system that automated attendance and payroll calculations. The system provided monthly reports that helped HR make strategic decisions.

Top Recommendations for SMB Payroll and HR Tools

- ConfluxHR: Offers a robust cloud-based payroll software solution tailored to Indian SMBs, ensuring compliance and accuracy.

- Zoho Payroll: Known for its intuitive interface and automated compliance features.

- GreytHR: Ideal for comprehensive workforce management solutions and employee self-service portals.

Conclusion

For Indian SMBs, adopting the right payroll management software and HR system software is essential for improving efficiency, ensuring compliance, and reducing administrative workload. Tools like cloud-based payroll software and HR automation tools empower businesses to focus on growth while managing HR seamlessly. Platforms like ConfluxHR provide scalable solutions that meet the unique needs of Indian SMBs, enabling them to thrive in a competitive market.